Shares of Salesforce (CRM.US) and ServiceNow (NOW.US) were, not long ago, among Wall Street’s hottest market darlings. Today, the picture has shifted dramatically, as investors appear to be pricing in a risk that is not yet fully reflected in either company’s (still very solid) results: the continued development of artificial intelligence — including so-called AI agents being built by major tech giants. The market has embraced a simple narrative: “agentic AI will take their work, so it will take their revenue.” However, in the SaaS space, what matters most is the monetization model, not automation alone.

Are markets right?

Markets have long had a weakness for declaring that an industry is “over.” Still, there is a real chance we get a reality check: incumbents do not just stand still. They absorb the threat and turn it into a product.

- 2015–2016: the “Amazon will kill retail” story. In practice, leaders like Walmart and Target turned stores into an operational advantage: same day pickup, BOPIS, and mini distribution points close to the customer.

- 2010–2012: the cloud shock. “AWS will finish Microsoft and Adobe.” Both companies pivoted into SaaS and monetized the cloud.

From a business model perspective, the key point is this: agentic AI does not have to “eat SaaS.” It can attach an additional revenue layer. The market often overestimates the speed of disruption and underestimates the adaptability of entrenched leaders. For years, the basic unit of SaaS monetization was the “seat” (a user license). Agentic AI changes the question:

- Not “how many people click inside the system,” but how much work the system actually performs. Work done by AI agents is, in practice, a new category of “digital labor.”

- That is why leaders are beginning to move away from per seat pricing toward outcome based or usage based models, meaning fees tied to results or to actions inside the platform.

- This is an attempt to capture the value created by automation, rather than handing it over to “agents” as an excuse to compress ARPU.

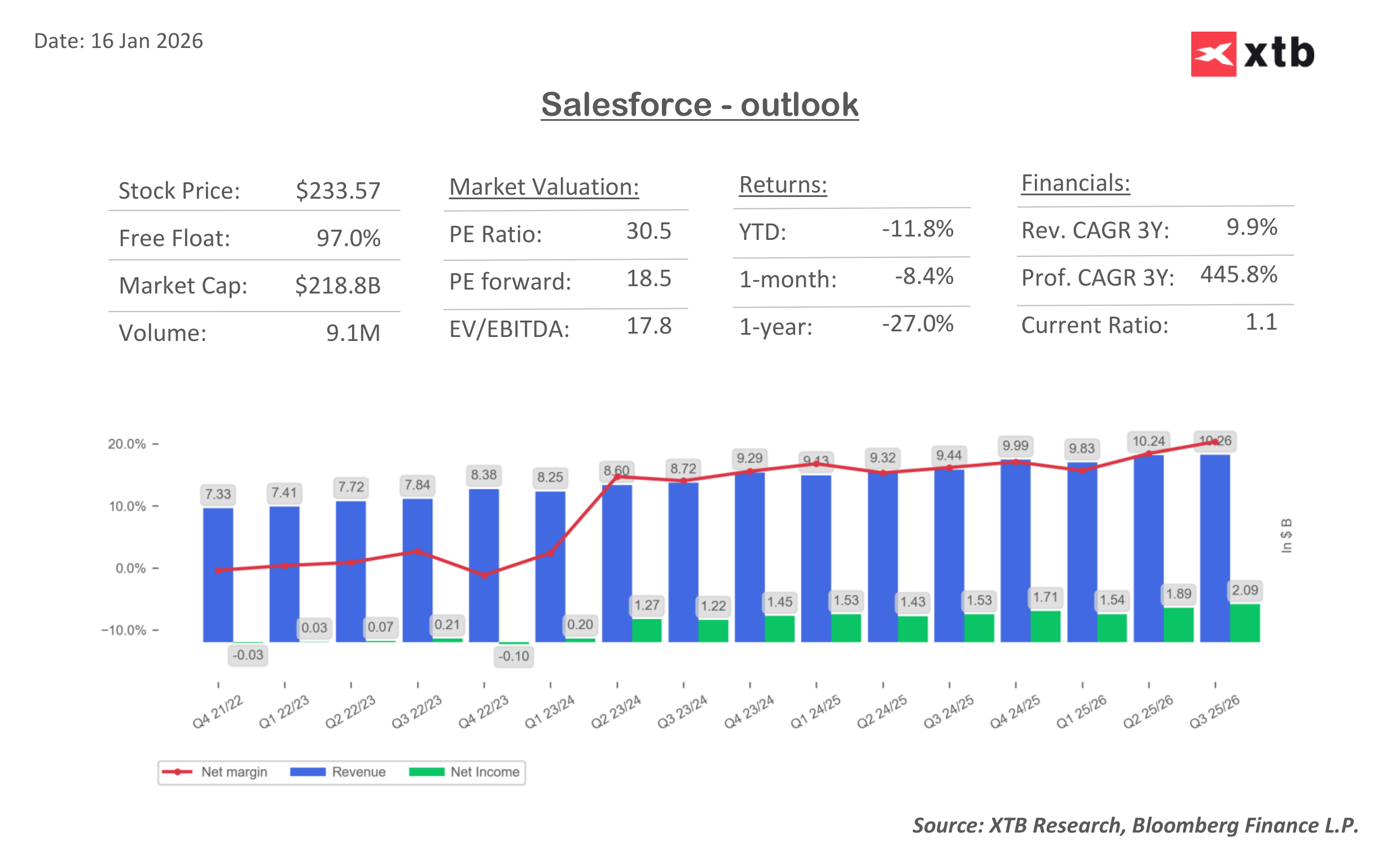

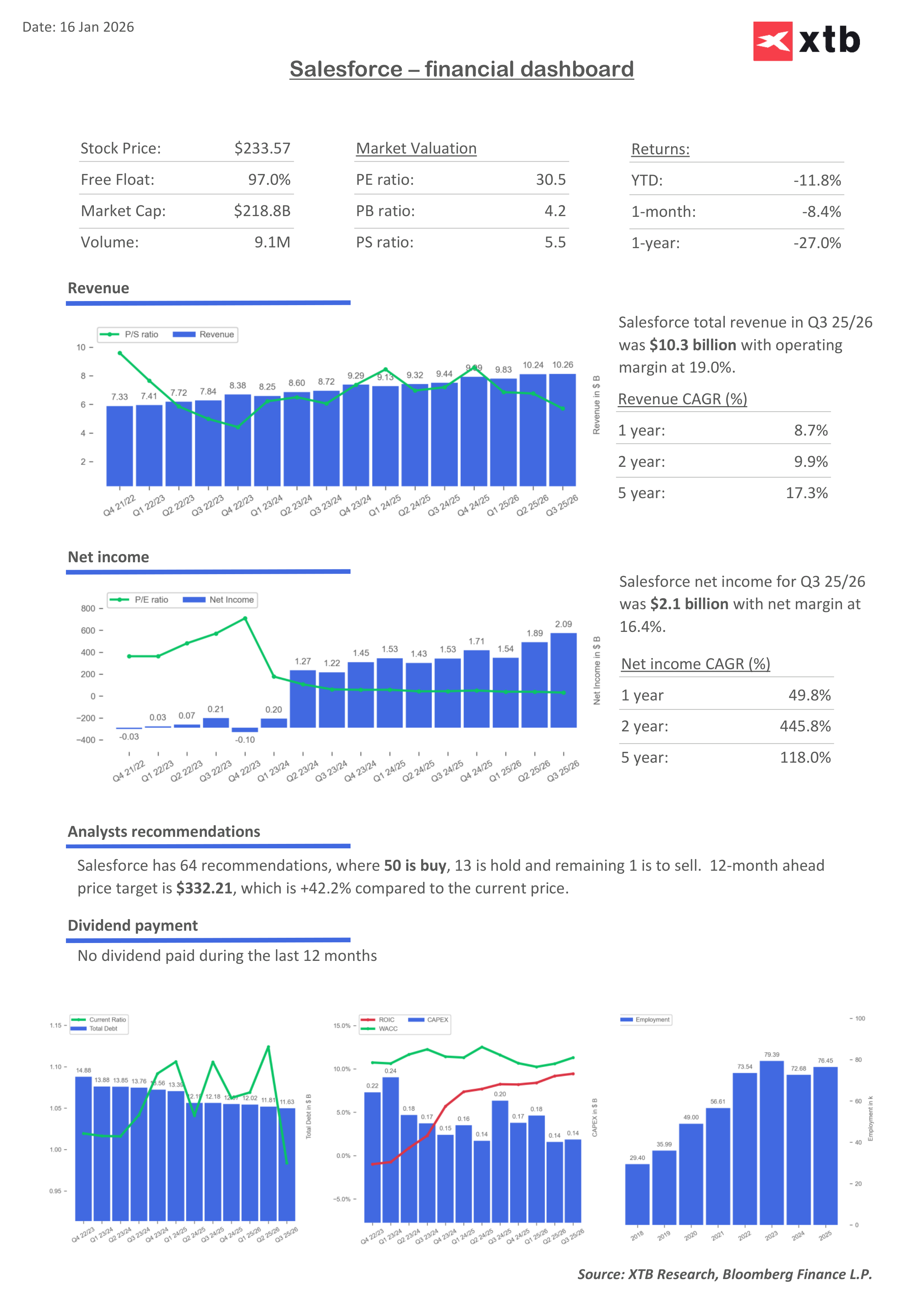

Salesforce (CRM)

In CRM, many sales processes are highly repeatable. Agentic AI can take over a meaningful portion of that work. Salesforce is not pretending it does not exist. Instead, it is rolling out Agentforce and adding mechanics that resemble “pay for execution.”

From a monetization standpoint this is crucial: an AI agent can do multiple times the work of one human. If you pay per action rather than per person, the company has a chance to preserve, and potentially increase, revenue per unit of work instead of losing it. This also explains why AI may, but does not have to, mean “less revenue” for the company. It may simply mean a different billing unit.

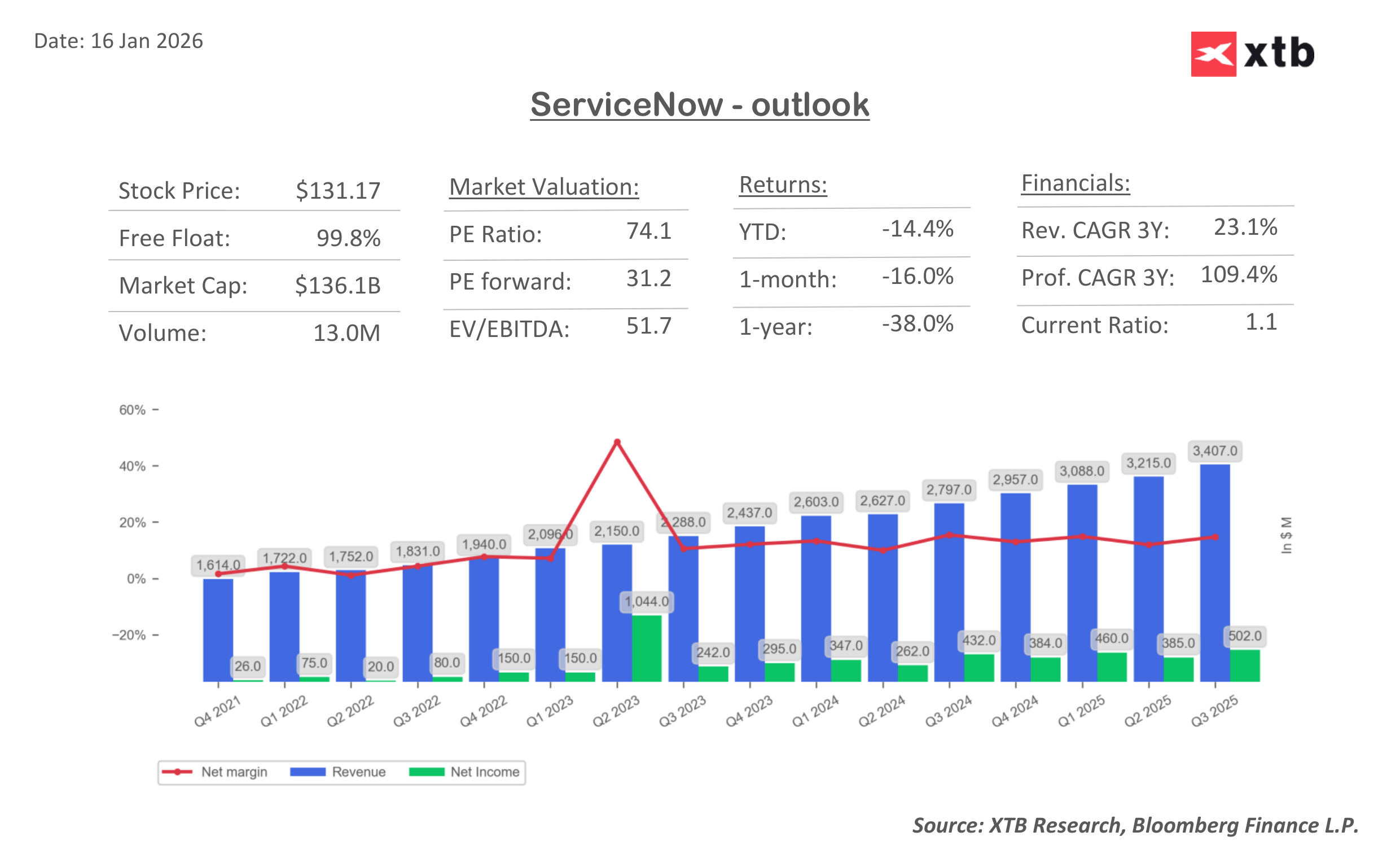

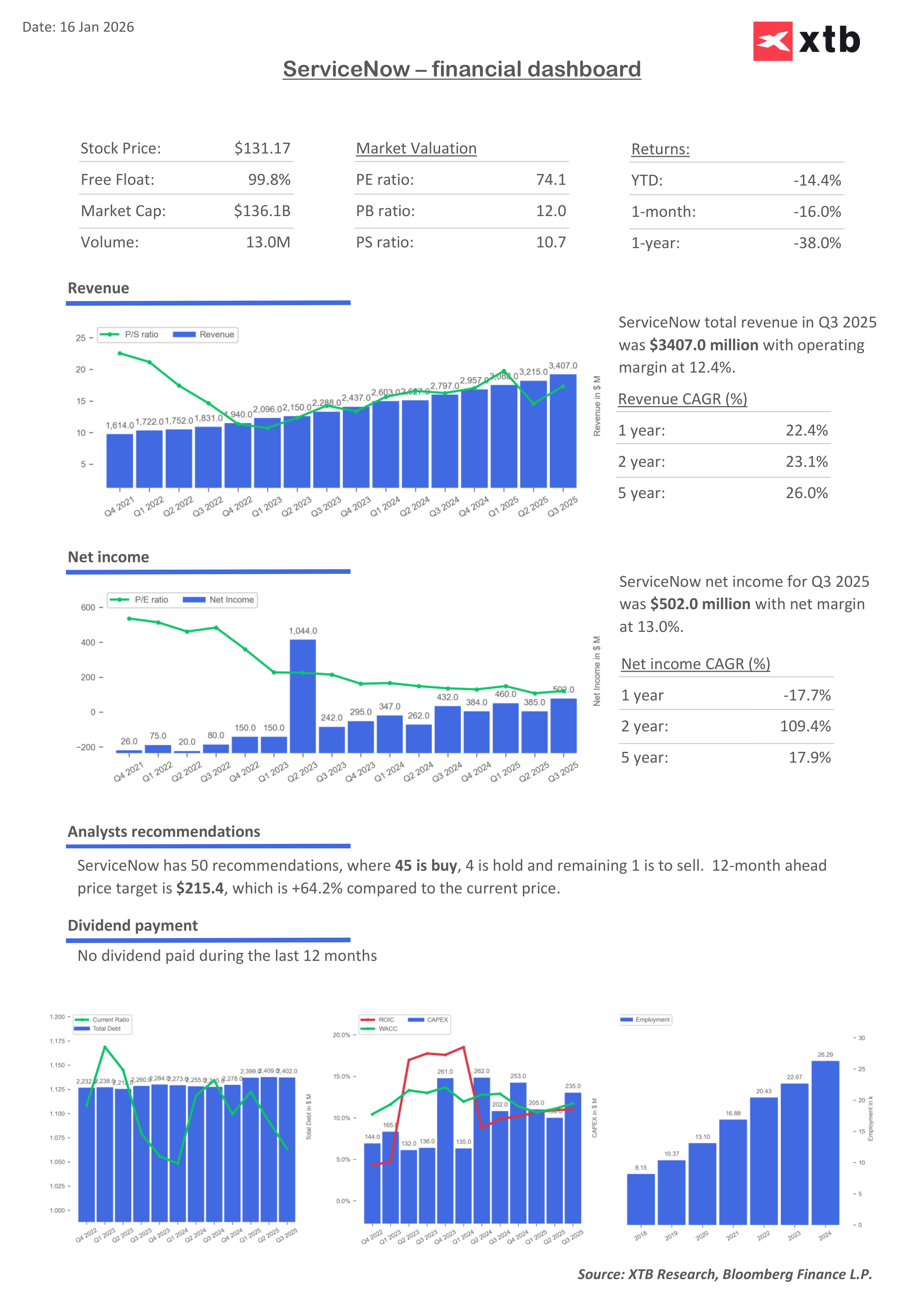

ServiceNow (NOW)

ServiceNow may even become a beneficiary of agentic AI for a simple reason: it is a workflow company operating in cross department processes, exactly the places where automation is both the most painful and the most valuable. ServiceNow can act as the system that binds together processes across IT, HR, security, finance, and service operations. A model in which “AI agents communicate with each other” inside those processes is difficult for startups to replicate. A startup would have to:

-

get inside the organization,

-

integrate with dozens of systems,

-

clear security policies,

-

and then explain why it should replace a platform the company has been running on for years.

That is switching costs plus friction in real life. And the market tends to downplay it. So even if agentic AI reduces the number of “clicking humans,” SaaS platforms will try to monetize “work performed” rather than “the user.” That does not have to be bad news for the leaders.

On top of that, if customers were to leave Salesforce or ServiceNow, they would have to reckon with switching costs, regulatory and security constraints, and the impact on tool distribution across the organization. So if you look past the loud “software apocalypse” imagination on Wall Street, something else may be closer to the truth. SaaS companies will use powerful AI, change the monetization unit, and their solutions may become even more central inside enterprises.

Salesforce (CRM.US) and ServiceNow (NOW.US) stock charts (D1 interval)

Salesforce shares fell back toward multi month lows around $220 per share, and the decline from the local peak is now close to 15%.

Source: xStation5

ServiceNow (NOW.US), a company focused on process and task automation, declined after the company approved a 5 for 1 split in December, and since then it has fallen another 12%. The current price is almost 50% below the all time high from the turn of 2024 and 2025.

Source: xStation5

Valuation and multiples

As share prices have fallen, the stocks are trading at a growing discount to their earnings and sales. The price to expected 12 month earnings ratio is currently around 18, and the PEG ratio is close to twice as “attractive” on valuation versus the peak valuation levels in 2024.

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

ServiceNow’s shares trade at a clear premium versus Salesforce due to its sales momentum and the value it has delivered in recent years. Price to earnings metrics, including price to forward 12 month earnings, have fallen materially. Forward P/E for ServiceNow is around 30, which does not look particularly demanding relative to the Nasdaq 100 average and the company’s high quality profile. ServiceNow is generating record profits and revenue, and sales are growing at a very solid pace quarter after quarter. A solid U.S. economic backdrop should support further expansion.

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.