Arista Networks (ANET.US) rallied at a double-digit pace in the after-hours trading yesterday following the release of the Q2 2023 earnings report. US company designing and selling multilayer network switches reported better than expected sales and earnings as well as provided an upbeat guidance for the current quarter. Let's take a look at the release.

Arista beats revenue and profit expectations in Q2 2023

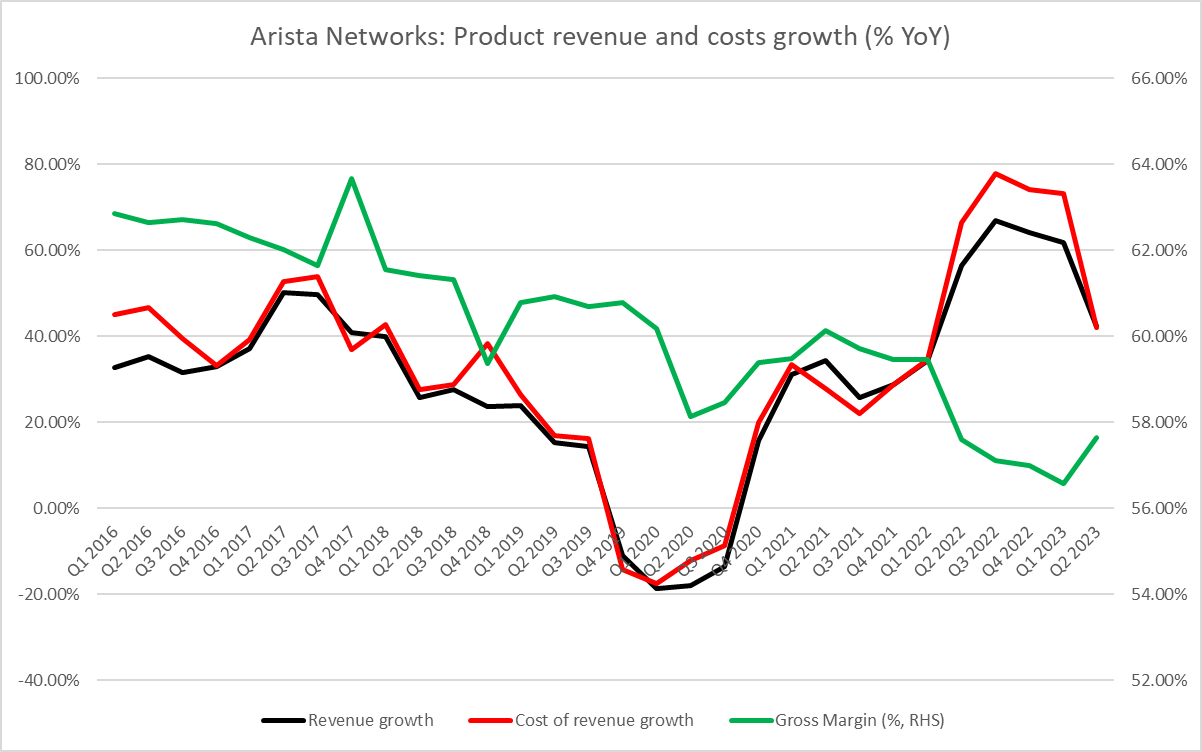

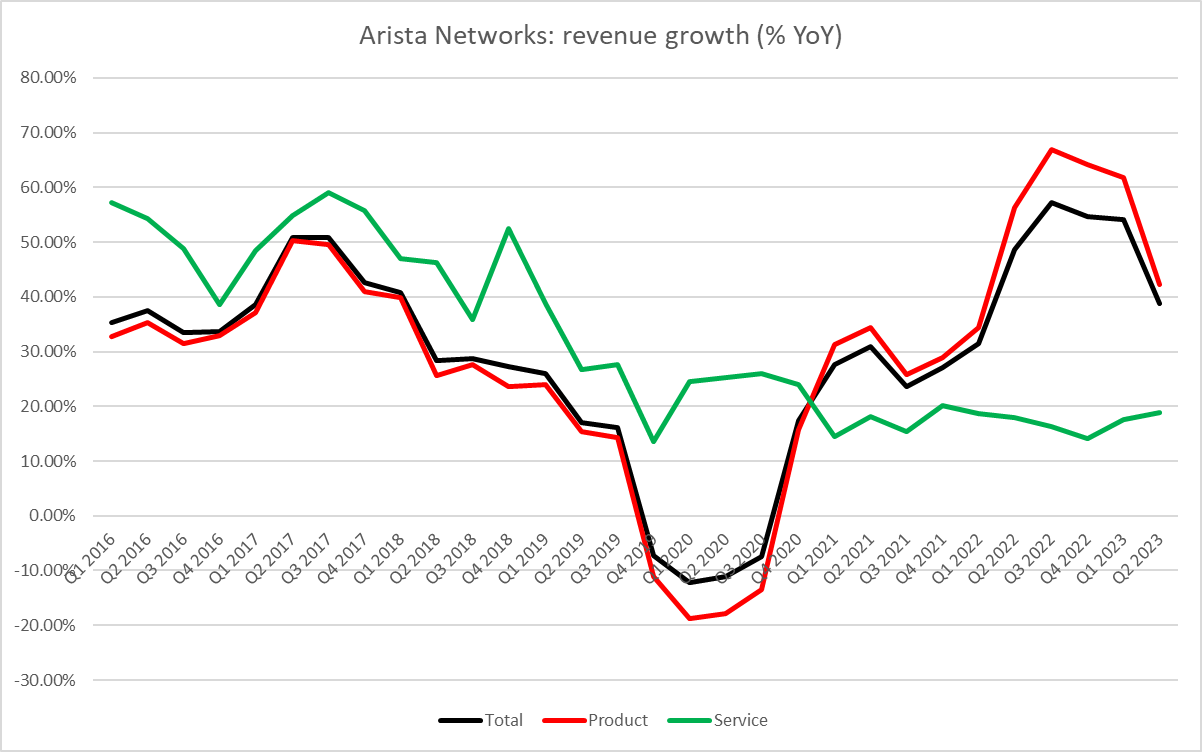

Arista Networks (ANET.US) published an upbeat Q2 2023 earnings report yesterday after the close of the market session. Company reported a 39% YoY jump in revenue, driven by a 42% YoY jump in product revenue. However, what one may find concerning is 41% YoY jump in cost of revenue. Faster growth in costs than sales means deterioration in gross margin. Operating margin, however, improved compared to a year ago, thanks to lower SG&A as well as R&D costs as share of revenue. Adjusted EPS was almost 50% YoY higher at $1.58.

Arista said its cumulative shipments of cloud network ports surpassed 75 million in the first half of 2023. Company continued to gain share in the enterprise market, which includes selling gear to large companies. This is very much welcome as previously Arista's sales were highly concentrated at a few large clients.

Q2 2023 earnings

-

Revenue: $1.46 billion vs $1.38 billion expected (+39% YoY)

-

Product revenue: $1.26 billion vs $1.18 billion expected (+42% YoY)

-

Services revenue: $197.4 million vs $191.9 million (+19% YoY)

-

-

Cost of revenue: $574.8 million vs $546.9 million expected (+41% YoY)

-

Product cost of revenue: $533.6 million vs $501.7 million expected (+42% YoY)

-

Services cost of revenue: $41.2 million vs $38.3 million expected (+25% YoY)

-

-

Adjusted EPS: $1.58 vs $1.44 expected ($1.08 a year ago)

-

Adjusted operating margin: 41.6% vs 40.7% expected (40.4% a year ago)

-

Adjusted gross margin: 61.3% (61.9% a year ago)

Arista's product revenue and costs growth continues to slow. Costs growth slowed more than sales growth and the two were equal in Q2 2023. However, will this improvement continue into Q3 2023? Source: Bloomberg Finance L.P.

Arista's product revenue and costs growth continues to slow. Costs growth slowed more than sales growth and the two were equal in Q2 2023. However, will this improvement continue into Q3 2023? Source: Bloomberg Finance L.P.

Upbeat forecast for Q3 2023 but growth continues to slow

Apart from better-than-expected Q2 2023 earnings, Arista also issued an upbeat forecast for the current quarter. Company expects revenue to reach $1.45-1.50 billion in Q3 2023, more than $1.39 billion expected by the market. However, it translates to 23-27% YoY growth, which would be the slowest pace of growth since the second half of 2021. Operating margin is expected to be slightly lower than in Q2 2023 while gross margin is seen improving.

Company said that in spite of shorter lead times and reduced visibility, it is executing gradual incremental improvements to its 2023 outlook and now expects revenue growth in excess of 30% this year!

There was a concern that results and outlook from Arista may disappoint as its biggest customers - Microsoft and Meta Platforms - announced rather conservative spending plans in their recent earnings releases. However, the company managed to beat expectations and analysts note that it also managed to diversify its revenue stream further in Q2 2023, which is viewed as a positive.

Q3 2023 forecast

-

Revenue $1.45-1.50 billion vs $1.39 billion expected

-

Adjusted operating margin: 41% vs 41.2% expected

-

Adjusted gross margin: around 62%

Arista's revenue growth continued to slow in Q2 2023 and the company expects further slowdown in Q3 2023 as well. Source: Bloomberg Finance L.P.

Arista's revenue growth continued to slow in Q2 2023 and the company expects further slowdown in Q3 2023 as well. Source: Bloomberg Finance L.P.

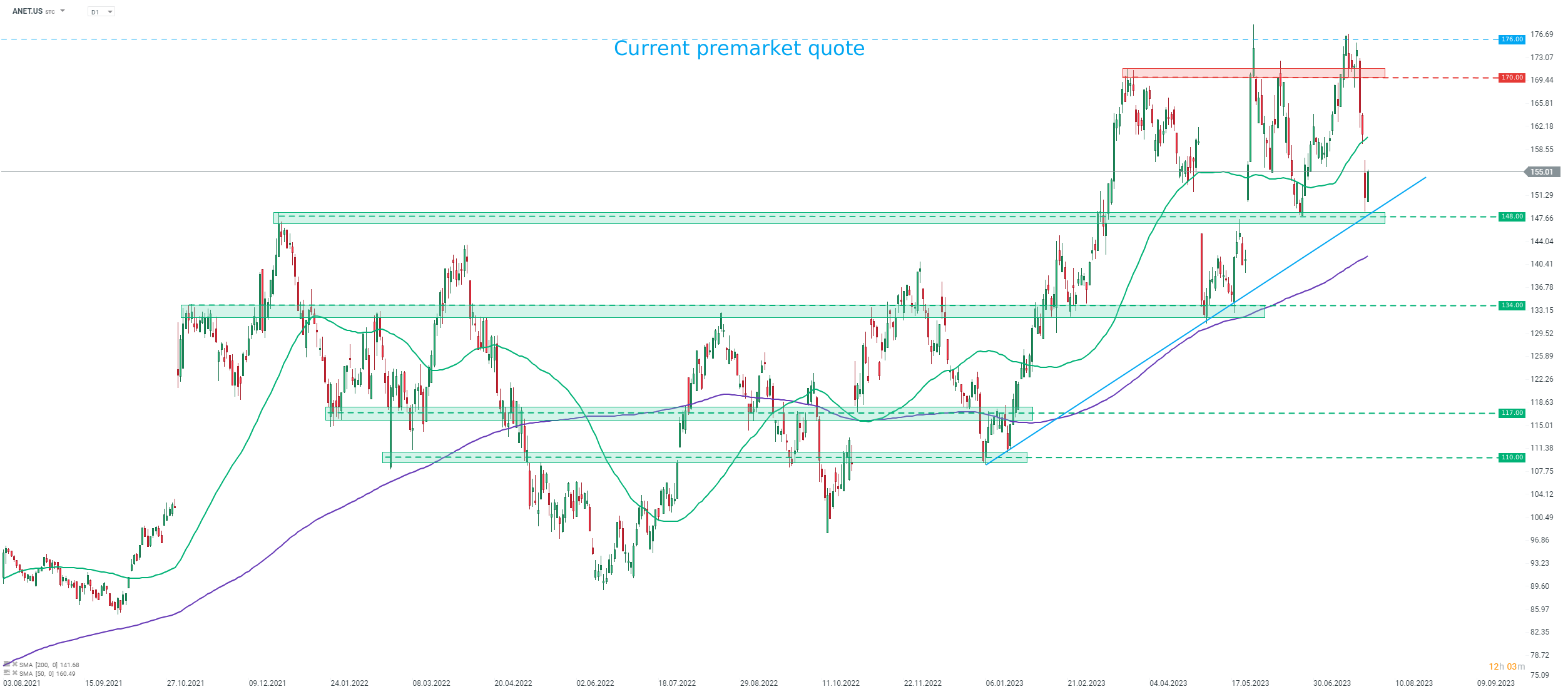

A look at the chart

Taking a look at Arista Networks (ANET.US) chart at D1 interval, we can see that the stock has experienced a strong correction recently. However, declines were halted at the $148 support zone, marked with previous price reactions as well as the upward trendline, and stock began to recover. Stock is trading around 14% higher in pre-market today and should bulls hold onto those gains until Wall Street session opens at 2:30 pm BST, there is a chance that the stock will look towards fresh all-time highs today.

Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.