Rate decision from Bank of Japan is a key event of the pre-Christmas week on the markets. Japanese central bank is set to announce its decision during the upcoming Asia-Pacific session. While there is no exact timing for the decision, it is usually released around 3:00 am GMT. Bank is not expected to change the level of interest rates this week, but markets hope for a hawkish guidance.

What is market expecting?

Expectations for this week's Bank of Japan announcement are clear - no change in the level of rates is seen by either economists or money markets. Out of over 50 economists surveyed by Bloomberg not a single one expects outcome other than leaving main rate unchanged at -0.10% and 10-year target yield at 0.00%. Money markets price in less than 2% chance of a rate move tomorrow.

Source: Bloomberg Finance LP

Focus on guidance

While the Bank of Japan is not expected to change the level of rates tomorrow, traders will look for shifts in BoJ guidance. Global central banks have been hiking rate aggressively in order to combat pandemic-driven and war-related inflation, but Bank of Japan stood on the sidelines and did not join the trend. However, Bank of Japan may be preparing for a rate hike that will push Japanese rate out of the negative territory.

A continued JPY weakness has prompted a few central bank intervention this year and currency started to regain ground as possibility of the negative rate exit by the end 2023 was hinted by BoJ officials. As recently as at the beginning of December 2023, BoJ Deputy Governor Himion speculated in a speech on the effects of negative rate exit would have on the Japanese economy, boosting hopes that such a move is imminent. However, around a week later media reports began to surface suggesting that BoJ is unwilling to hike rates at this year's final meeting.

Money markets are currently expecting the first 10 basis point rate hike for April 2024 meeting. While Bank of Japan is unlikely to provide hints on exact timing of the rate hike, any suggestions that the Bank is considering and discussing such a move would be a strong hawkish signal for JPY.

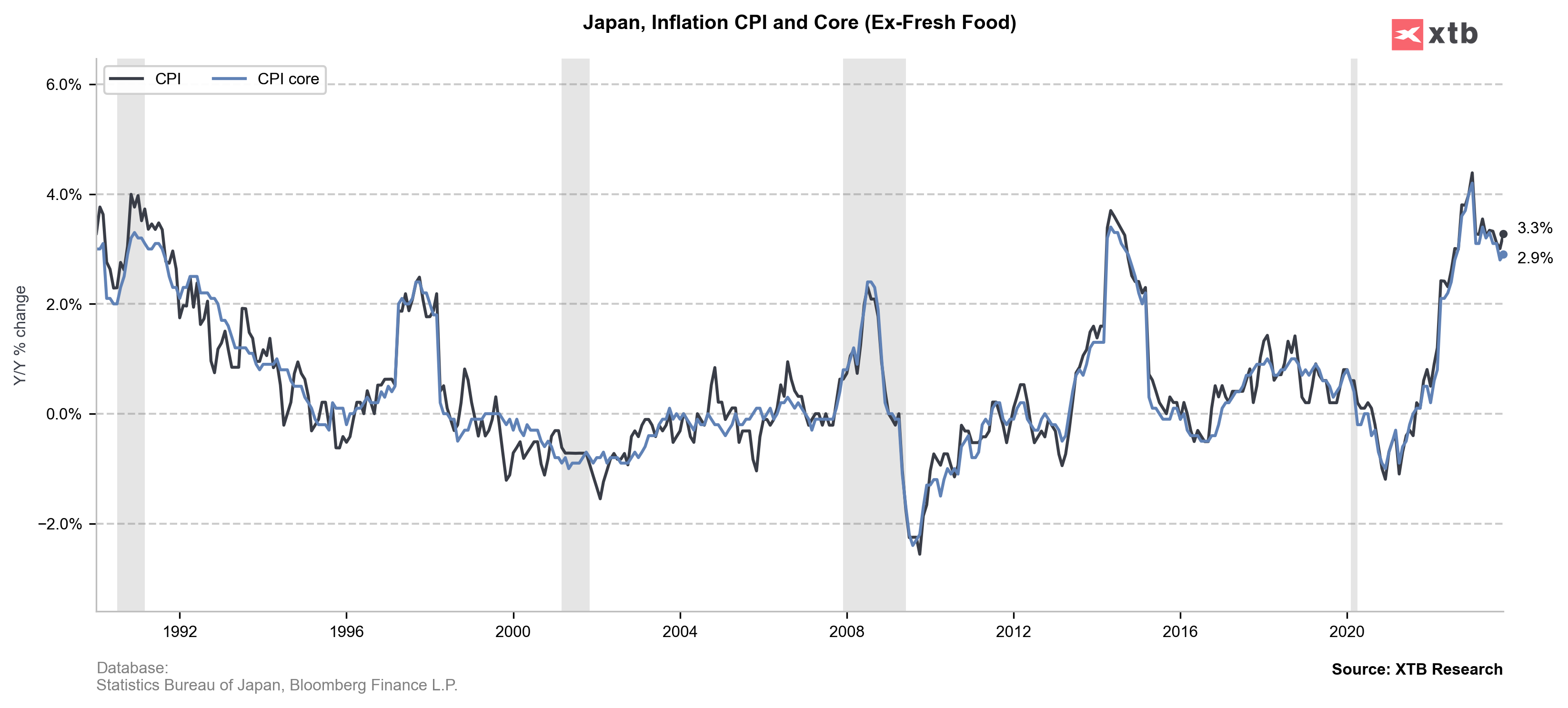

CPI inflation climbed above BoJ 2% target but whether this increase in price growth will be sustained is a different story. Source: Bloomberg Finance LP, XTB Research

Significant post-meeting volatility expected

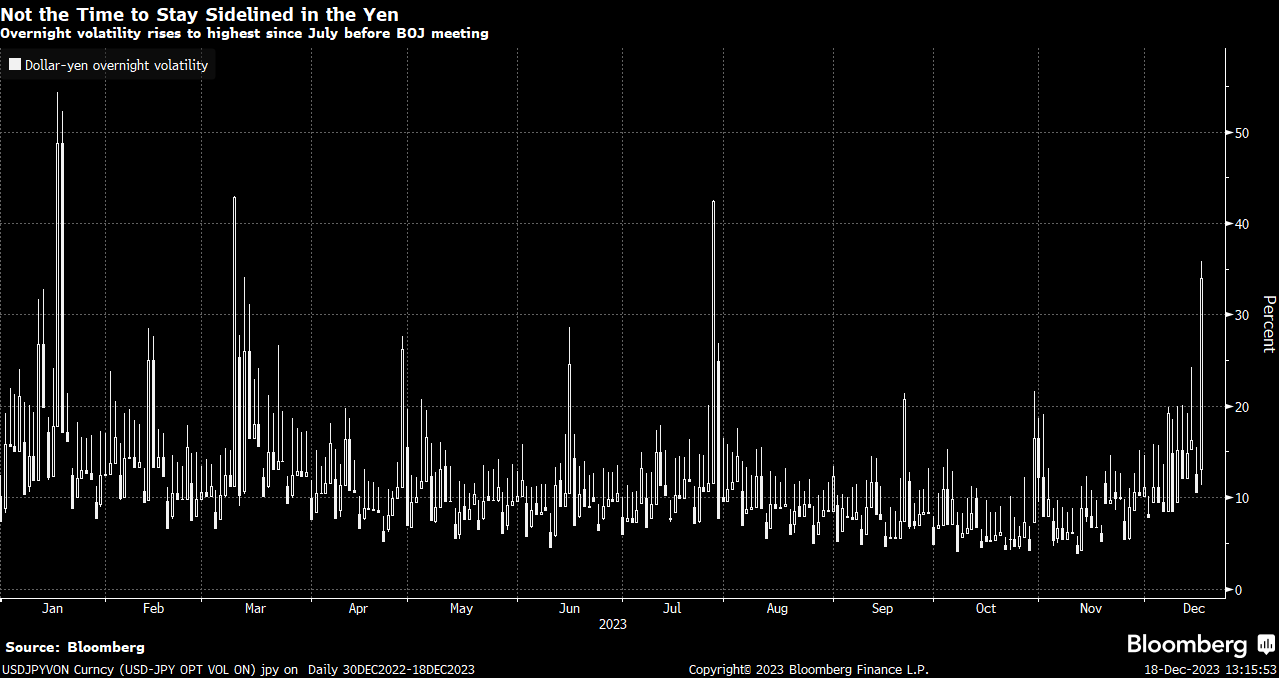

There is a lot of uncertainty on the markets heading into Bank of Japan meeting this week. Rate move seems unlikely but guidance will be crucial. Should Bank of Japan hint that rate hikes will come soon, JPY is likely to benefit. On the other hand, sticking to the previous narrative and failing to mention plans to hike would likely trigger JPY sell-off. Each of this outcomes seems as likely as the other so there is a huge scope for a surprise. Markets seem to be reflecting it with an overnight USDJPY volatility jumping to annualized 35% - the highest level since July 27, 2023.

Source: Bloomberg Finance LP

A look at the chart

FX pairs tied to Japanese yen are expected to be movers tomorrow. However, the pair that may see the biggest volatility spike is AUDJPY, as RBA minutes will also be released tomorrow (0:30 am GMT). Taking a look at the pair at D1 interval, we can see that a recent downward correction has been halted at the 200-session moving average (purple line). An initial attempt to break below this hurdle gained some traction but it was halted almost exactly at the lower limit of the market geometry, suggesting that the uptrend is still in play.

Pair is testing the 96.00 resistance zone at press time. Note that this resistance was also tested last week but bulls failed to break above. Moves on the pair has been largely limited to 95.00-96.00 range since. A hawkish BoJ could provide a fuel for a downside breakout from the range, with textbook target for such a breakout being the 94.00 swing area. However, a more important support can be found lower in the 93.00 area. On the other hand, failure to deliver onto hawkish expectations may see JPY slump and cause AUDJPY to rise. In such a scenario, the 97.00 swing area would be the first target for buyers.

Source: xStation5

Source: xStation5

BREAKING: EURUSD muted; US services growth cools in December as demand softens 📌

Barkin and Miran remain on opposite sides of the Fed policy path🎙️

BREAKING: German inflation comes in significantly below expectations, EURUSD slips 📉

BREAKING: European PMIs slightly weaker than expected; Spain stands out positively 🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.