Beyond Meat (BYND.US) and PepsiCo (PEP.US) announced today that will form a joint venture called PLANeT Partenship to sell new plant-based snacks and drinks. The joint venture will combine Beyond Meat’s skills with protein prestidigitation and PepsiCo’s world-class marketing and commercial capabilities to develop and sell snacks and beverages made from plant-based protein. "Plant-based proteins represent an exciting growth opportunity for us, a new frontier in our efforts to build a more sustainable food system," said Ram Krishnan, PepsiCo global chief commercial officer. However no financial terms and other details were revealed, except to say that the operations will be managed through the aforementioned PLANeT Partnership.

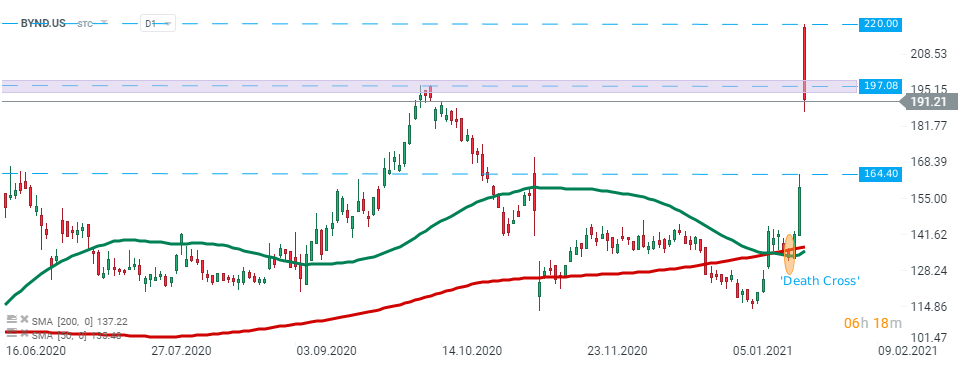

Beyond Meat (BYND.US) stock launched today's session with a massive bullish price gap, however buyers failed to break above resistance at $220.00 and price pulled back. Stock broke below the support at $197.08 and if the current sentiment prevails the downward move could be extended to the $164.40 handle where the lower limit of the aforementioned price gap is located. Meanwhile, the 50 SMA (green line) broke below the 200 SMA (red line) painting a pattern known as the 'death cross'. While this is a pattern heralding declines, it should be noted that it is very often a lagging pattern therefore traders should be cautious trying to trade on it. On the other hand, should buyers manage to bring the price back above $197.08, the move towards recent highs could be on the cards. Source: xStation5

Beyond Meat (BYND.US) stock launched today's session with a massive bullish price gap, however buyers failed to break above resistance at $220.00 and price pulled back. Stock broke below the support at $197.08 and if the current sentiment prevails the downward move could be extended to the $164.40 handle where the lower limit of the aforementioned price gap is located. Meanwhile, the 50 SMA (green line) broke below the 200 SMA (red line) painting a pattern known as the 'death cross'. While this is a pattern heralding declines, it should be noted that it is very often a lagging pattern therefore traders should be cautious trying to trade on it. On the other hand, should buyers manage to bring the price back above $197.08, the move towards recent highs could be on the cards. Source: xStation5

Pepsi (PEP.US) stock price is testing the upper limit of the descending channel. In case a break above occurs, the upward move may accelerate towards major resistance at $142.70 which coincides with 50 SMA (green line) and the 200 SMA (red line). Only breaking above this hurdle, may pave the way for a bigger upward move. Failure to break higher could see the stock price pull back towards near-term support at $137.50. A point to note is that, similarly to the above, the 'death cross' pattern appeared on the 4H interval. Source: xStation5

Pepsi (PEP.US) stock price is testing the upper limit of the descending channel. In case a break above occurs, the upward move may accelerate towards major resistance at $142.70 which coincides with 50 SMA (green line) and the 200 SMA (red line). Only breaking above this hurdle, may pave the way for a bigger upward move. Failure to break higher could see the stock price pull back towards near-term support at $137.50. A point to note is that, similarly to the above, the 'death cross' pattern appeared on the 4H interval. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.