Alaska Air Group (ALK.US) is losing more than 6% today following the release of its 2Q24 results and the presentation of its forecasts for the next quarter. The company, despite its solid results, disappointed investors most strongly precisely with its projections for the next quarter, which differed sharply from analysts' predictions.

The company generated $2.9 billion in revenue in 2Q24, an improvement of 2.1% over the previous year, marking a record quarter for the company. Sales of premium seats accounted for 33% of the company's total revenue, and it was this segment that led to such a strong result.

The company recorded similar growth in RPM, or the value equivalent to one mile traveled by one paying passenger (revenue passenger miles). The company recorded RPM 15.3 billion (+2.5% y/y). Stronger growth was recorded in cpacity, as measured by the ASM value (a measure of 1 seat allowing to travel 1 mile). In this value, Alaska Air achieved 6% y/y growth to a value of 18.2 billion. The value of RASM, which stands for revenue per ASM unit, declined y/y by 3.7% because of higher capacity growth.

Adjusted EPS came in at $2.55, compared to $3 a year earlier, a stronger result than the $2.38 the market had predicted.

The company expects capacity growth to diminish in the following months, while for the full year of 2024 it expects growth to decline to 2.5% y/y, due to lower deliveries from Boeing than it had previously anticipated.

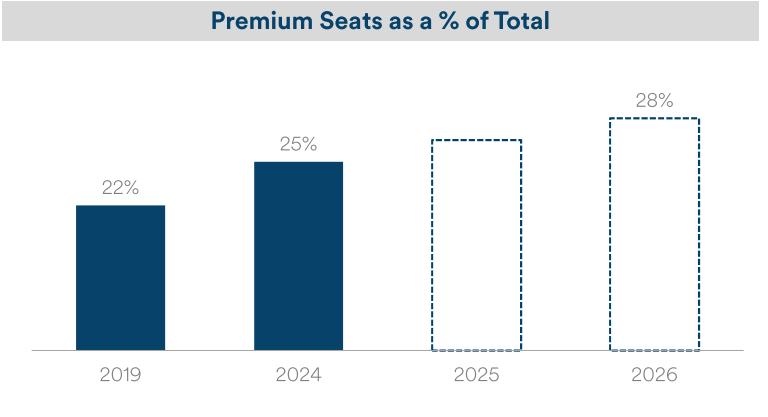

Alaska Air also announced an increase in the share of premium seats on its aircraft, which should boost both the company's revenue and its margins. Fleet modifications this September include adding premium seats to 64% of the group's aircraft. Ultimately, by 2026, the share of premium seats in the number of total seats offered is expected to rise to 28% from 25% today.

Source: Alaska Air Group

Source: Alaska Air Group

The company, despite solid results, disappointed investors most strongly with its predictions for the coming periods. In 3Q24, it expects to deliver $1.4-1.6 in adjusted earnings per share versus Wall Street's average expectation of $2.06. The drop in projected profit is due to following in the footsteps of its competitors including United AIrlines Holdings and Delta Air Lines, which have decided to cut prices for the summer season, which translates into increased competition for the record number of passengers expected to travel this summer, some 270 million. The price cut will also affect profitability for all of 2024, with the company lowering its forecast to $3.5-4.5 (previously: $3.25-5.25). The market consensus was for $4.52 for the full year.

The company is losing more than 6% today after the release of results and forecasts, approaching the support level at around $37 set by the consolidation zone from February this year. The company has remained in a downtrend since the April peaks. Source: xStation

2Q24 RESULTS:

- Revenues: $2.9 billion (+2.1% y/y), expected: $2.93 billion

- Revenue from passengers: $2.65 billion (+2.1% y/y), expected: $2.68 billion

- RPM: $15.3 billion (+2.5% y/y), expected: $15.74 billion

- ASM: 18.2 billion (+6% y/y), expected 18.17 billion

- RASM: 15.92c (-3.7% y/y)

- Adjusted EPS: $2.55 (vs. $3 a year earlier), expected $2.38

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.