Inflation expectations

- 1-year horizon: 3.4% (previously 3.2%)

- 5-year horizon: 3.0% (unchanged)

Labor market

- Average probability of higher unemployment in 1 year: 41.8% (previously 42.1%)

- Mean probability of losing job in 12 months: 15.2% (12M avg 14.3%)

- Mean probability of finding a job if current job is lost: 43.1% (series low)

Household finances

-

Probability that US stock prices will be higher in 12 months: 38.0%

The December New York Fed Survey of Consumer Expectations shows that short-term inflation expectations increased, while medium- and long-term expectations remained anchored.

One-year inflation expectations rose to 3.4% (from 3.2%), while three- and five-year expectations held at 3.0%. Uncertainty around inflation increased, although expectations for home price growth remained unchanged at 3%, and expectations for most commodity prices declined. In household finances, perceptions of credit availability deteriorated. The risk of delinquency rose to its highest level since early 2020, even as expectations for income and spending growth remained broadly stable. Sentiment toward the equity market improved slightly, with the probability that US stock prices will be higher in a year rising to 38%.

By contrast, labor-market prospects deteriorated markedly, representing the most concerning signal from the survey. Expectations of finding a job fell to a record low, while the perceived probability of job loss rose to 15.2%. This points to declining worker confidence and bargaining power. Although expectations for unemployment eased slightly, they remain elevated, and expected wage growth fell to 2.5%, below the 12-month average.

Overall, rising job-security concerns and weaker wage expectations suggest cooling labor demand, which could limit wage pressures and strengthen the case for deeper interest-rate cuts by the Federal Reserve.

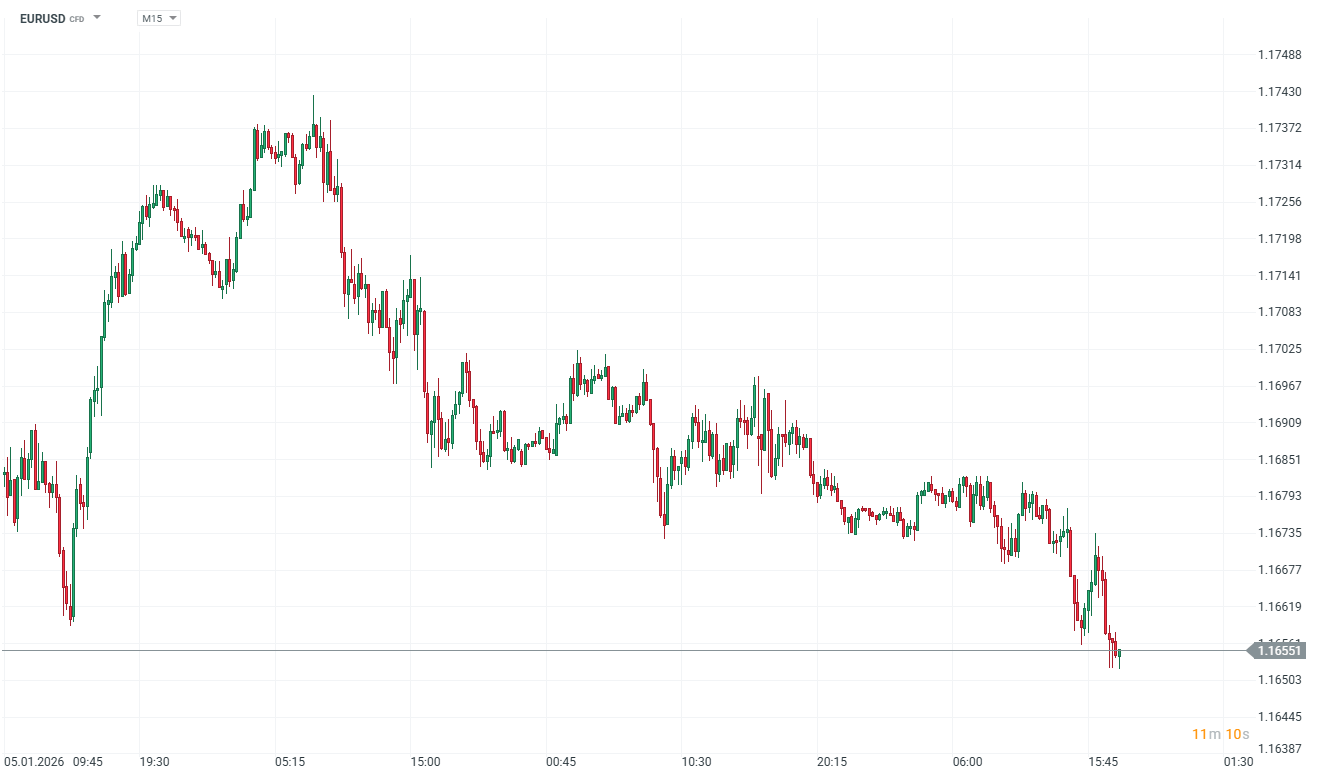

The US dollar is the strongest G10 currency today, partly supported by strong US trade balance data and a significant narrowing of the deficit. EURUSD is down 0.20%, while the USDIDX dollar index is up 0.15%.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.