-

AMD has signed an agreement with OpenAI to supply Instinct MI450 chips, increasing its share in the AI market.

-

OpenAI can purchase up to 160 million AMD shares, highlighting the strategic nature of the partnership.

-

AMD has signed an agreement with OpenAI to supply Instinct MI450 chips, increasing its share in the AI market.

-

OpenAI can purchase up to 160 million AMD shares, highlighting the strategic nature of the partnership.

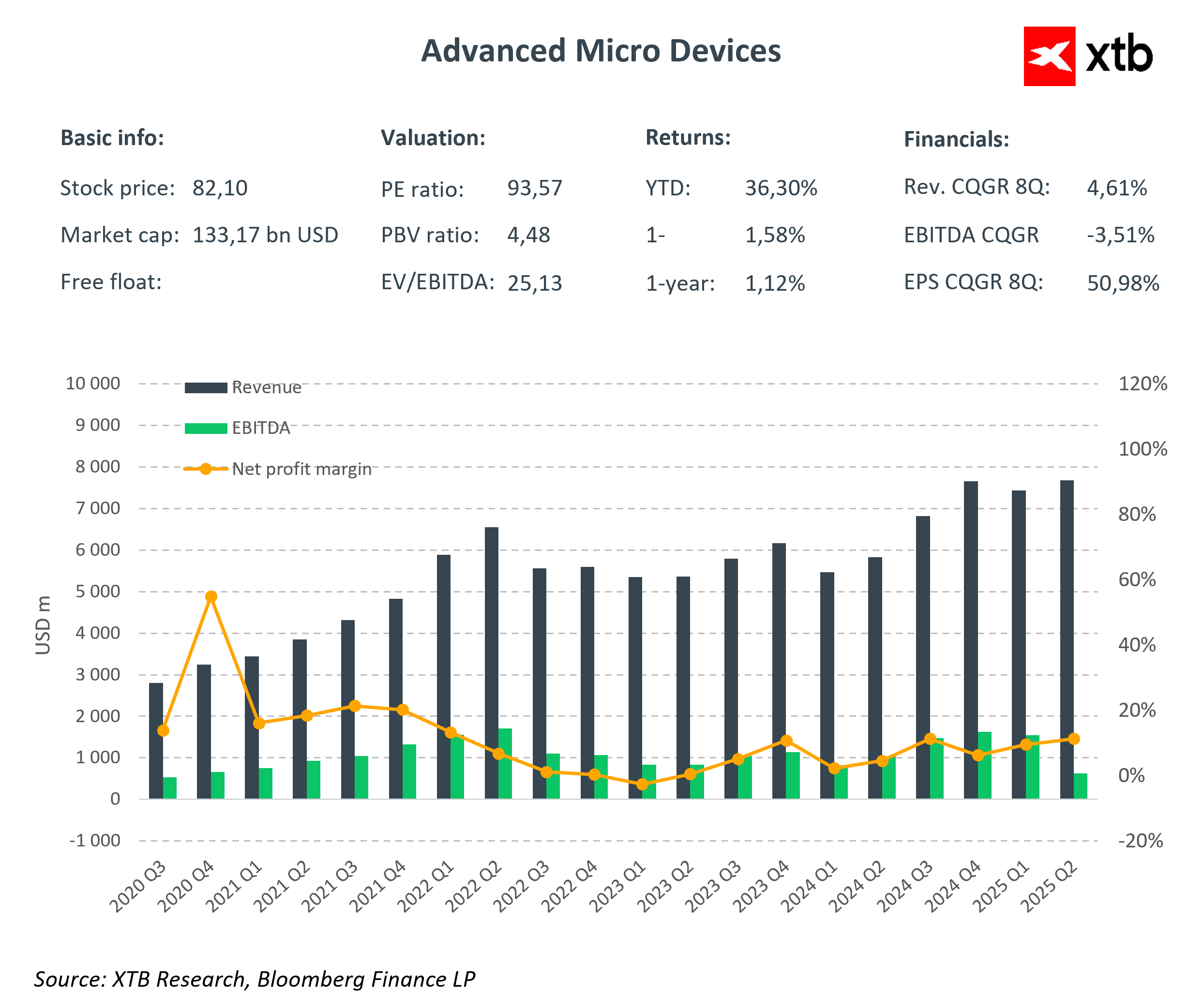

The agreement between AMD and OpenAI is a pivotal moment not only for the company itself but also for the entire artificial intelligence market. By supplying powerful Instinct MI450 chips with a total capacity of 6 gigawatts, AMD demonstrates that it is ready to compete with Nvidia, the current leader in the AI chip industry. This collaboration will allow AMD to significantly increase its share in the rapidly growing AI infrastructure segment while accelerating the development of advanced AI solutions worldwide.

Additionally, AMD has issued OpenAI warrants for up to 160 million shares, which will be activated upon achieving specific technical and financial milestones.

The possibility for OpenAI to purchase shares on preferential terms clearly indicates that this partnership has a long-term and strategic nature, with potential mutual benefits. For AMD, this means the prospect of substantial revenue growth, especially since the deal's value could reach tens of billions of dollars annually. Collaboration with a leader in the AI field also confirms that AMD is not only developing advanced technologies but is also capable of building high-level strategic business relationships effectively.

Sam Altman, co-founder and CEO of OpenAI, emphasized that the partnership with AMD is crucial for increasing the computing power needed to fully unlock the potential of artificial intelligence. This agreement fits into the broader trend of expanding AI infrastructure worldwide, where companies are investing heavily in the development of generative AI technologies. For example, Nvidia recently announced plans to invest up to $100 billion in OpenAI to jointly develop data centers based on their systems.

In the context of the semiconductor market, this deal could change the balance of power, especially given the growing demand for AI chips driven by the development of generative artificial intelligence and the widespread application of these technologies across various economic sectors. For investors, this is a clear sign that AMD is dynamically expanding its portfolio and has the potential to compete effectively in the global market, which should positively impact the company’s financial results in the coming years.

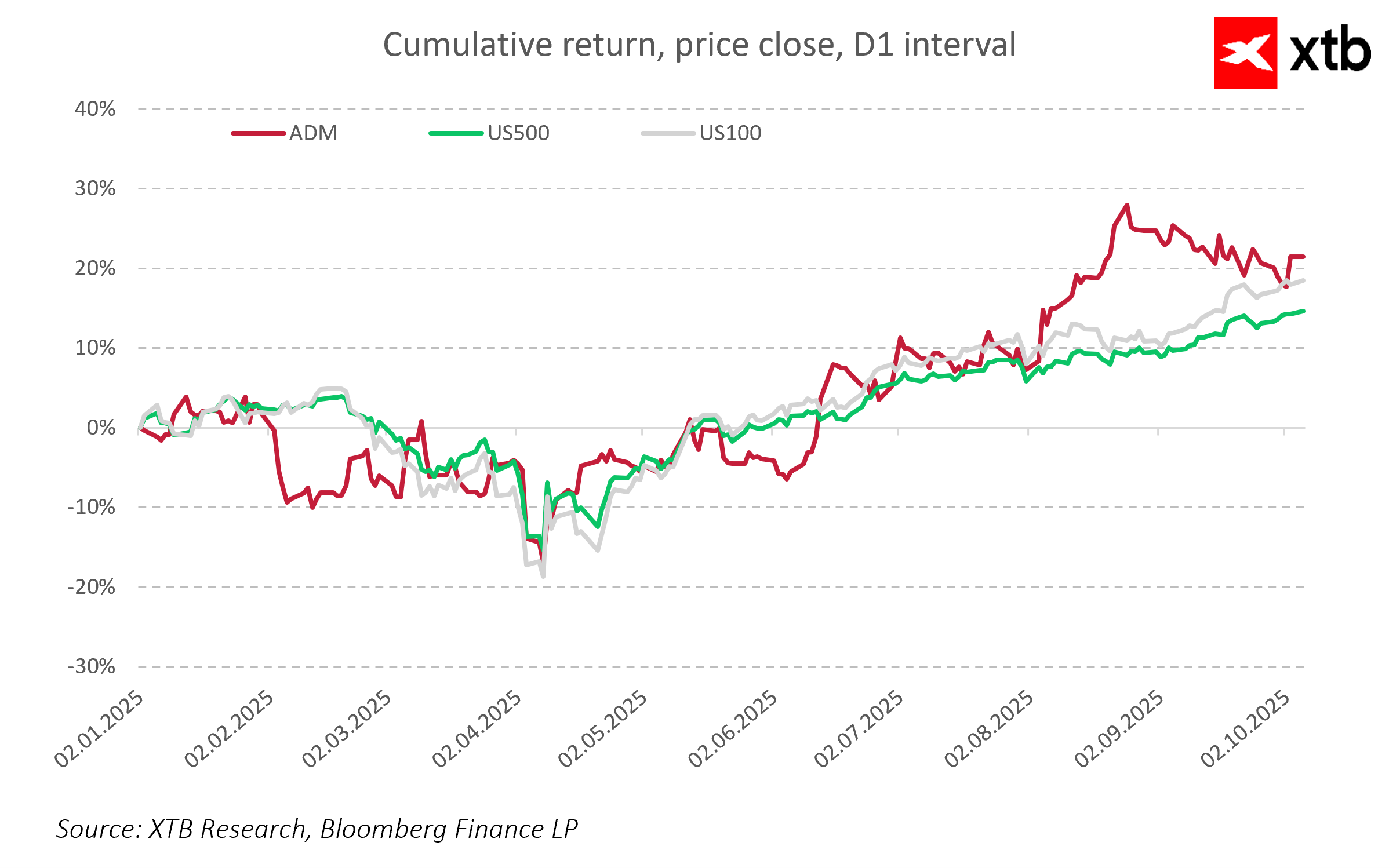

Moreover, since the beginning of the year, AMD shares have gained approximately 20% in value, outperforming benchmarks such as the S&P 500 and NASDAQ. The company’s stock price remains in a strong upward trend, further confirming growing investor interest and optimism about the company’s future.

This agreement is not only a success for AMD but also an important step toward a more competitive and innovative semiconductor market, where strategic partnerships play a key role. It will be worth following the development of this collaboration and how it will influence the future of the AI sector.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.