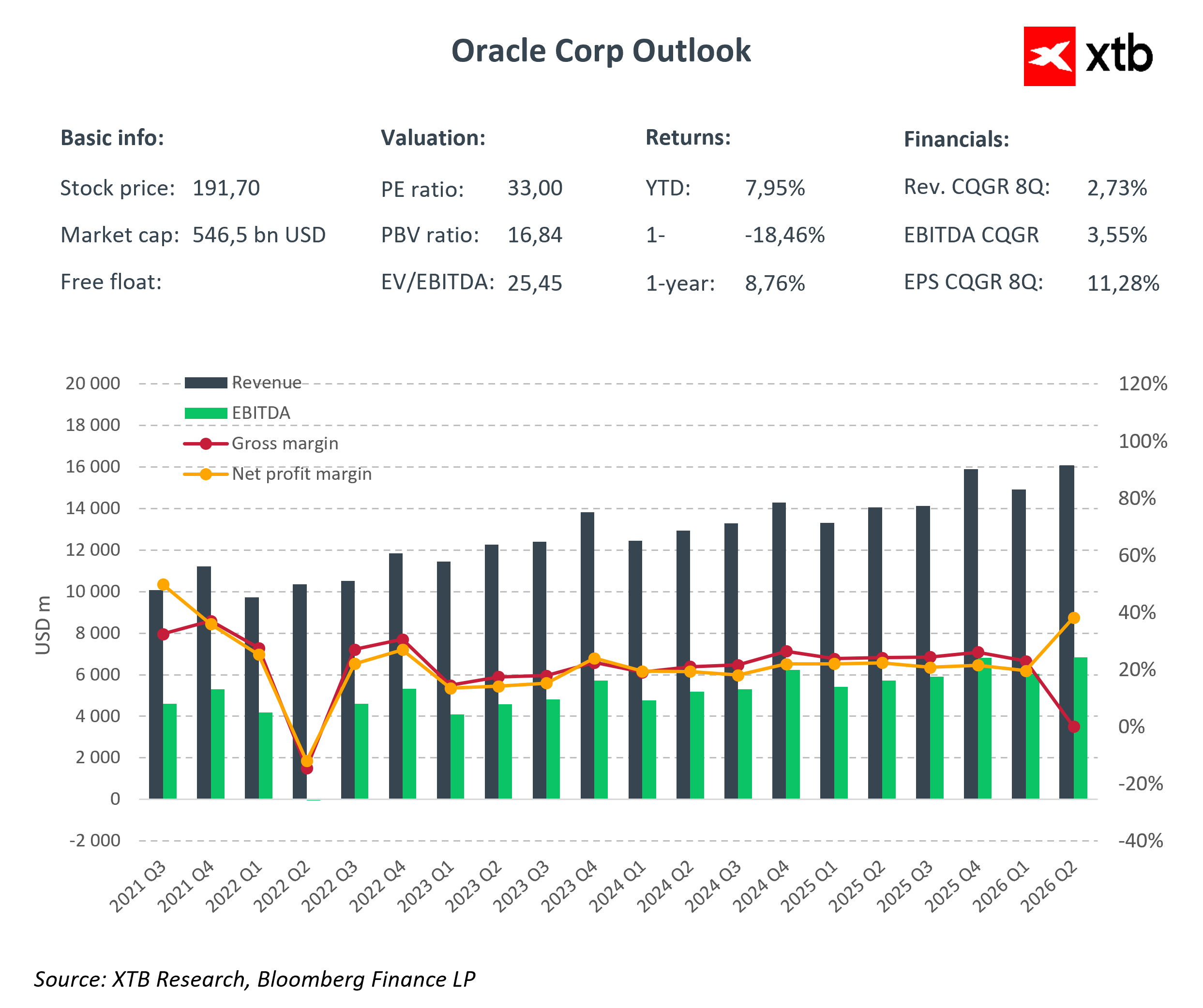

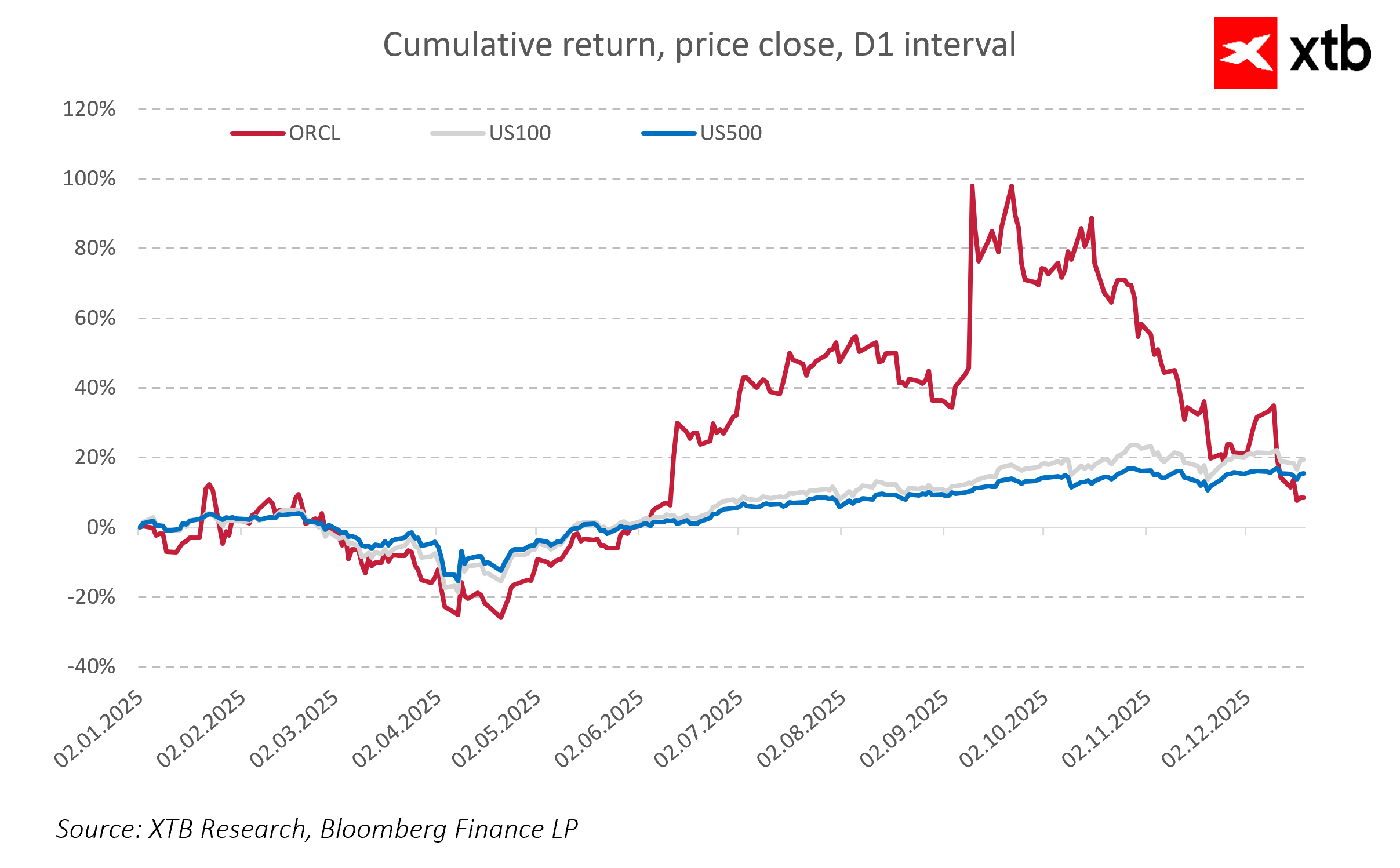

Oracle (ORCL) shares experienced a dynamic increase following reports on progress in the TikTok transaction in the U.S. and fundraising discussions with OpenAI, highlighting the company's strategic strengthening in the cloud computing and artificial intelligence sectors.

ByteDance has agreed to sell over 80% of TikTok’s U.S. operations to a consortium including Oracle, Silver Lake, and MGX from Abu Dhabi. The transaction aims to meet national security requirements and avoid a potential ban on the app in the United States. Oracle and its partners will acquire a majority stake in the newly formed TikTok US with the deal expected to close by the end of January. This will position Oracle to manage the algorithm, user data, and Oracle Cloud Infrastructure (OCI), potentially driving significant growth in cloud revenues.

Simultaneously, OpenAI is conducting preliminary negotiations to raise up to USD 100 billion at a valuation of USD 750 billion, signaling strong investor appetite for AI and easing Oracle’s cost pressure related to its cloud partnership with the company.

The TikTok US transaction strengthens Oracle’s position in a key segment of the technology market, enhances the company’s role in data security and cloud infrastructure, and creates potential for further stock value growth in the coming quarters.

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Sentiments on Wall Street are falling 📉S&P 500 earnings season highlight

Daily summary: The beginning of the end of disinflation?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.