The world's largest cryptocurrency continues to do well, with Bitcoin's price already rebounding more than 15% from April's lows. At the same time, the US dollar has been consistently weakening, 'weighed down' by slowly weakening macro data from the United States. BTC is also gaining amid a rebound in stock markets, fueled by strong results from US technology companies. It is also currently favored by a bull market in China, where investors are repositioning as the specter of deflation and a larger slowdown slowly recedes.

- The re-entry above key indicators of resistance (formerly support) of the average Short Term Holder Realized Price of Bitcoin and the average purchase price of BTC in U.S. ETFs, reassures markets that a surge in demand for risky assets and bonds, has halted the Bitcoin sell-off

- In addition, the reported recent changes in the portfolios of US funds managing more than $100 million in capital confirms that large institutions are interested in investing in ETFs. In the first quarter of the year, holdings in ETFs on BTC were concentrated by Morgan Stanley, Wells Fargo and US pension and hedge funds, among others. It may be a signal, that if US monetary conditions will change to dovish, demand for Bitcoin may be even stronger than now

- This week will likely bring a test of upward momentum for Bitcoin. On May 22, after the session, Nvidia will report results, and a number of Fed members will speak, commenting on recent inflation readings that have pleased Wall Street despite the still 'pro-inflationary' picture in services and other price indicators.

- Nvidia's report will close out fiscal 2024 and potential euphoria among tech companies could favor Bitcoin. On the other hand, disappointment with any element of the report; e.g., guidance or lack of 'new' growth catalysts from CEO, Jensen Huang's comments, could give an excuse for profit taking, with high valuations and record margins. If this is the case, it's hard to expect this not to reflect negatively on Wall Street and Bitcoin.

BITCOIN (H1, D1 charts)

We can see that Bitcoin's recent dynamic rebound coincided with the decline in the dollar index (USDIDX, the orange chart line). The price is once again trading above the SMA100, SMA50 and SMA200 on the hourly interval, indicating a potentially significant spike in volatility if the dollar and Wall Street see significant declines or increases again.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appSource: xStation5

We can see that the April decline to $56,000 ended with a V-shaped rebound, and the price broke above the 50-session simple moving average (orange line). Momentum seems to 'favor' the bulls again. Previous V-shaped bounces have yielded sizable gains but despite on that, it's never guaranteed scenario.

Source: xStation5

On-chain data indicated that the source of Bitcoin's rebound was not only Wall Street surge but also the 'oversold' conditions and sellers exhaustion. As we can see on the chart (blue lines) historically, such a scenario has not always been a guarantee of a sustained BTC rebound Source: Glassnode

Source: Glassnode

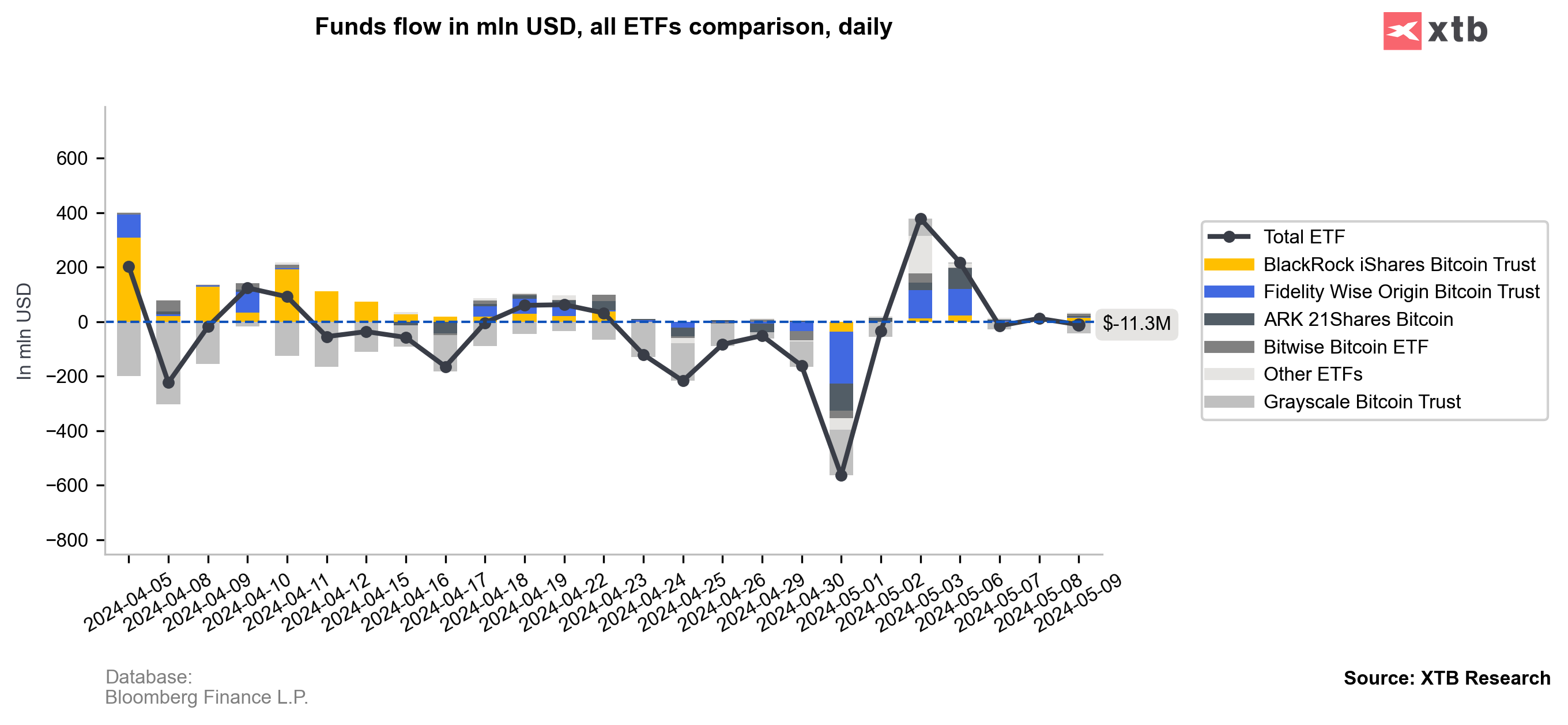

Bitcoin's price rebound has drawn renewed interest in US ETFs. At the same time, we see high interest in the case of Fidelity (probably purchases of some funds), but BlackRock Bitcoin Trust is still recording rather 'subdued' inflows.

Source: Bloomberg Finance LP, XTB Research

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.