World Liberty Financial (WLFI) begins trading today on major cryptocurrency exchanges, including Binance, OKX, and Bybit. The token, originally sold last year as a governance instrument, is now available for open trading.

WLFI is a project directly tied to the U.S. presidential family, including Donald Trump. Early investors are allowed to sell only 20% of their holdings — a deliberate supply management strategy aimed at limiting short-term selling pressure. Trading opened around $0.31 but later fell to $0.24, implying a fully diluted market capitalization of $24 billion. That places WLFI 26th among all crypto projects by market cap.

Estimates suggest the Trump family has already earned around $500 million from the broader World Liberty suite of products, which includes stablecoins, crypto mining, and digital asset funds. Despite criticism over potential conflicts of interest stemming from Trump’s regulatory influence, the project has attracted a wave of retail investors hoping for quick profits.

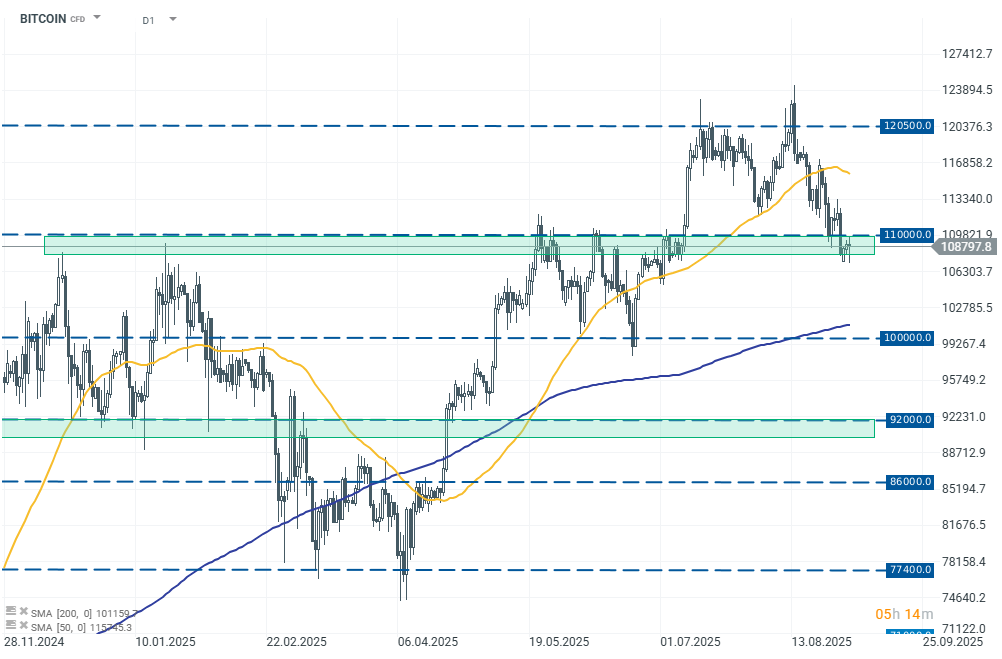

Broader crypto market sentiment remains mixed, though the recent sell-off appears to be slowing. Bitcoin is consolidating near the $108,000 support level.

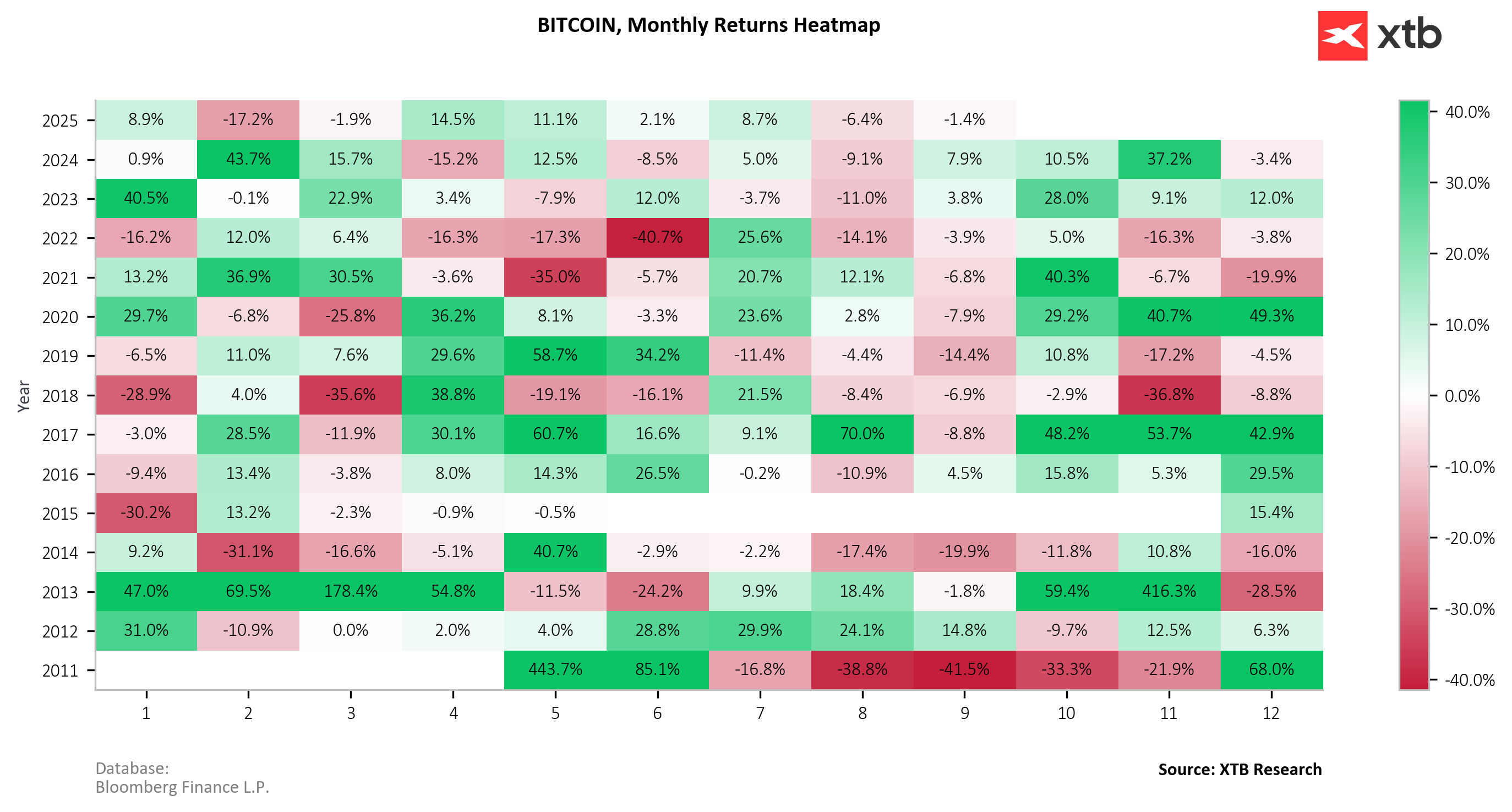

Historically, September has been a weak month for the market, often marked by declines — though exceptions exist, such as last year when Bitcoin gained 7.9% after sell-offs ended in the first week of September.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.