-

WTI crude rose over 2% toward $59 per barrel, driven by expectations that a potential US-India deal will restrict Russian oil imports, increasing demand for other sources.

-

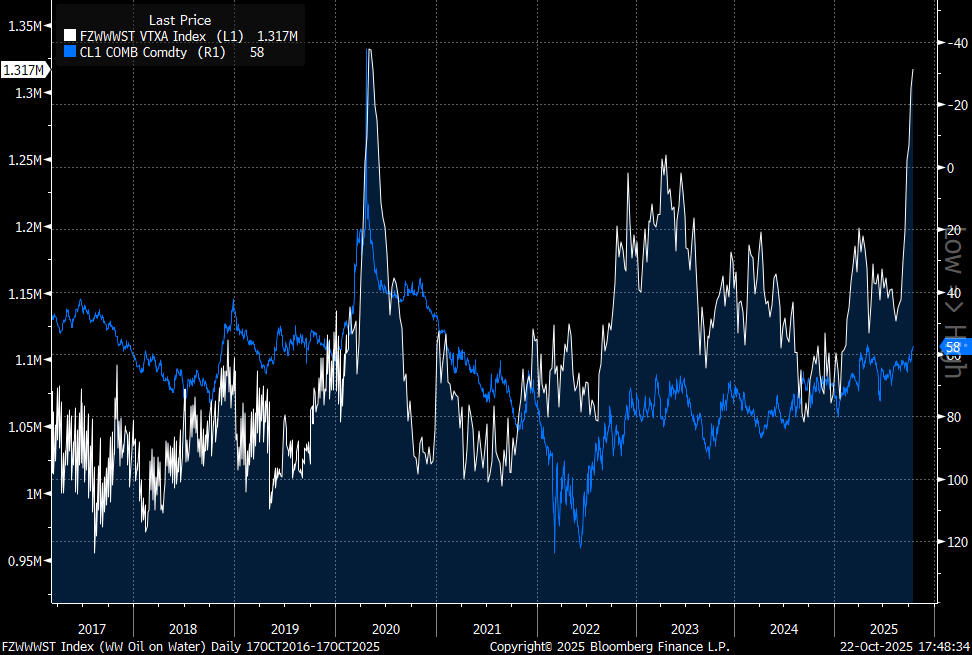

The market continues to face an oversupply: $1.3 billion barrels of oil are currently at sea (the highest level since 2020). Banks expect the surplus to persist into next year.

-

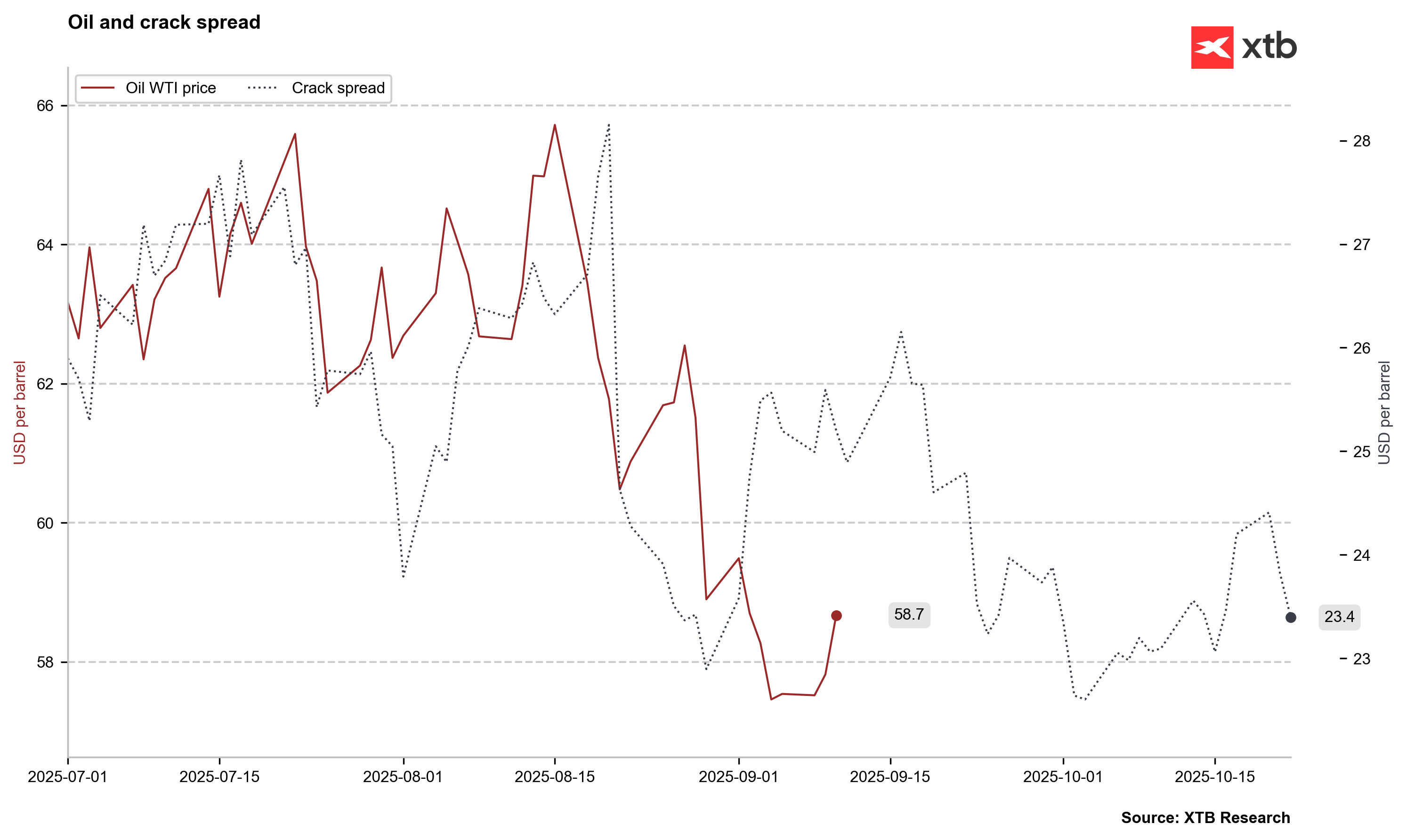

$59 is the key technical resistance, while the crack spread indicator suggests no demand surge should be expected in the US in the coming month.

-

WTI crude rose over 2% toward $59 per barrel, driven by expectations that a potential US-India deal will restrict Russian oil imports, increasing demand for other sources.

-

The market continues to face an oversupply: $1.3 billion barrels of oil are currently at sea (the highest level since 2020). Banks expect the surplus to persist into next year.

-

$59 is the key technical resistance, while the crack spread indicator suggests no demand surge should be expected in the US in the coming month.

Oil prices are rallying by over $2\%$ today, pushing West Texas Intermediate (WTI) crude towards the $59 per barrel level. This surge is linked to a potential agreement between the United States and India aimed at reducing Indian imports of Russian oil. Such a scenario would create a challenge for Russian crude in finding a market outlet, thereby increasing demand for oil from alternative destinations, specifically OPEC nations and the US.

Nonetheless, the market is facing a significant potential supply glut, evidenced by the largest volume of oil on the water since 2020. Currently, an estimated $1.3 billion barrels of crude are held in tankers, either moving or at anchor. According to projections from major institutions like JP Morgan and Goldman Sachs, the oil market should anticipate sustained oversupply into the coming year. JP Morgan suggests that maintaining a price floor of $48 per barrel will be crucial, as this level currently represents the break-even point for cash flow from oil extraction.

The leading indicator for oil, the crack spread (the differential between crude and petroleum product prices), remains at a relatively low level compared to recent months but is concurrently very high against historical standards. However, the 30 day forward spread suggests that a significant increase in US demand is unlikely in the immediate future.

The volume of oil at sea is currently the highest since 2020, indicating a persistent, massive oversupply. Source: Bloomberg Finance LP, XTB

The crack spread suggests no excessive demand rebound should be expected in the US over the next month. Source: Bloomberg Finance LP, XTB

The crack spread suggests no excessive demand rebound should be expected in the US over the next month. Source: Bloomberg Finance LP, XTB

The price of crude oil is rebounding by more than 2% today, continuing the recovery observed since the beginning of the week. Ahead of the current price lies resistance in the form of the upper boundary of the descending trend channel, alongside the 23.6 Fibonacci retracement of the last decline. A decisive breach of the $59 per barrel level could potentially see the price rally toward the $61.5 per barrel area. Conversely, a close today below $58.5 could prompt crude to retreat and attempt to continue its downtrend. Source: xStation5

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.