The Reserve Bank of Australia (RBA) is scheduled to announce its next monetary policy decision during the upcoming Asia-Pacific session (Tuesday, 3:30 am GMT). Bank has kept interest rates unchanged at the four previous meetings but market consensus now expects a hike!

What to know before the RBA rate decision?

- Main interest rate: 4.10%

- Rates last changed in June 2023 (+25 bp)

- 400 basis points of tightening delivered since April 2022

- RBA expects inflation to drop below 3% in Q4 2025

- Q3 CPI at 5.4% YoY (exp. 5.3% YoY, prev. 6.0% YoY) and 1.2% QoQ (exp. 1.1% QoQ, prev. 0.8% QoQ)

- Q3 PPI at 3.8% YoY (prev. 3.9% YoY) and 1.8% QoQ (prev. 0.5% QoQ)

- Employment change in September: +6.7k (exp. +20k, prev. +63.3k)

- Unemployment rate in September: 3.6%, down from 3.7% in August

- Retail sales for September: 0.9% MoM (exp. 0.3% MoM, prev. 0.3% MoM)

- Services and manufacturing PMIs for September below 50 points

- New home sales for September: -4.6% MoM (exp. 1.1% MoM, prev. 8.1% MoM)

RBA expected to deliver 25 bp rate hike

Median consensus among economists and financial institutions is for the Reserve Bank of Australia to deliver a 25 basis point rate hike after staying on hold for almost half a year. Recent inflation data for Q3 2023 came in above expectations with price growth accelerating compared to Q2 on quarter-over-quarter basis. Labor market remains tight and retail sales data hints that consumer spending is still robust. Reasons for a hike are there and recent hawkish comments from RBA members are a strong hint that one may be coming.

However, this would likely be the final one. In spite of a rather solid picture of the Australian economy, money markets price in just a slightly above-50% chance of a 25 basis point rate hike and no more hikes afterwards. First rate cuts are priced in for the second half of 2024.

Money markets price in 56% chance of RBA delivering a 25 basis point rate hike tomorrow. Source: Bloomberg Finance LP

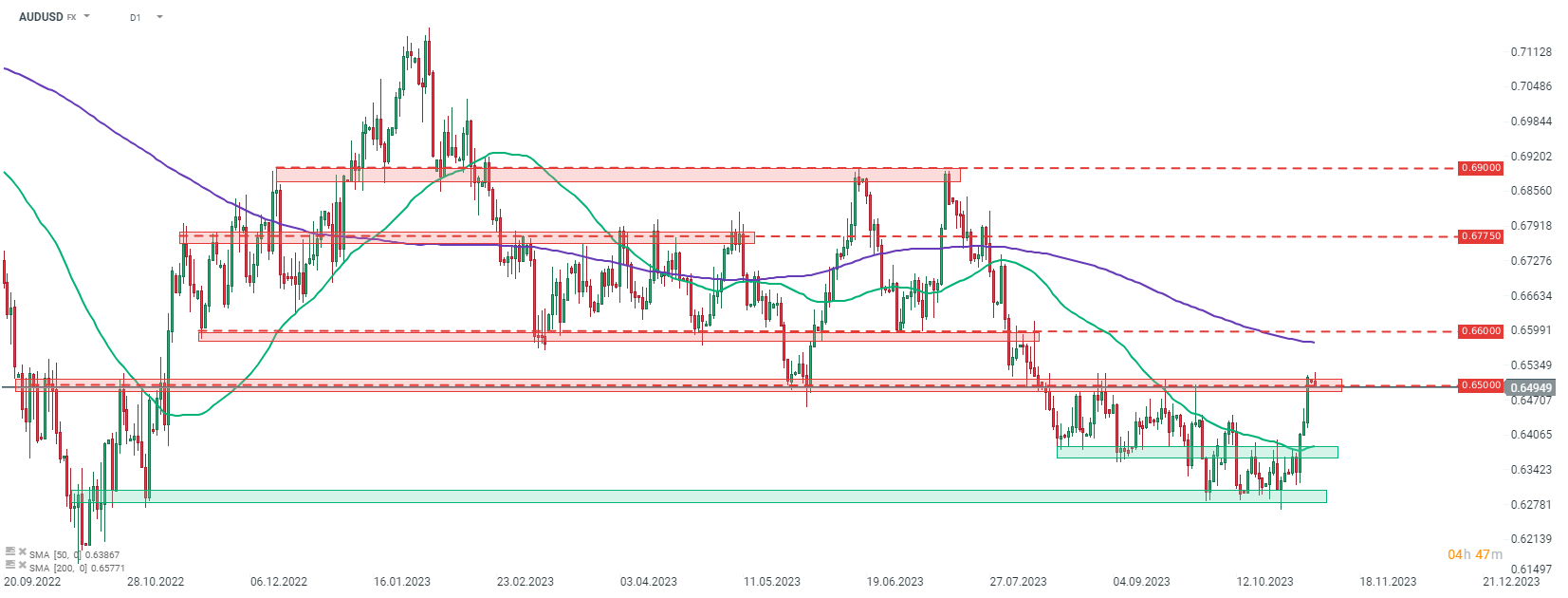

A look at AUDUSD

AUDUSD has been trading higher recently, partially on USD weakening and partially on better performance of Antipodean currencies. Pair bounced off 1-year lows and is now testing resistance zone ranging around 0.6500 mark - the highest level since the turn of August and September 2023. While a 25 bp rate hike is expected by economists, a sub-60% pricing on the money markets shows that there is a room for surprise. Hike not being fully priced in also means that AUD could gain if expectations are met. In case we see a break above the 0.6500 resistance zone, the next level to watch can be found in the 0.6600 area.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.