European stock market indices and US index futures trade lower on Friday ahead of the release of US retail sales data for December. The US dollar is trading mixed against major peers following strong declines earlier this week. Market expects headline retail sales growth to be flat month-over-month (0.0% MoM) while gauge excluding transport is expected to jump 0.2% MoM. The reading will be closely watched as investors will assess how big of an impact elevated inflation has on the US consumer. A disappointing reading could have a negative impact on equities moods as it would highlight that consumers are struggling amid high price growth. Meanwhile, it would also highlight the need for quicker tightening, what could be positive for the US dollar.

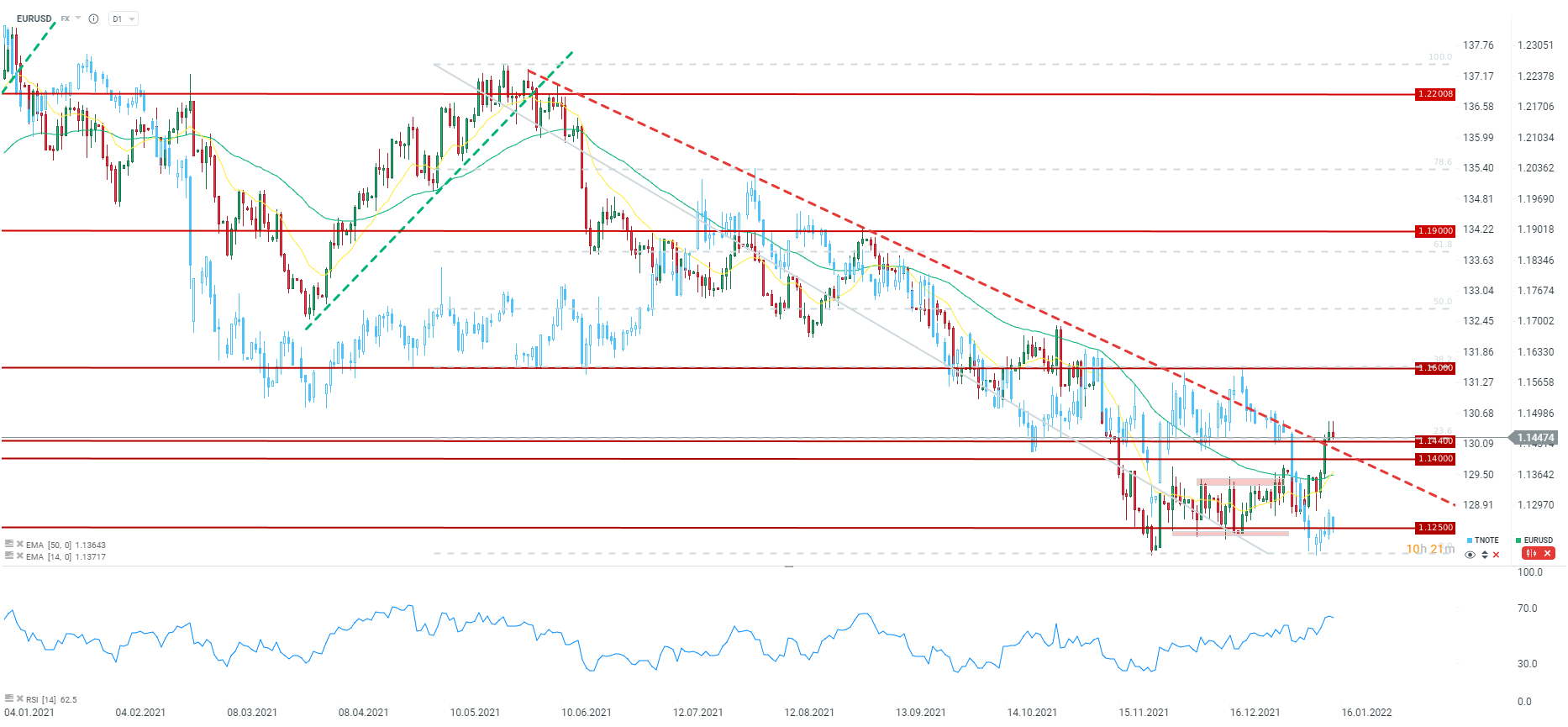

The US dollar has been trading lower this week in spite of hawkish comments from Fed members, allowing EURUSD to jump above the 1.14 mark. The pair is attempting to break above the mid-term downward trendline - a move that could pave the way for a bigger rally.

Source: xStation5

Source: xStation5

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.