Adidas (ADS.DE) stock tumbled more than 10.0% as the apparel maker lowered its full-year financial guidance, citing weaker demand.

-

The German sporting goods maker warned that unsold inventories are building up as consumer demand weakens across China and western markets. Adidas also expects one-off costs largely relating to its exit from operations in Russia will have a negative impact on its financials. Also publicity crisis over an alliance with rapper and designer Ye formerly known as Kanye West also weighs on the company's performance.

-

Net income from continuing operations fell sharply to €179 million ($175 million) in the quarter from €479 million in the same period last year. Operating margin also plunged to 8.8% in the quarter from 11.7% previously.

-

Net income from continuing operations should come in at some €500 million ($489.4 million) for the year, against a previous target of around €1.3 billion.

-

The company’s prognosis for 2022 has fallen from an optimistic growth of 11 to 13% at the beginning of this year, to a mid-single-digit rate now. Adidas lowered its expectations for this year’s operating margin to 4% from 7%.

-

Company plans to implement an efficiency program that should compensate for higher costs next year and generate around €200 million in profit.

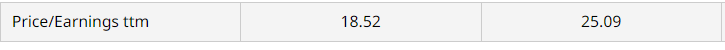

Adidas main rival Nike Inc. also reported a similar surge in inventory in September, warning of a squeeze on profit margins from resulting discounts and other clearing activity necessary to sell off excess stock. Nevertheless Adidas has a lower P / E ttm ratio. Source: Barchart

Adidas main rival Nike Inc. also reported a similar surge in inventory in September, warning of a squeeze on profit margins from resulting discounts and other clearing activity necessary to sell off excess stock. Nevertheless Adidas has a lower P / E ttm ratio. Source: Barchart

Adidas (ADS.DE) stock fell nearly 70.0% from its 2021 highs. This month price broke below major support at €113.60 which coincides with 78.6% Fibonacci retracement of the upward wave started in October 2014 and 200 SMA (red line). If current sentiment prevails, downward move may accelerate towards local support at €77.40. Source: xStation5

US OPEN: Investors exercise caution in the face of uncertainty.

Oklo shares surged in a true “atomic open” on today’s session

Rio Tinto and Glencore shake up the mining market🚨 Giants negotiate merger 🤝

Morning wrap (09.01.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.