Europe’s largest company, the Dutch ASML, will report its results before the session on January 28. Some time ago, the market realized just how indispensable ASML is to the global economy and the technology sector. The company is coming off a period of impressive growth in both financial performance and valuation. The question remains: is there still room for further upside?

ASML has managed to beat profit expectations six quarters in a row. Will it be able to maintain its winning streak? Market expectations are elevated.

Consensus forecasts assume EPS of approximately USD 8.2 and revenues exceeding USD 11 billion. This represents growth of more than 50% on a quarter-on-quarter basis.

With the bar set so high, risks to both results and market reaction are increasing. Even ASML may struggle to deliver such strong growth over such a short period, especially given that sales constraints are occurring primarily on the customer side rather than within the company itself. This stems, among other factors, from delays in project execution or an insufficient number of so-called “clean rooms,” which are required for the installation and operation of the machines.

One area the market will be watching particularly closely is the “High NA” segment, representing the latest generation of lithography machines. This is a market segment in which ASML continues to hold a complete monopoly, while also being the segment to which the market attaches the greatest expectations.

Even if the company delivers the outstanding results anticipated by investors, its guidance may prove conservative. Strong results combined with “weak” guidance could trigger a short-term pullback in the share price.

A significant risk to the company’s long-term outlook may be the behavior of demand linked to the “AI revolution.” However, even in such a scenario, the inertia of ASML’s financial performance would be substantial, making it more likely that the market has not yet fully priced in the benefits for the company rather than beginning to discount potential risks.

A potential dark horse of the earnings call could be stronger-than-expected results or guidance driven by a massive increase in demand for RAM memory.

Ultimately, market reaction will be determined by the interaction between reported financial results and forward guidance.

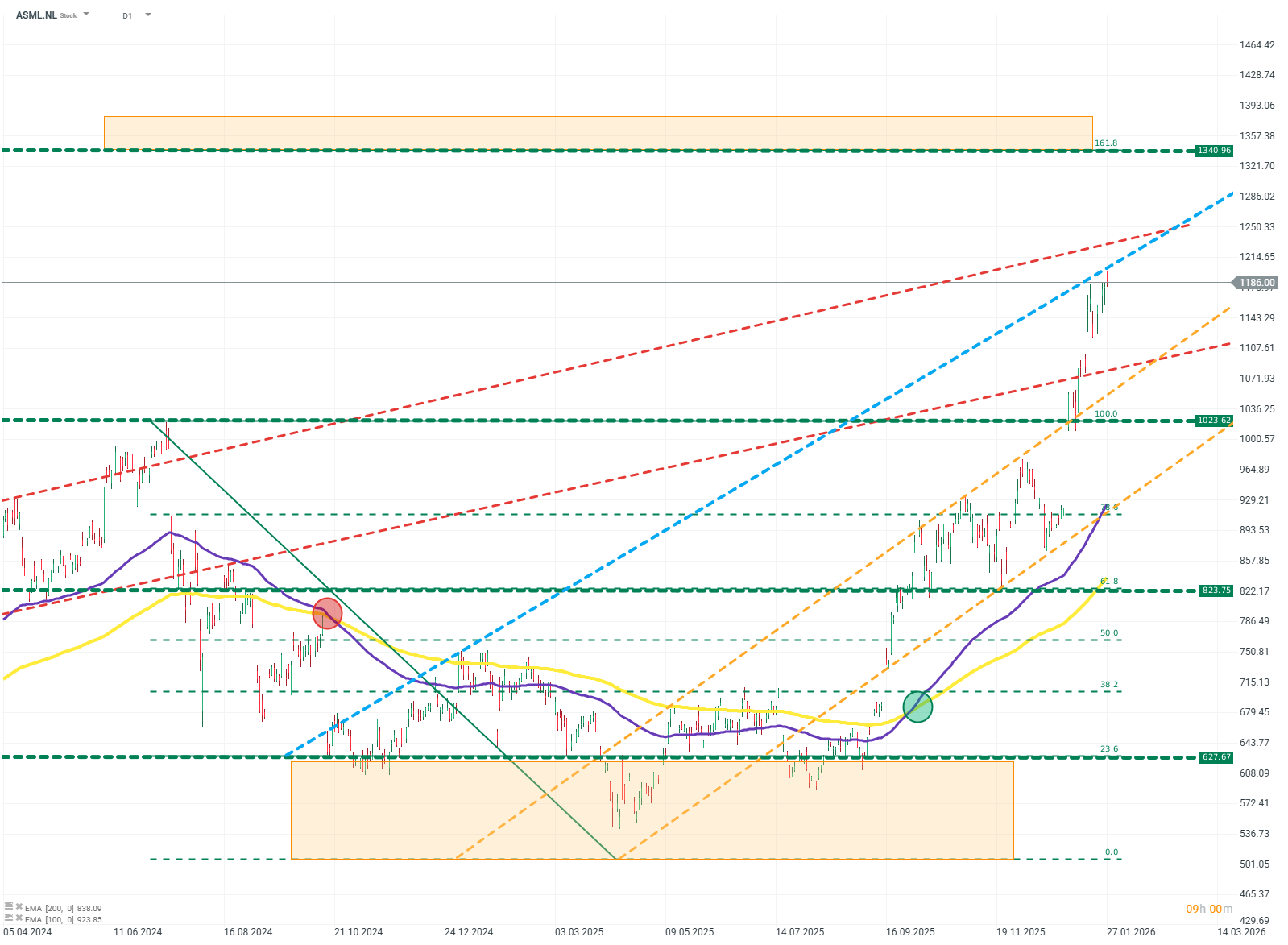

ASML.NL (D1)

The uptrend remains strong, and there are few indications that it is coming to an end, although the remaining upside appears increasingly limited. Source: xStation

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.