- Improved market sentiment at the start of the week

- Tech companies climb on positive news

- Gold and silver support mining companies

- Improved market sentiment at the start of the week

- Tech companies climb on positive news

- Gold and silver support mining companies

The beginning of the week starts optimistically on the American stock exchange. Investor sentiment is clearly better, and the absence of macroeconomic readings allows investors to focus on positive company announcements.

The leader of growth among American indices is Russell2000, whose contracts are rising by about 0.8%. Smaller, yet still noticeable increases are recorded by US100, US500, and US30, where growth is limited to 0.4%.

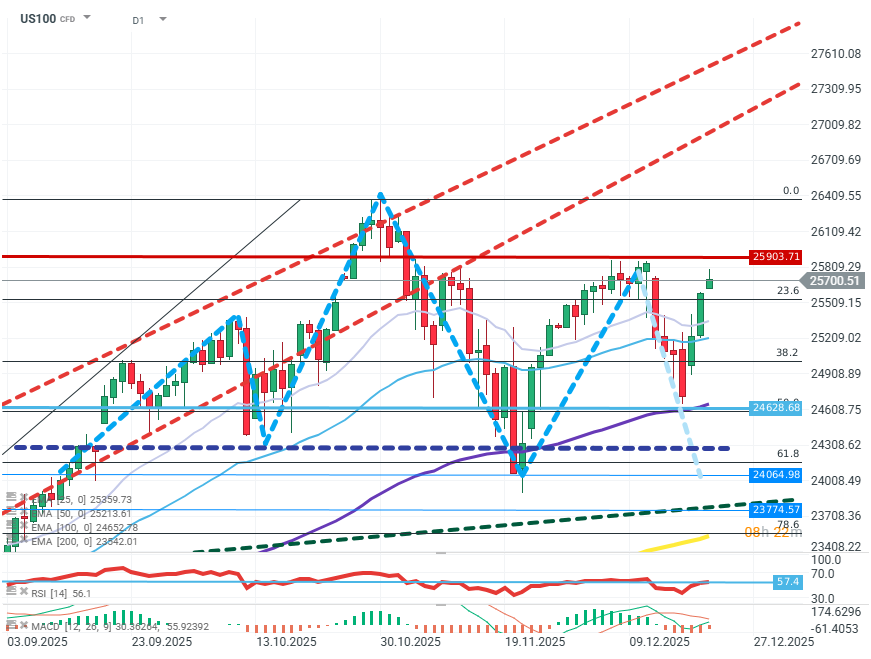

US100 (D1)

Source: xStation5

Buyers managed to break the RGR formation, defending the FIBO 50 level and the EMA100 average. The next target is around 25,900, which must be exceeded to attempt testing all-time highs on the chart. If the supply wants to regain initiative, a quick return below FIBO 38.2 is necessary, from where an attempt could be made to pass through the EMA100 average to deepen the correction.

Company News:

Clearwater Analytics (CWAN.US) - The company's valuations are rising by over 8% after it was announced that a private equity group will purchase the software producer for $8.5 billion.

Rocketlab (RKLB.US) - The orbital and rocket technology company is rising by over 4% at the opening after announcing it won a contract to build 18 satellites. This is the company's largest single contract to date.

Anglogold (AU.US) - The rise in precious metals is driving up valuations of mining and jewelry companies. Increases exceed 4%.

Warner Bros Discovery (WBD.US) - The company is rising by over 3% at the opening after information that Netflix will receive a $59 billion loan to purchase the company.

Nvidia (NVDA.US) - The chip and AI giant announces that the first batch of export H200 processors will reach China before the end of February 2026. The company is rising by about 1.5%.

Carnival (CCL.US) - The cruise ship operator published results significantly above expectations, with EPS at the end of the year amounting to $0.34 compared to the expected ~ $0.25. This simultaneously allowed for a series of positive recommendations from investment banks. The company is rising by about 8% at the opening of trading.

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.