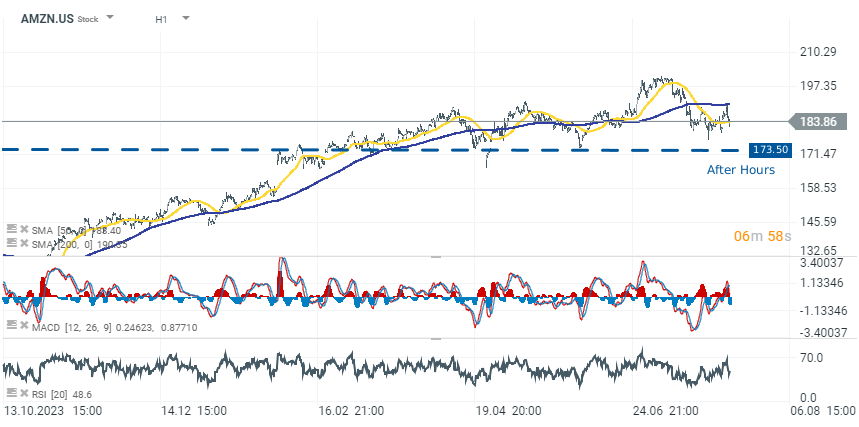

Amazon (AMZN.US) drops 5.70% in post-market trading in the USA. The Q2 results were close to consensus, but this was not enough to meet investors' high expectations. As a result, Amazon deepens today's decline to $173.50 per share. Despite this, year-over-year results are significantly better and confirm a growth trend.

- Revenue: USD 148 billion, up 10.2% year-on-year, below estimates by USD 760 million.

- Sales in the North American region: USD 90 billion, up 9% year-on-year.

- AWS segment sales: USD 26.3 billion, up 19% year-on-year.

- Operating profit: US$14.7bn, more than doubled from US$7.7bn in Q2 2023.

- AWS operating profit: $9.3bn, up from $5.4bn in Q2 2023.

- Net profit: $13.5bn ($1.26 per share), up from $6.7bn ($0.65 per share) in Q2 2023.

Guidance for Q3 2024:

- Revenue: US$154bn to US$158.5bn, up 8% to 11% year-on-year.

- Operating profit: $11.5bn to $15bn, up from $11.2bn in Q3 2023.

Amazon Web Services (AWS), a key part of Amazon's operations, showed impressive growth and significant contributions to overall results. AWS sales increased by 19% year-over-year to $26.3 billion, and operating income was $9.3 billion compared to $5.4 billion in the previous year. CEO Andy Jassy highlighted the continued high demand for the AWS segment, driven by increasing demand for cloud services and generative AI models. AWS continues to attract customers with its comprehensive functionality, security, operational efficiency, and advanced AI capabilities such as SageMaker, Bedrock, Trainium, and Q for various AI applications.

For the next quarter, Amazon provided cautious but optimistic guidance. The company expects net sales to be between $154 billion and $158.5 billion, representing an 8% to 11% increase compared to the third quarter of 2023, although it acknowledges a negative currency impact of 90 basis points. Operating income is projected to be between $11.5 billion and $15 billion, compared to $11.2 billion in Q3 2023. Amazon's management emphasized the risk of not meeting future projections due to factors such as changing economic conditions, currency fluctuations, and customer demand, but remains confident in its strategic initiatives and market position.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.