- AUD and NZD gain the most against other G10 currencies.

- RBNZ lowered its Official Cash Rate to 2.25%, with lower inflation estimates suggesting the end of an easing cycle.

- Australia's CPI surprised again on the upside, delaying RBA rate cut prospects.

- AUD and NZD gain the most against other G10 currencies.

- RBNZ lowered its Official Cash Rate to 2.25%, with lower inflation estimates suggesting the end of an easing cycle.

- Australia's CPI surprised again on the upside, delaying RBA rate cut prospects.

Antipodean currencies are dominating today’s FX session in response to new monetary policy prospects in the region. Central banks in Australia and New Zealand are facing very different inflation dynamics, yet the latest Australian CPI data together with the tone of the Reserve Bank of New Zealand’s (RBNZ) decision have reinforced hawkish expectations in both economies.

The NZD is leading gains across the G10 today, strengthening by around 1% against the dollar and the euro despite today’s interest-rate cut in New Zealand, which lowered the Official Cash Rate to 2.25%, its lowest level in more than three years. The AUD is also gaining—up 0.5% vs the dollar and 0.4% vs the euro—in reaction to another inflation print that exceeded expectations.

After breaking out from an almost eight-month low, the NZDUSD pair has moved above the 10-day EMA (yellow) and is currently testing the 30-day EMA (light purple). Despite the bullish momentum, the RSI remains neutral, leaving room for further upside amid shifting expectations toward the RBNZ. Source: xStation5

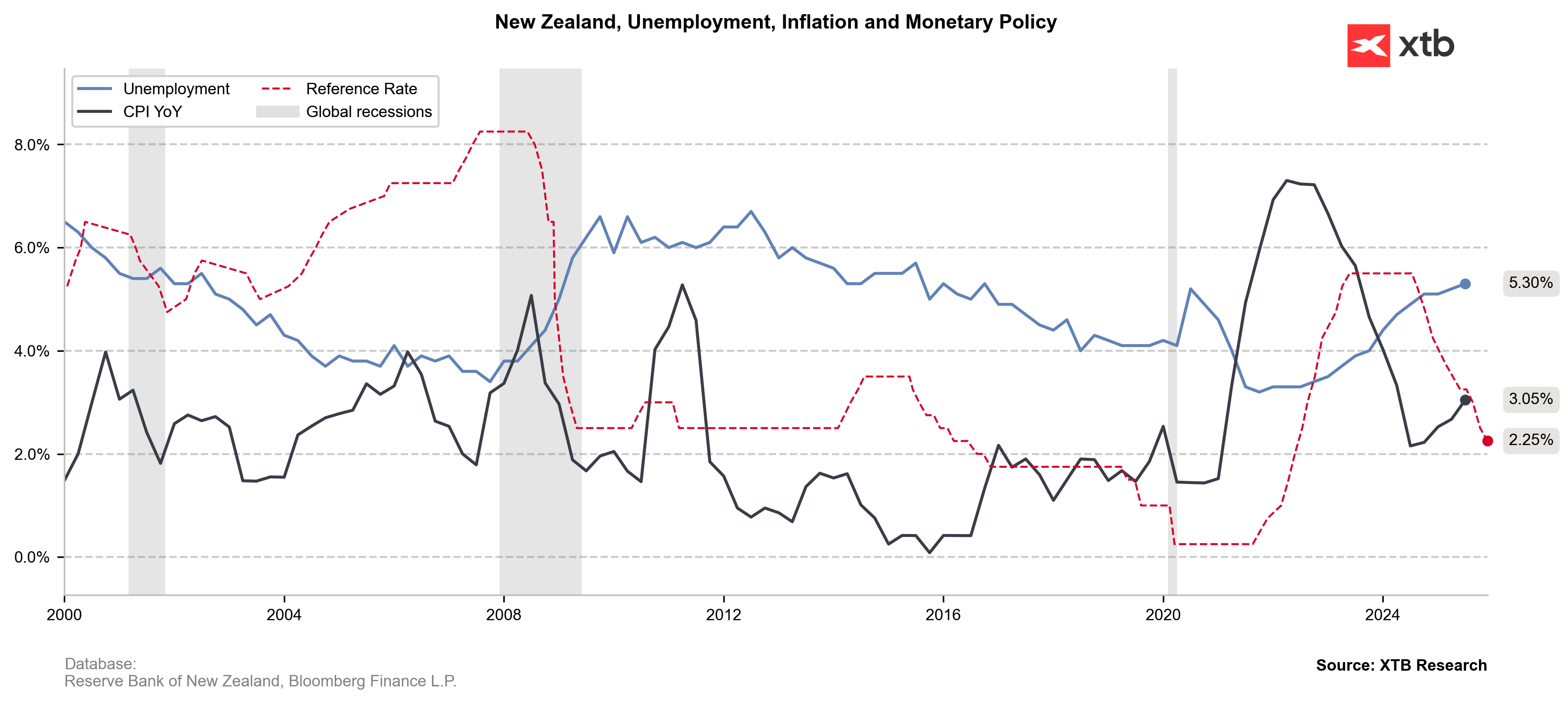

The easing cycle that began in August 2024 consistently pushed the kiwi dollar into a downward trend, which deepened in 2025 due to a pronounced economic slowdown. Although retail sales rebounded strongly in Q2 (+2.3% y/y), this was largely driven by base effects after declines from Q2 2022 to Q3 2024. The main concern has become unemployment, which is at its highest level since 2016 (5.3%) and is contributing to a rise in outward migration, especially among young people of working age.

Today’s rate cut in New Zealand was well priced in, but market expectations adjusted to the RBNZ’s revised inflation forecasts. The central bank projects inflation to return to around 2% by mid-2026, a meaningful relief compared to the latest 3% reading. Reduced concerns about meeting the inflation target (the 1–3% range) in the medium term, combined with Governor Hawkesby’s neutral tone (“all options on the table”), were interpreted as a potential end to aggressive easing—providing long-awaited support for the NZD.

Given the current level of CPI, the RBNZ appears to be acting pre-emptively to prevent further economic slowdown in New Zealand. Source: XTB Research

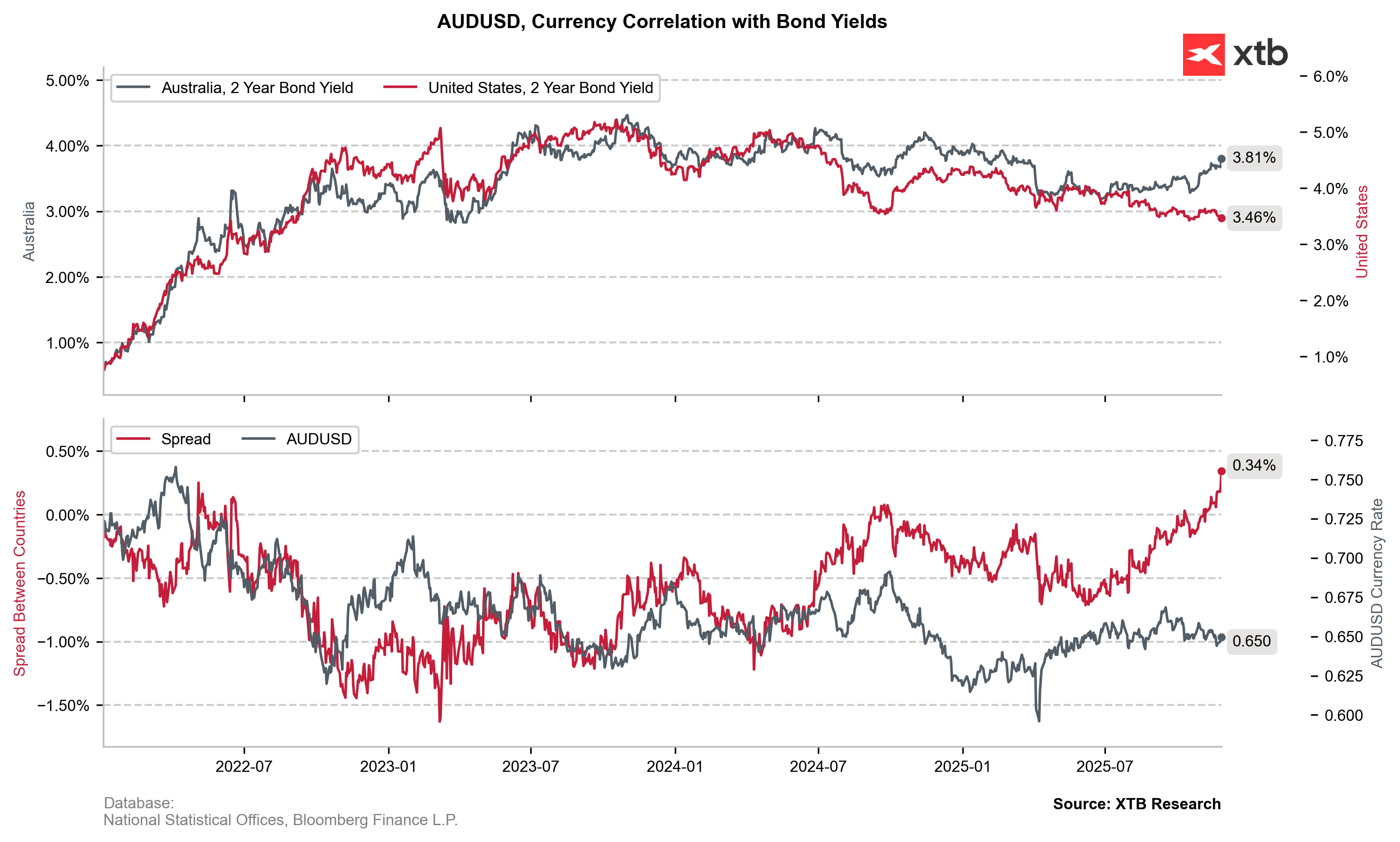

The gains in the AUD, meanwhile, stem from yet another stronger-than-expected monthly inflation reading. CPI unexpectedly accelerated from 3.6% to 3.8%, with the trimmed measure—which excludes the most volatile fuel and energy prices—rising from 3.2% to 3.3%. The RBA halted its easing cycle in August at 3.6%, suggesting that negative real rate combined with inflation running above the RBA’s projections further delay prospects of rate cuts in Australia.

The Australia–US 2-year yield spread is at its highest level since June 2022. Source: XTB Research

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.