Beyond Meat (BYND.US) stock jumped more than 15% on Friday after producers of plant-based meat substitutes posted a narrower-than-expected loss in Q4, even with sales falling more than 20% YoY. Company also forecast solid revenue gains for the coming year.

-

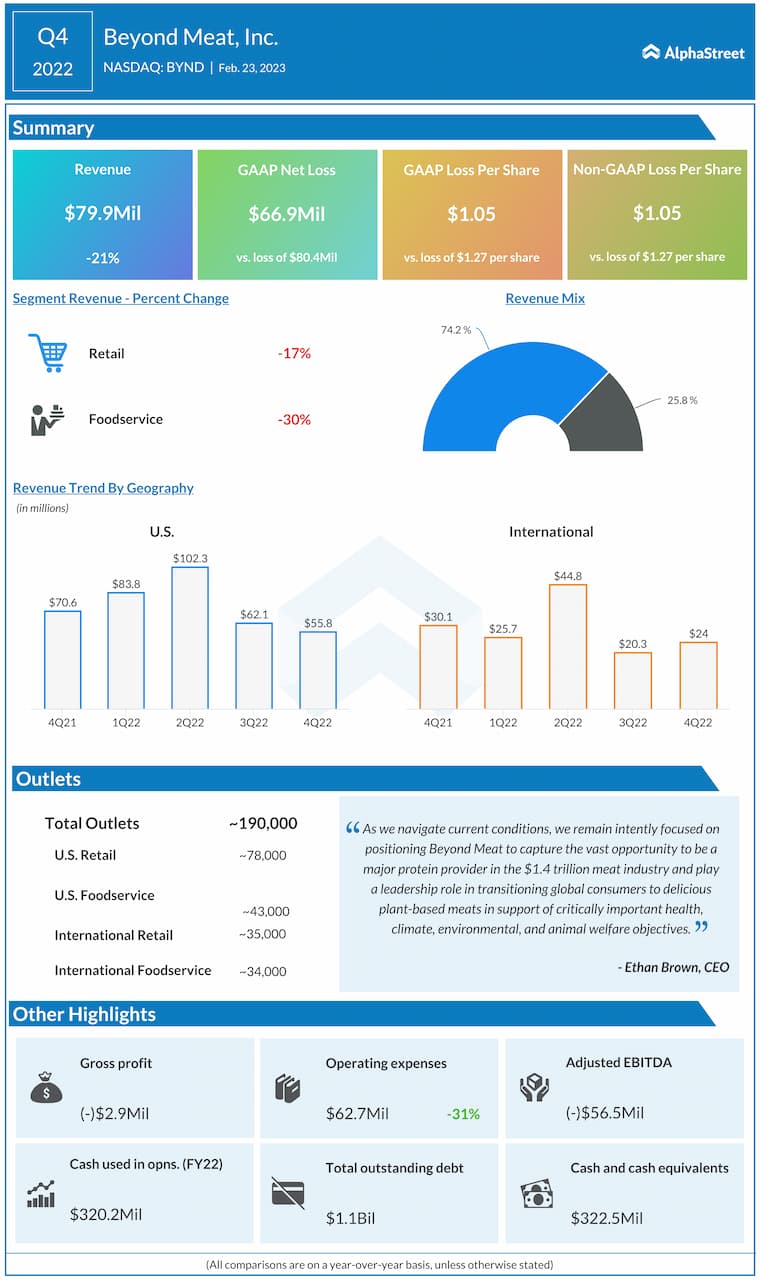

Beyond Meat recorded a loss of $1.05 a share, narrower than projections for a loss of $1.18 a share, according to FactSet.

-

Revenue of $79.9 million topped market expectations of $75.8 million.

Highlights of Beyond Meat Q4 financial results. Company reported better-than-expected Q4 revenue despite flagging consumer demand. Source: Alpha Street

-

"Our fourth-quarter results clearly demonstrate delivery against our strategy and plan, including solid sequential progress on margin recovery and operating expense reduction, and continued inventory drawdown," Beyond Chief Executive Ethan Brown said in a statement announcing the numbers.

-

Those savings along with lower costs for raw ingredients should help Beyond Meat tackle one of its most persistent problems: the high cost of its products relative to animal-based meat. Yesterday, Walmart was advertising Beyond Meat burgers at $9.68 per pound; lean ground beef was $5.86 per pound.

-

"We are encouraged by tighter cost management, but for us to become constructive, demand will have to increase - on this, we remain skeptical," Cowen analyst Brian Holland said.

-

Company expects full-year sales in the region between $375 million to $415 million as it looks to revive growth for its plant-based products amid persistent food price inflation and a pullback in consumer spending.

Beyond Meat (BYND.US) stock rose sharply on Friday, however upward momentum seem to lose steam in the evening, as buyers failed to reach key resistance at $24.00, which coincides with 38.2% Fibonacci retracement of the last downward wave. Price pulled back to local support at $19.00, which coincides with 23.6% retracement. Should a break lower occur, a downward move may deepen towards next support at $15.20, where the lower limit of the 1:1 structure and 200 SMA (red line) can be found. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.