American chipmaker Advanced Micro Devices (AMD.US) warned investors of a revenue decline in Q3 2022 due to weaker PC market demand and worsening supply chain problems. The company lowered forecasts, with shares already down nearly 6% before the open:

- Q3 revenue will be roughly $5.6 billion vs. earlier forecasts of around $6.7 billion

- Revenue from the client market fell 40% year-over-year to about $1 billion

- AMD reported a non-GAAP gross margin of close to 50%, versus a previous expectation of 54%

- Gaming (14% y/y) and Data Center (45% y/y) revenues increased

- The acquisition of Xilinx earlier in the year proved to be a hit for AMD, generating $1.3 billion in revenue for the company

AMD during Q2 assumed a maximum of $200 million deviation in further revenue estimates, the difference of nearly 1 billion is also a surprise for the company, according to the company, there is currently a significant inventory correction taking place in the overall computer market. It is worth adding that even AMD's previous forecasts, which have not been 'proven', looked quite pessimistic, and their update affects the already weak sentiment of the semiconductor market. If AMD's quarterly sales come in at $5.6 billion, it will still represent almost 29% growth compared to Q3 2021, but will shake the quarterly revenue growth rate. The market has been expecting AMD to keep beating earnings forecasts and maintain a steady pace of growth through which the stock has particularly suffered recently due to its exorbitant P/E valuation.

- Stacy Rasgon, a semiconductor market analyst at Bernstein, warned investors of a deteriorating semiconductor market picture in which the stock prices of chipmakers Intel, TaiwanSemiconductors, AMD and Korea's Samsung are suffering.

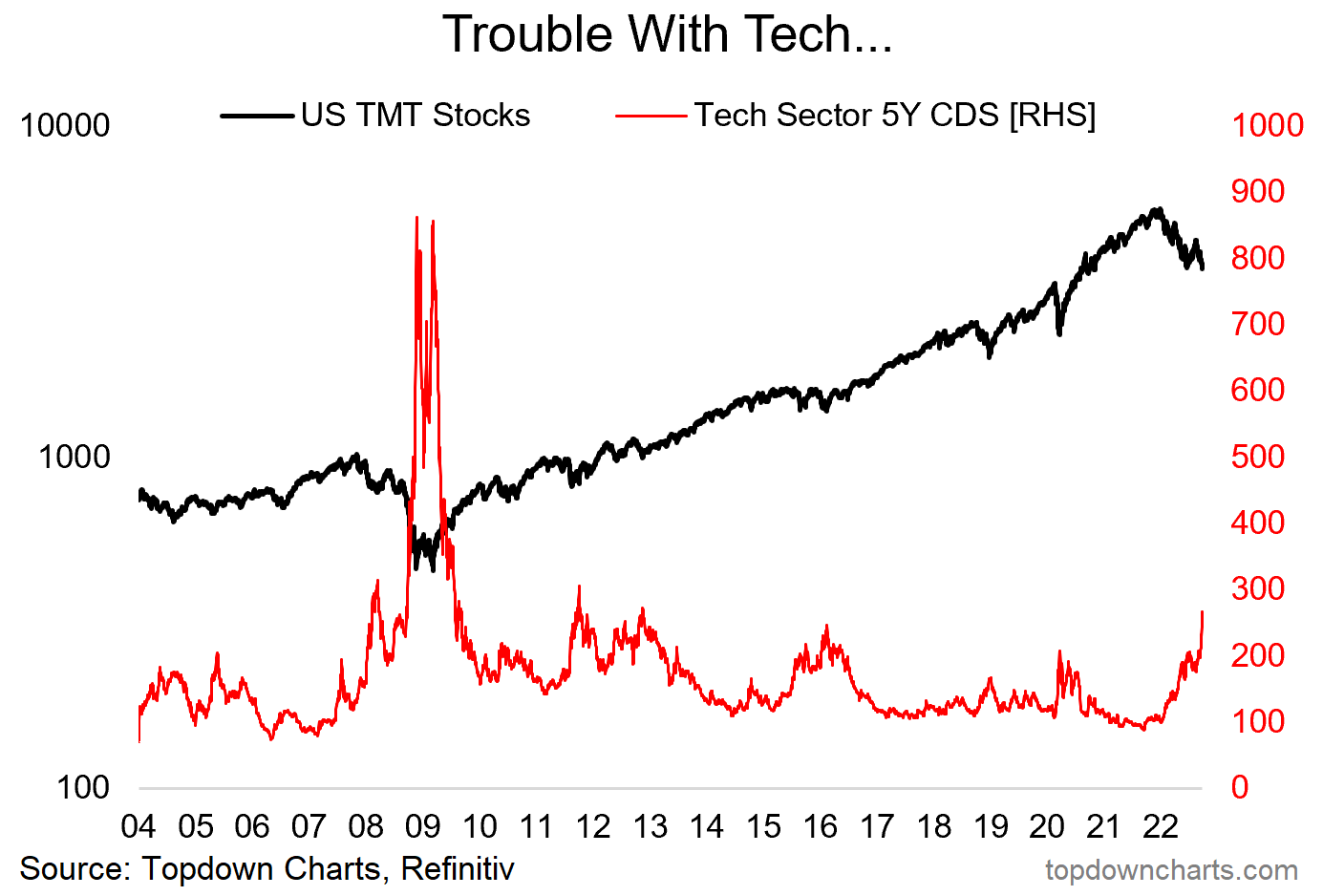

The chart shows an increase in 5-year CDS spreads (credit default swap) for tech companies, illustrating the priced-in increase in bond default risk and financial instability among US tech stocks. We saw a similarly rapid rise during the 2008 - 2009 financial crisis. Source: Refinitv, Topdowncharts

The chart shows an increase in 5-year CDS spreads (credit default swap) for tech companies, illustrating the priced-in increase in bond default risk and financial instability among US tech stocks. We saw a similarly rapid rise during the 2008 - 2009 financial crisis. Source: Refinitv, Topdowncharts

- In pre-opening trade, shares of Intel (INTC.US), Taiwan Semiconductors (TSMC.US) and Nvidia (NVDA.US) are falling, having already reported up to $400 million in quarterly losses due to U.S. sanctions on China's tech market that include a ban on technology exports and restrictive licensing. Dell (DELL.US) and HP (HPQ.US) are also losing stock.

- Samsung also lost, showing its first drop in quarterly earnings since 2019. The forecast cuts look worrisome in the context of the upcoming earnings season. The Korean giant's profit surprised analysts, falling 31.7% year-on-year amid inflation hitting demand for smartphones, home appliances and chips;

- The United States plans to move some semiconductor production from Taiwan to Phoenix, Arizona. The May 2020 Taiwan Semiconductors deal, initially valued at $12 billion, is now being widely discussed in the U.S., which has faced the logistical challenge of diversifying its critical technology supply chain and recreating domestic production;

- Increased recession risk, still-high inflation and a strong dollar are eroding technology sector margins and driving up financing costs; stocks of companies driven by debt and venture capital and private equity fund inflows may be particularly vulnerable during this period, likely to cut spending and reduce risk exposure.

Advanced Micro Devices (AMD.US) shares. The price of the stock has encountered strong resistance in the form of the 200-session SMA200 average running around $70, the opening near $64 indicates further downside potential although the stock market may be supported by a possible weaker NFP reading at 2:30 p.m. The company's fundamental valuation has cooled dramatically, with the P/E ratio settling around 19 points and P/B ratio reaching 2, making the valuation appear to be within the index average. The PEG Ratio (the stock's valuation relative to expected revenue growth rate and expected earnings per share) has cooled tremendously, at 0.67, which may encourage contrarian investors to take an interest in the company's stock. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.