- Amazon will release its financial results for the second quarter today after the market closes.

- The company is expected to announce a significant increase in both revenue and earnings per share.

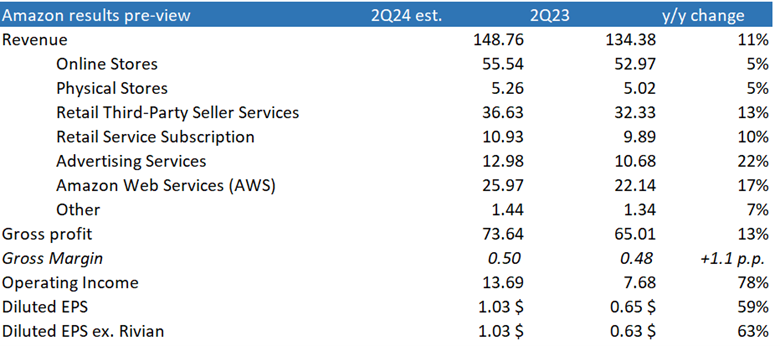

- Revenue is projected to climb 11% year-over-year to $148.76 billion, while earnings per share (EPS) are expected to soar nearly 60% to $1.03.

- Investors will be closely watching the performance of Amazon's advertising business, a relatively new but rapidly growing segment, as well as its cloud computing division, Amazon Web Services (AWS).

Market Expectations

Amazon has consistently exceeded earnings expectations for the past six quarters. In fact, on average, the company has surpassed analyst estimates by a remarkable 70% over the last decade. More recently, the average earnings surprise has been around 40%. To maintain this trend, Amazon would need to report EPS of approximately $1.40.

Similarly, the company has outperformed revenue expectations for six consecutive quarters. While the most recent beat was a more modest 0.51%, Amazon's average revenue surprise historically has been 1.3%. Based on this, revenue is anticipated to surpass $150 billion.

Market expectations for Q2 2024. Source: Amazon, Bloomberg, XTB

Key Areas of Focus

Several factors will be in the spotlight. Amazon's advertising business is gaining traction and contributing increasingly to overall results. AWS, the company's cloud computing arm, achieved 17% growth in the first quarter, reaching $25 billion in revenue. Expectations for Q2 AWS growth are also around 17%. Amazon's CEO has emphasized the company's commitment to technology and its belief that AWS will be a cornerstone of global artificial intelligence development. The acquisition of AI startup Anthropic earlier this year underscores this focus.

Investors will also be keen to hear about the progress of Alexa, Amazon's AI-powered virtual assistant. Recent reports suggest the product is still under development, and any lack of updates or a delayed launch could dampen investor sentiment.

Core Business and Challenges

Online retail remains Amazon's core business, although the company has expanded into food delivery, which has the potential to increase revenue from Prime members (now totaling 200 million). However, Amazon faces growing competition from Chinese e-commerce giants like Temu, Shein, and AliExpress.

Other Key Indicators

Beyond the top line and bottom line, investors should monitor the following:

- AWS Growth: Any slowdown in AWS growth below the expected 17% could disappoint investors, especially given the strong performance of competitors like Alphabet's cloud business.

- Impact of Food Delivery: The contribution of food delivery subscriptions to overall sales and profitability will be closely watched.

- Competitive Response: Amazon's recent introduction of discounts for Chinese customers could positively impact future results, but the company's ability to compete effectively against Chinese rivals remains a key challenge.

Stock Performance

Amazon's stock price has experienced a recent correction after reaching highs above $200 per share. Analysts have set a 12-month price target of $223, implying potential upside of around 7% from the current level of $185. Key support and resistance levels are identified at $175, $185-$190, and $198.

Gaming companies with huge discounts 🚨 Will Project Genie end the traditional era of gaming ❓

Lockheed Martin earnings: The peak of global tensions and valuations

Market wrap: European indices outperform US stocks ahead of the opening bell on Wall Street 📉

Apple’s Record Quarter: iPhone, Services, and ‘Invisible’ AI. Is a Return to the Throne Imminent?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.