Tomorrow at 05:30 BST, the Reserve Bank of Australia (RBA) will announce its decision on interest rates. Recent inflation data have largely ruled out further monetary easing in Australia following the cautious 25-basis-point cut in August, while an overall improvement in economic conditions removes arguments for additional rate reductions.

AUDUSD has been in a clear uptrend since April, driven mainly by broad-dollar depreciation (inverted USDIDX in blue). After notable swings in September, the pair has gained only 0.5% MTD. Nevertheless, a hawkish stance by the RBA, combined with aggressively priced easing in the U.S., should help maintain the trend in the coming months. Source: xStation5

What to expect from tomorrow’s RBA decision?

The RBA is expected to leave rates unchanged at 3.60% (Bloomberg consensus). The third and final 25-bp cut in August was precautionary, aiming to shield the Australian economy from a potential slowdown due to Donald Trump’s tariffs.

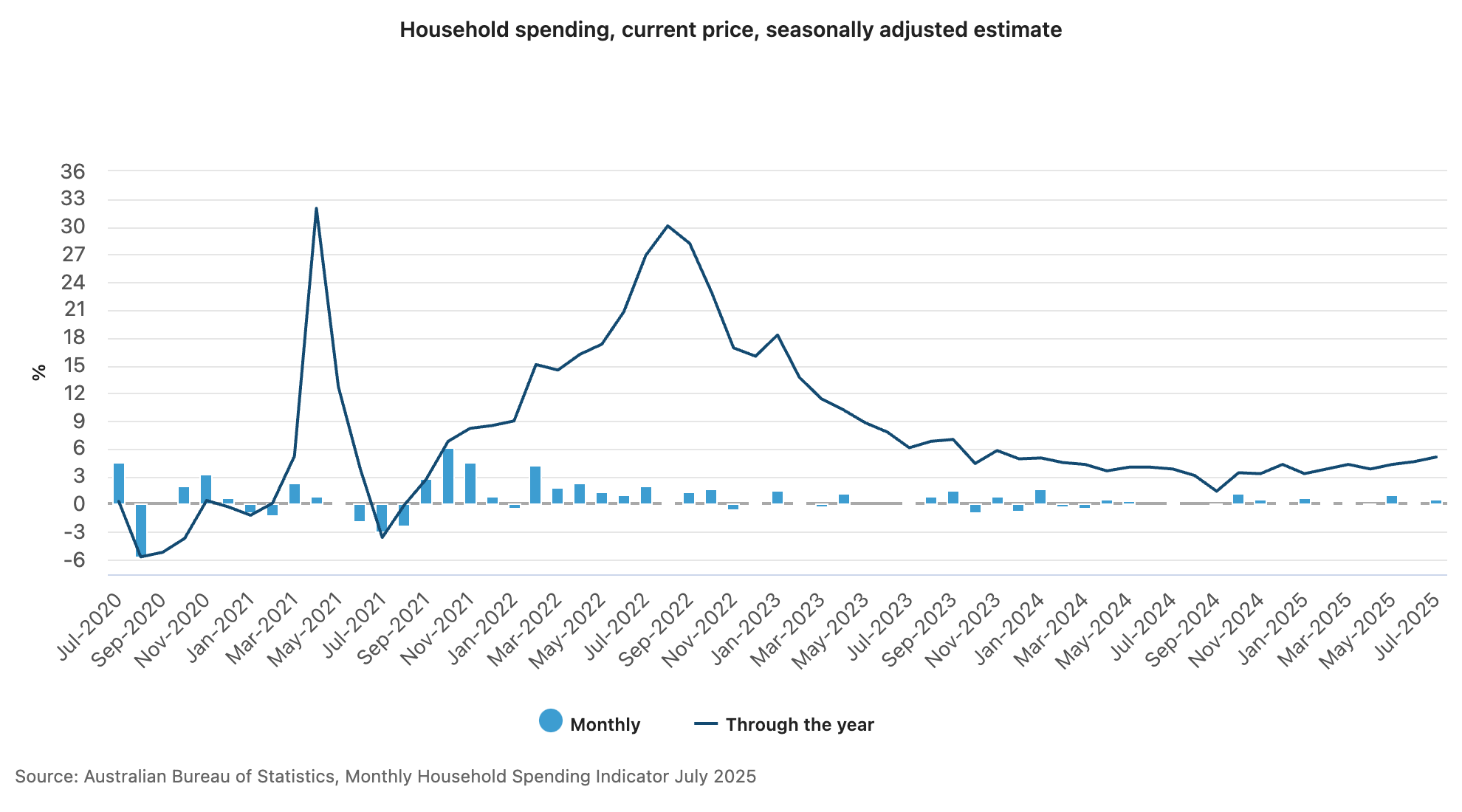

Q3 economic activity proved stronger than trade-related uncertainties, which could have dampened activity. Consumer spending is in a clear uptrend (June saw the largest year-on-year increase since November 2023, at 5.1%), and GDP surprised on the upside (1.8% vs 1.6% consensus).

Household spending in Australia continues its upward trend. Source: Australian Bureau of Statistics

Inflation rises again, labour market remains steady

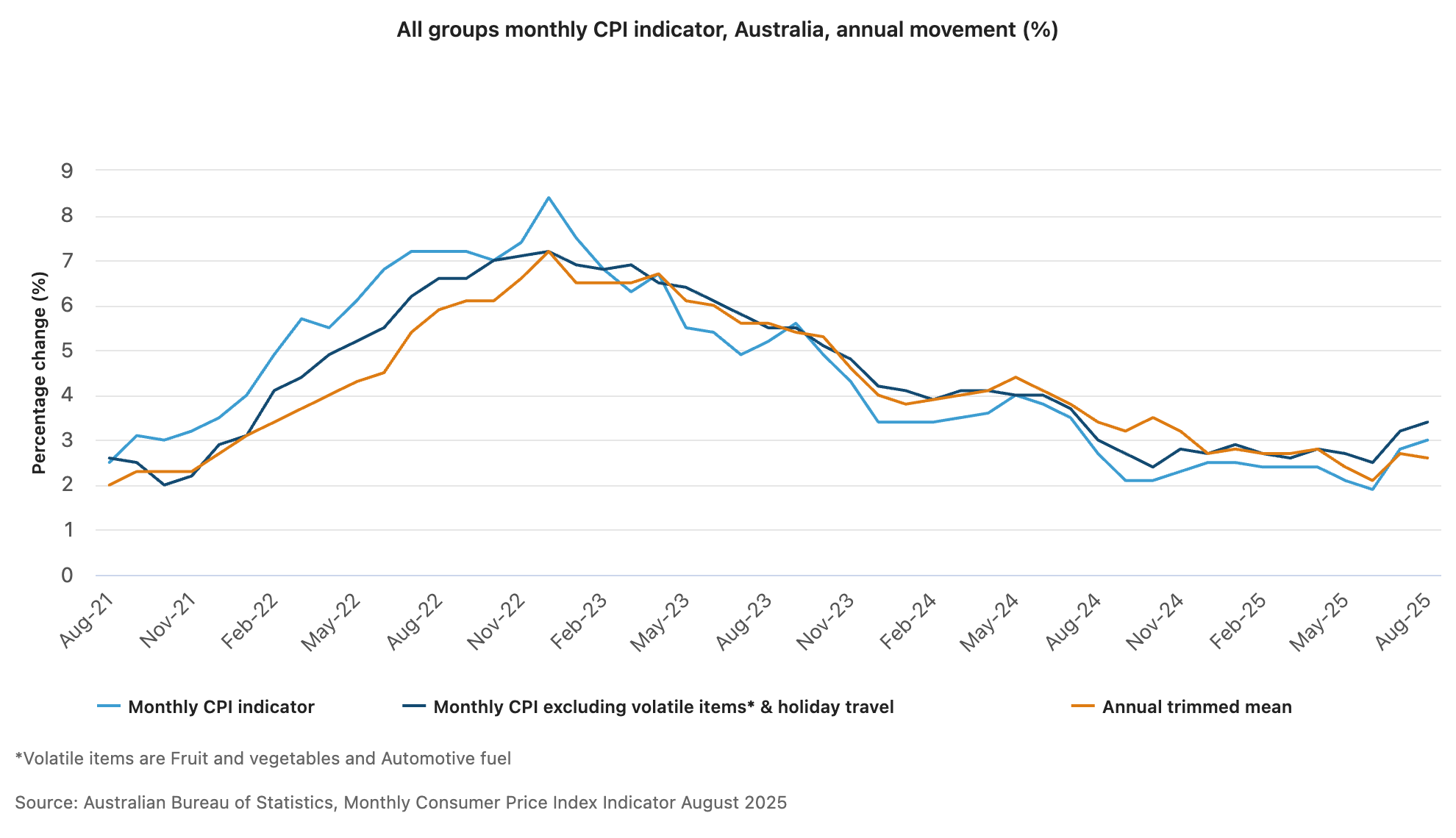

The chance of another rate cut has been ruled out by the latest monthly inflation reading. Australian CPI rose 3.0% YoY in August versus 2.8% in July, slightly above forecasts. The increase was partly due to base effects but highlighted persistent pressure, especially in services such as restaurant meals, takeout, and audiovisual services. Housing and rents also rose noticeably, potentially adding to Q4 wage pressures.

Markets have sharply reduced rate-cut expectations following the inflation increase, with major banks and financial institutions withdrawing forecasts for a November cut. Opinions on November remain divided, reflected in market-implied swap probabilities of roughly 50% for another reduction. Some institutions expect rates to remain unchanged through the year-end.

The labor market remains tight but stable, which, amid visible price pressures, reduces the case for further easing. Australian payrolls have alternated between missing and beating economist expectations (recently a surprise decline of 5k jobs, previously an increase of 26.5k), indicating no clear trend and a difficult-to-interpret labor market stagnation. Meanwhile, unemployment has held at 4.2% for two months after falling from 4.3%, with the RBA emphasizing quarterly data due to lower volatility.

The monthly CPI in Australia rose to 3%, with core CPI at 3.4%, the highest since July 2024. Source: Australian Bureau of Statistics

The monthly CPI in Australia rose to 3%, with core CPI at 3.4%, the highest since July 2024. Source: Australian Bureau of Statistics

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.