Bank of Canada is set to announce its next monetary policy decision tomorrow at 3:00 pm GMT. It is expected that BoC will keep interest rates unchanged at 5.00% for the third meeting in a row. Let's take a quick look at what are markets pricing, Canadian data since last BoC meeting and how USDCAD chart looks like.

Markets expect no change in rates

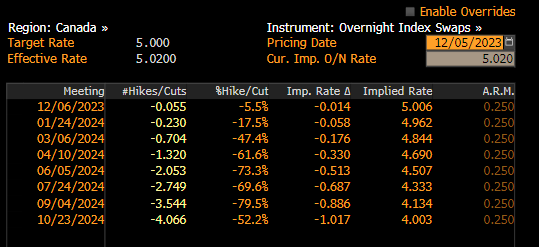

Economists surveyed by Bloomberg and Reuters expect Canadian central bank to keep rates unchanged, with the main interest rate staying at 5.00% for the third meeting in a row. Such is also view of the money markets with overnight index swaps pricing in a 5% chance of BoC delivering a 25 basis point rate cut at this week's meeting. Markets fully price in the first 25 basis point rate cut for April 2024, with 100 basis points of cumulative easing being priced in for the full-2024.

Money markets are not expecting more BoC rate hikes, with the first cut being fully priced in for April 2024. Source: Bloomberg Finance LP, XTB

Is there a chance for a surprise?

Expectations are clear - Bank of Canada will refrain from making a rate move tomorrow. However, is there a chance for a surprise? When it comes to rates, surprise looks highly unlikely - cut looks unlikely as inflation remains above BoC target and hike also looks unlikely given that already-delivered massive tightening is taking a toll on Canadian citizens. Having said that, any surprise would likely come from narrative.

Data from Canadian economy released since the last BoC meeting has been mixed. Solid housing starts data for October as well as strong jobs data for November show that the economy could weather another hike. On the other hand, lackluster Q3 GDP report as well as bigger-than-expected slowdown in October's CPI give some arguments to BoC doves. Having said that, the most likely outcome of tomorrow's meeting seems to be no change in the level of rates as well as maintaining current wait-and-see narrative.

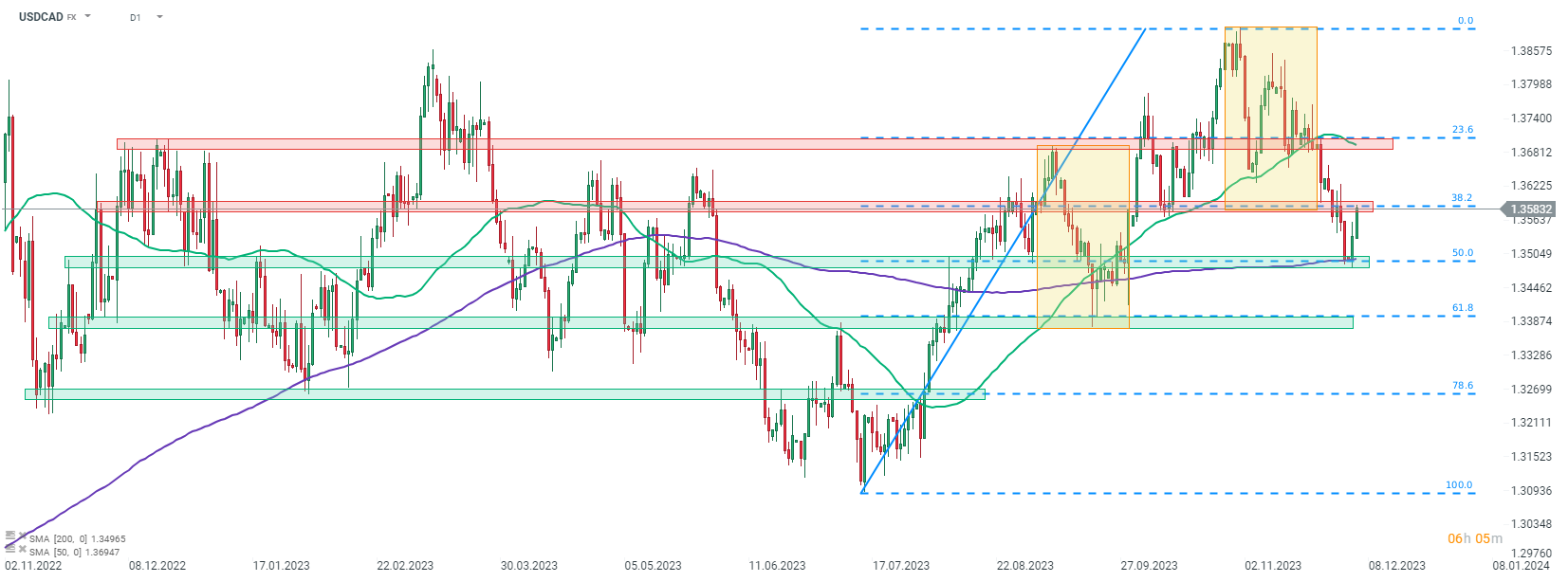

A look at USDCAD chart

Taking a look at USDCAD chart at D1 interval, we can see that the pair has been pulling back recently. Pair tested the 1.3500 support zone, marked with previous price reactions, 200-session moving average (purple line) as well as 50% retracement of the upward move launched in mid-July 2023, but failed to break below. USDCAD recovered some of recent declines this week but and is now testing the 1.3580 resistance zone marked with 38.2% retracement. A failure to break above this zone may hint that ongoing gains are just an upward correction, and that the pair may be about to resume downward move.

Source: xStation5

Economic Calendar: a calm start to an interesting week 🔎

BREAKING: German industrial production higher than expected 📌

Morning Wrap (08.12.2025)

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.