Some European banks are making up for yesterday's losses thanks to reports of a liquidity injection for Credit Suisse (CSGHN.CH) by the SNB. However, the rebound is relatively small, and the bank's problems still appear to be far from over.

European banking index rebounds less than 0.5%.A significant recovery is seen in the shares of Germany's Commerzbank (CBK.DE). Spain's Bankinter (BKT.ES) continues its declines from historic highs in early March. Its shares are losing 2.77% today. Source: Bloomberg

European banking index rebounds less than 0.5%.A significant recovery is seen in the shares of Germany's Commerzbank (CBK.DE). Spain's Bankinter (BKT.ES) continues its declines from historic highs in early March. Its shares are losing 2.77% today. Source: Bloomberg

News from the banking sector

- According to Saudi National Bank, which owns a significant stake in Credit Suisse, yesterday's panic was 'unjustified'. Credit Suisse is losing more analysts and equity executives in Asia, as employee departures have accelerated;

- 5-year credit default swaps for Swiss bank UBS have risen 26 bps to 171 bps this year, according to ICE data. Although overall credit risk in Europe has fallen as Credit Suisse shares have rallied;

- Japan Bank lobby chief Hanzawa indicated that Credit Suisse does not have a material impact on the financial system. but the collapse of SVB showed that a run on banks can happen quickly, even as they strengthen risk controls.

- According to Japan's banking lobby, systemic risk from the SVB collapse has diminished as the Fed has backed bank customers;

- According to FT sources, European regulators have criticized U.S. "incompetence" in the case of the collapsed Silicon Valley Bank;

- S&P: Several Japanese banks with large holdings of U.S. bonds may be vulnerable to market sentiment due to the SVB, but not enough to downgrade their ratings;

- S&P: The Asia-Pacific region is well positioned to absorb any spillover effects from the SVB collapse;

- JPMorgan estimates that slower loan growth by medium-sized banks will subtract 0.5 to 1% from U.S. GDP growth

- US Treasury Secretary Janet Yellen indicated that the U.S. banking system remains healthy, and this week's decisive action shows the government's determination to keep depositors safe;

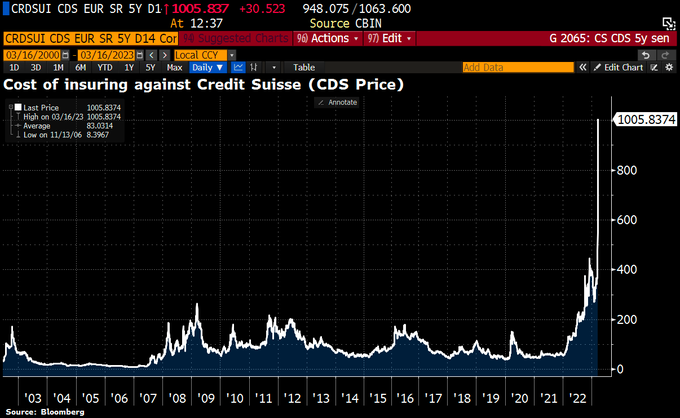

- The cost of insuring against Credit Suisse's insolvency remains very high even despite help from the SNB. The bank will borrow about CHF 50 billion from the SNB;

- The current valuation of the 5-year credit default swap (CDS) for Credit Suisse is already over 10% and continues to rise.

Insurance costs against Credit Suisse. Source: Bloomberg

Deutsche Bank (DBK.DE) shares, H4 interval. The share price has fallen below the 38.2 Fibonacci retracement and is heading towards the 61.8 retracement of the upward wave started in October 2022 at €9.2 per share. The SMA200 and SMA100 averages are approaching a bearish intersection in AT called the 'cross of death.' If the bulls manage to reverse the trend, the nearest support seems to be the psychological resistance at $10 per share. Source: xStation5

Deutsche Bank (DBK.DE) shares, H4 interval. The share price has fallen below the 38.2 Fibonacci retracement and is heading towards the 61.8 retracement of the upward wave started in October 2022 at €9.2 per share. The SMA200 and SMA100 averages are approaching a bearish intersection in AT called the 'cross of death.' If the bulls manage to reverse the trend, the nearest support seems to be the psychological resistance at $10 per share. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.