Shares of the manufacturer and tester of integrated circuits used in the automotive, aerospace and energy industries, Aehr Test Systems (AEHR.US) are losing more than 18% today, after the US market opened. The company beat earnings per share and revenue forecasts, the market is worried about revised revenue forecasts for 2024, which suggest a slowdown in the electric vehicle market.

Aehr Test (AEHR.US) Q4 2023 results

-

Earnings per share: $0.23 vs. $0.19 forecasts. (about 20% above expectations)

- Revenue: $21.43 million vs. 20.89 million forecasts (about 2.5% above expectations)

The company presented a 45% increase in Q4 2023 revenue to $21.4 million and an increase in net income. However, it softened full-year revenue forecasts in 2024 to $75-85 million (15% to 30% y/y growth), citing order delays and increased production capacity for devices built from silicon carbide. The company remains optimistic about future demand in various markets, including industrial power conversion and telecommunications, and is well positioned with cost-effective solutions for firing so-called semiconductor wafers. It also suggested that there is steady demand for silicon carbide solutions beyond the EV market, suggesting broader expansion opportunities.

Highlight from Aehr earnings call

- Despite the challenges, the growth in demand for silicon carbide chips is significant. Industry and power conversion are key

- Aehr Test Systems is working with silicon carbide and gallium nitride power semiconductor customers, expecting new orders in 2024

- The company is developing new WaferPak designs and a high-power configuration of its own FOX manufacturing system for silicon photonic devices.

- With no debt and $50.5 million in cash, the company can scale its operations and R&D investments without significant downside risk

- The company is struggling with chip burn-in challenges for DRAM due to cost inefficiencies

- Aehr remains confident of further growth and is focusing operations in key markets to develop niches and further improve profitability. Among other things, the company is analyzing expansions into the Chinese market and intellectual property rights

Company's gross margin is currently over 51% with a C/Z ratio of around 26 and a return on invested capital (ROIC) of over 20%. However, the less than 1% EVA ratio suggests that the company is incurring a lot of costs (WACC) during its expansion.

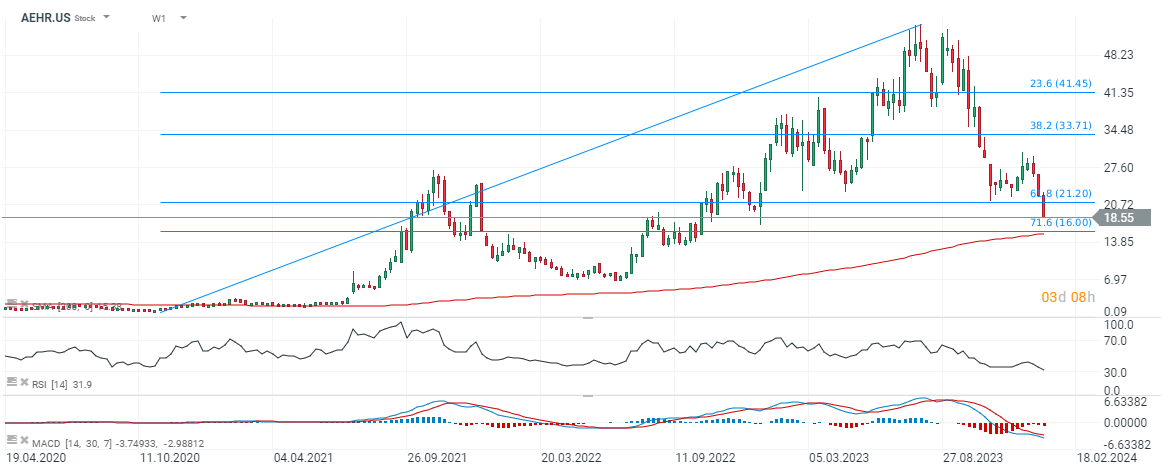

AEHR.US stock chart (Interval W1)

AEHR shares are down more than 60% from their peaks in the fall of 2023, with euphoria turning to panic after the company signaled a clear weaker environment for further growth. The main risk to further upside remains the recession. The stock could bounce towards $21, where we see the 61.8 Fibonacci retracement of 2020 upward wave. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.