Alphabet (GOOGL.US) faced a very difficult challenge given the high expectations set by the market. Nevertheless, the company managed to report strong results for the third quarter, surpassing consensus market forecasts in key areas, thereby maintaining robust revenue growth dynamics. The Cloud segment, in particular, delivered a positive surprise and continues to be the most closely watched component of the company's revenue. In after-hours trading, the company's stock jumped by over 4% in the initial reaction to the results.

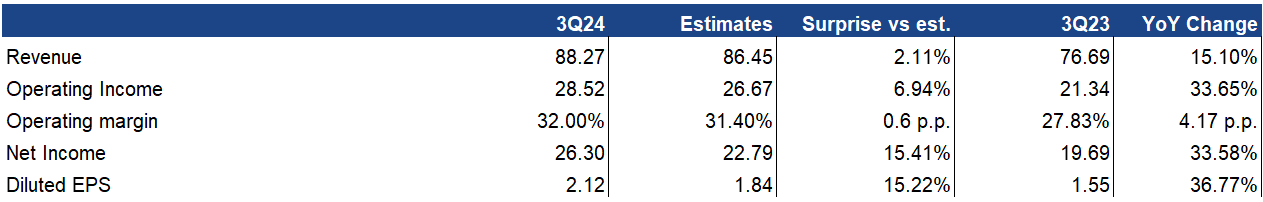

The company achieved $88.27 billion in revenue, representing a growth rate of 15.1% and a 2.11% higher than forecasted. Even after adjusting for payouts to partners who direct customers to the Google environment, revenues remained strong at $74.6 billion (compared to the forecasted $72.9 billion).

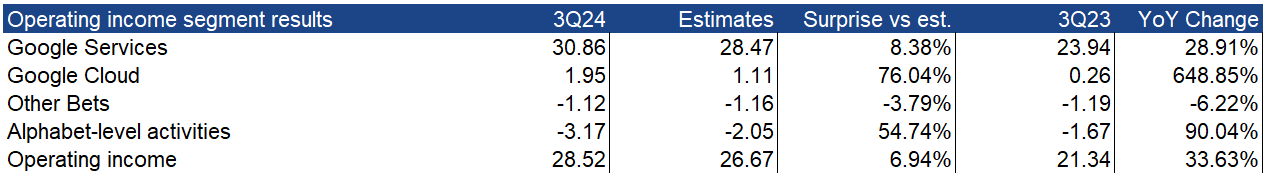

The company also maintained excellent cost discipline, resulting in a 33.7% year-over-year increase in operating profit to $28.52 billion (compared to $26.67 billion the previous year). This translated into a record operating margin of 32%. This marks the third consecutive quarter that the company has maintained an operating margin above 30%.

Alphabet also performed exceptionally well at the adj. EPS level, which for Q3 2024 amounted to $2.12, significantly exceeding the forecasted $1.84.

Key data for Q3 2024 (in billions of dollars, except for adjusted earnings per share). Source: XTB Research, Bloomberg Finance L.P.

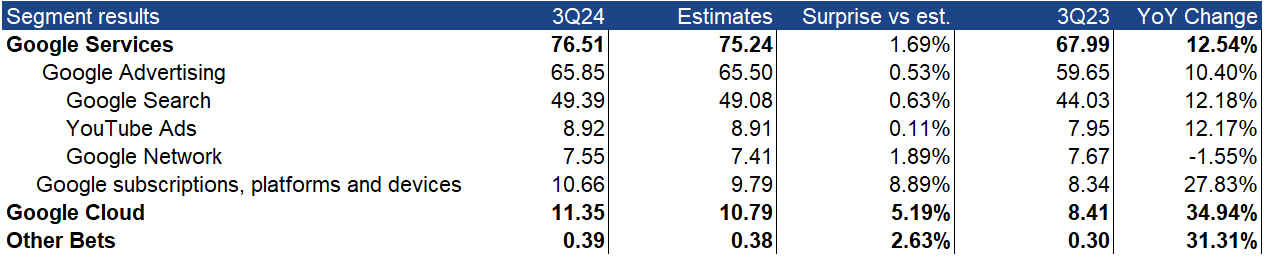

Among the individual segments, the company delivered solid sales dynamics in its core areas. Maintaining high growth rates in segments based on advertising revenues (particularly the YouTube and Google Search segments) allowed the company to mitigate one of the biggest concerns investors might have had for this quarter's results. AI is one of the company's leading growth drivers, and with the increasing development of generative artificial intelligence, there is significant potential for revenue generation in the company's flagship market segment, search.

Nevertheless, Alphabet demonstrated that its AI-driven solutions, which enhance search and the use of the company's technologies, not only improve customer experience but also sustain high, double-digit revenue growth rates. Alphabet's CEO announced that the company is still at the beginning of its journey to introduce more new solutions and improvements in this crucial segment.

Revenue breakdown by segments. Source: XTB Research, Bloomberg Finance L.P.

For YouTube segment, the total value from both advertising and subscriptions over the past four quarters exceeded $50 billion for the first time in history. This segment, particularly in areas like YouTube Music Premium, YouTube TV, and NFL Sunday Ticket, is leading the growth in subscription revenues.

In the Google Cloud segment, the company significantly accelerated its revenue growth to nearly 35% year-over-year. This figure is well above forecasts and indicates Alphabet's strengthening position in a market where it competes heavily with Amazon and Microsoft.

Operating income breakdown by segments. Source: XTB Research, Bloomberg Finance L.P.

In conclusion, the company's results for Q3 2024 indicate not only the maintenance of strong growth dynamics in key segments but also the dynamic development of the company in the rapidly evolving AI market. This translates to Alphabet maintaining a leading position in the technological race.

The company's stock is up over 4% in after-hours trading. However, the change is still lower than what was priced in by the options market during the session preceding the earnings release. The implied change indicates a level of $180. Source: xStation

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.