Market looks to be in a wait-and-see mode ahead of a speech from the Fed Chair at Jackson Hole Symposium today. Powell will speak at 3:00 pm BST and the market sees a chance for him to stress that the Fed will fight inflation with all tools at its disposal. While Jackson Hole Symposium is not meant to trigger big market moves, significance of the event increased under Ben Bernanke - Fed Chair who used the Jackson Hole meeting to announce monetary policy actions during the Global Financial Crisis, like for example the QE announcement. However, both Yellen and Powell did not follow in Bernanke's footsteps and refrained from making major announcements at the event. Is there any chance for Powell to make any big statements this time?

Tough financial conditions

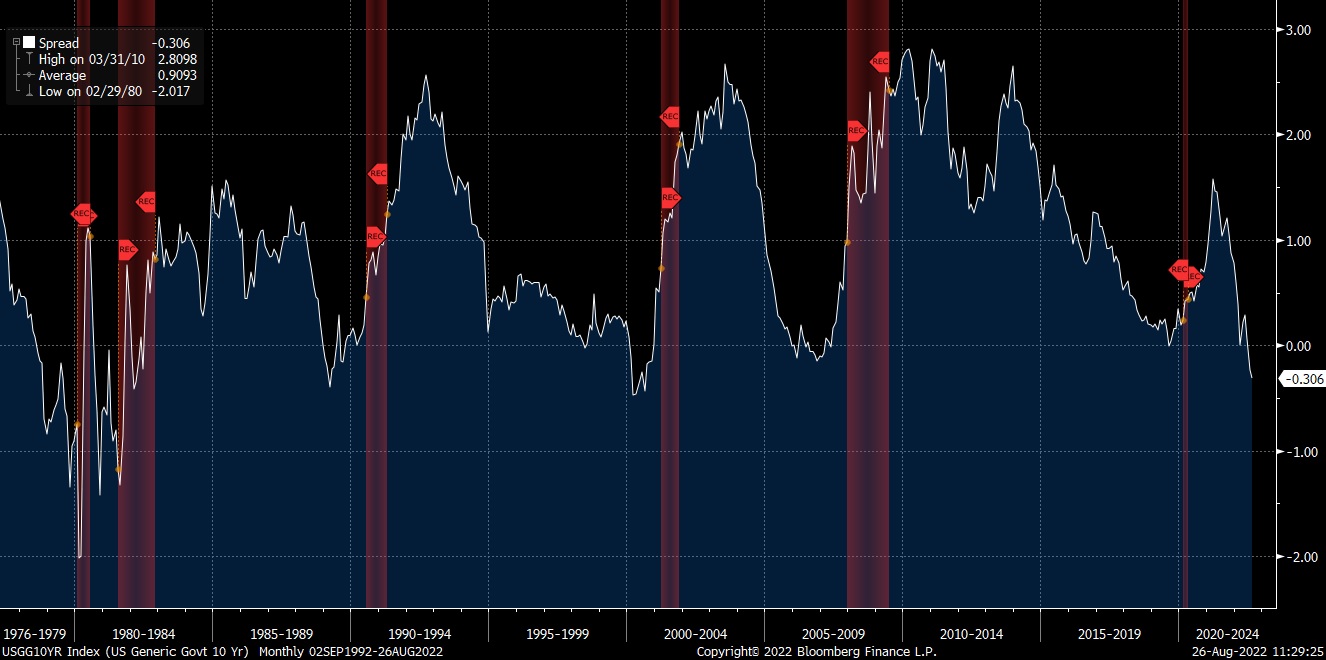

The Fed suggested at its latest meeting that the pace of rate hikes will have to slow at some point. SItuation on the market has improved since - USD gave back some gains while Wall Street rebounded. However, commodity prices are on the rise again, what leads to tightening of financial conditions on the markets. 10-year US yields returned above 3%. Jump in 2-year yields was even bigger leading to further yield curve inversion. Signals pointing to a recession are becoming more frequent but the Fed still sees a chance for a continued tightening.

2-10 year yield curve inverts further. Spread between 10- and 2-year yields already exceeds negative 30 basis points! Source: Bloomberg

2-10 year yield curve inverts further. Spread between 10- and 2-year yields already exceeds negative 30 basis points! Source: Bloomberg

Fed wants to be hawkish but balance sheet doesn't show it

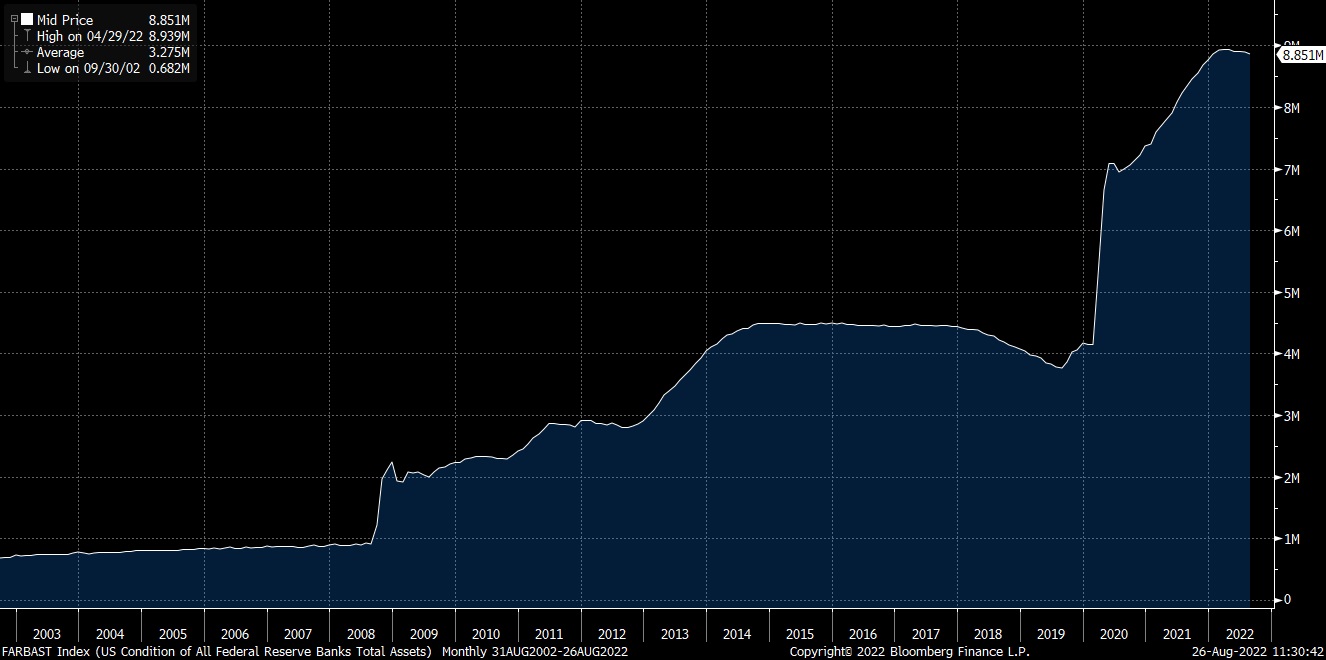

Fed decided to scrap forward guidance and this is why we should not expect any clear hints on interest rates from Powell today. Things look different when it comes to balance sheet reduction. Just like Ben Bernanke surprised with the QE announcement, Powell may use Jackson Hole to commit to strong reduction of the balance sheet. It should be noted that since Fed started to reduce its balance sheet, the reduction amount to around 1% of total balance - not enough to produce a meaningful impact on the markets. In theory, things may change in September as pace of reduction is expected to pick-up. Powell may want to ensure markets that should a need arise, Fed is ready to sell assets even quicker.

Fed balance sheet reduction has been barely noticeable so far and is much slower than it was in 2018. Source: Bloomberg

Fed balance sheet reduction has been barely noticeable so far and is much slower than it was in 2018. Source: Bloomberg

Market expects quick pace of tightening to remain

Market expects Fed fund rates to jump above 3.5% by year's end. This means that the Fed could hike by 75 basis points in September and follow with 50 basis point rate hikes in the remaining two meetings of 2022. Market pricing for next year points to even higher rates at 3.8%. According to Powell, Fed funds rate has already reached restrictive levels therefore we should not expect any major hawkish declarations from him today. On the other hand, should such a declaration be made, EURUSD exchange rate has a lot of room to fall.

EURUSD

EURUSD has been hovering around parity levels recently. Should the Fed maintain its hawkish view and no profit taking occurs, there is a chance for deepening of the ongoing downward move on the main currency pair. However, profit taking is a real possibility given recent outperformance of USD. Yield spread favors EURUSD bulls but the European energy crisis seems to be capping any upside for the euro. Source: xStation5

EURUSD has been hovering around parity levels recently. Should the Fed maintain its hawkish view and no profit taking occurs, there is a chance for deepening of the ongoing downward move on the main currency pair. However, profit taking is a real possibility given recent outperformance of USD. Yield spread favors EURUSD bulls but the European energy crisis seems to be capping any upside for the euro. Source: xStation5

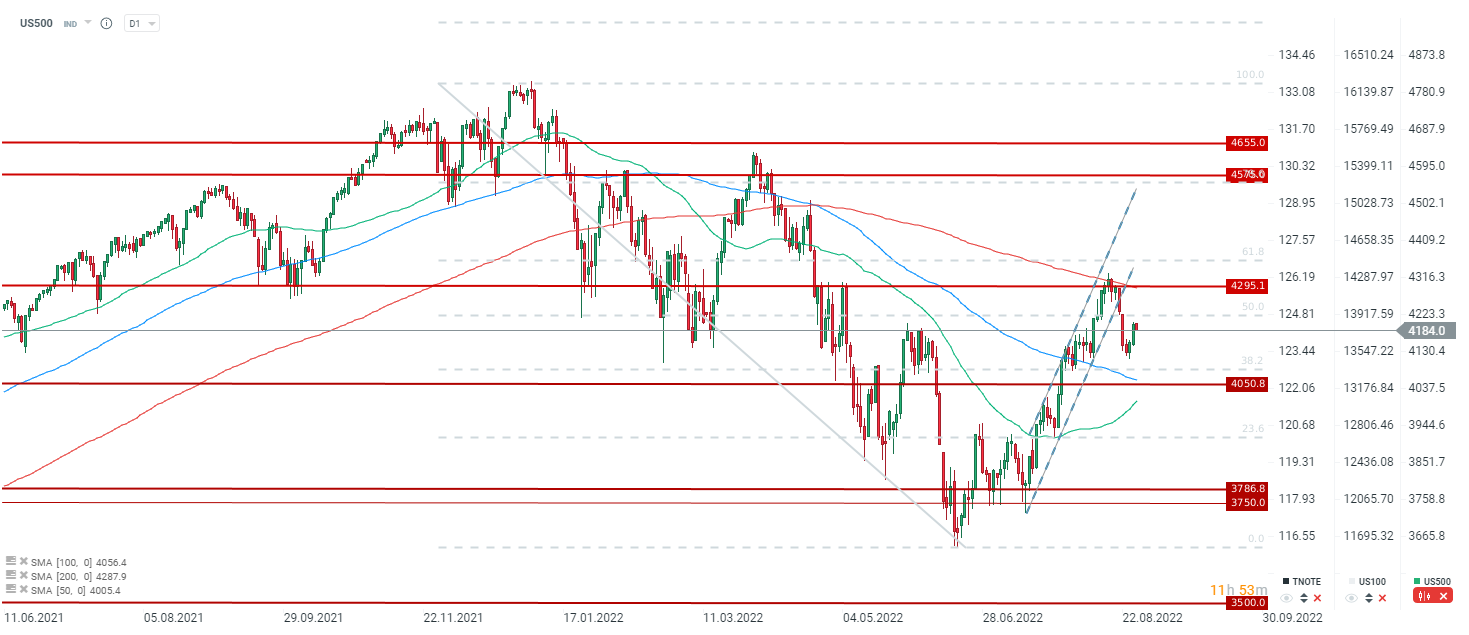

US500

US500 recovered around half of a drop from the first half of the year. Gains since mid-June low amount to almost 20% already. Taking a look at Wall Street performance during the dot-com bubble, we can see that a 20% correction occurred a few times back then. It cannot be ruled out that, in the case of a very hawkish Fed, the ongoing upward move is just a correction. On the other hand, lack of any strong message from Powell, as was the case last year, another test of 200-session moving average cannot be ruled out. Source: xStation5

US500 recovered around half of a drop from the first half of the year. Gains since mid-June low amount to almost 20% already. Taking a look at Wall Street performance during the dot-com bubble, we can see that a 20% correction occurred a few times back then. It cannot be ruled out that, in the case of a very hawkish Fed, the ongoing upward move is just a correction. On the other hand, lack of any strong message from Powell, as was the case last year, another test of 200-session moving average cannot be ruled out. Source: xStation5

Investors should remain calm

While Jackson Hole is a big event, traders should stay on guard and remain calm. Symposium was designed not to move the markets but as a platform for presenting ideas. Powell likely wants to avoid any major announcements that could trigger volatile market moves. However, lack of any strong message from Powell may be seen by market participants as a dovish tilt, what would increase risk of USD profit taking occurring.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.