The cryptocurrency market started today in a weak mood, but it was clearly improved by a dovish statement from the Bank of England, which intends to buy Treasury bonds. We also see a moderate positive reaction on the indices. Will this be enough for Bitcoin to rise and leave the levels below $20,000 for longer?

- Bitcoin is back above $19,000 and has again defended key support levels. Ethereum is trading above $1,300 per token;

- FTX exchanges, which owns the cryptocurrency of the same name, has won a bid to acquire bankrupt cryptocurrency company Voyager, for $1.4 billion. Voyager filed for bankruptcy in July. FTX outbid Binance and Wave Financial. At the same time, news surfaced of the resignation of the CEO of another bankrupt cryptocurrency lender, Celsius Network;

- The head of the exchange, billionaire Sam Bankman-Fried has also considered buying out Celsius in the past. Voyager customers have until Oct. 3 to file claims for cryptocurrency recovery. Bankman-Fried reported over the summer that he wanted to reduce the negative effects of bankruptcies and improve sentiment toward the battered cryptocurrency industry.

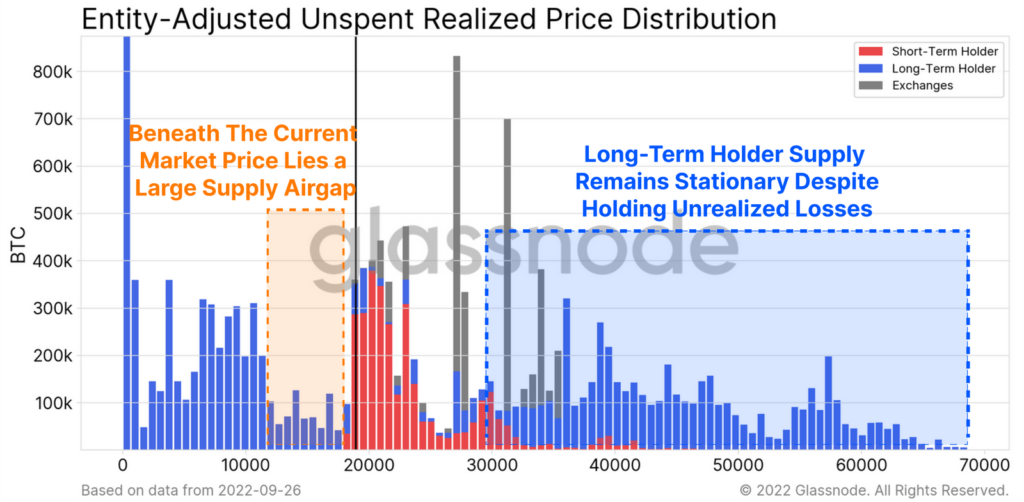

The chart analysis above shows the market for Short Term Holders (STH for short). Dividing Bitcoin supply between long and short term addresses, we can observe several phenomena. Bitcoins bought above $30,000 are already mostly owned by LTHs, and there is little supply from them, due to the significant unrealized loss and investors' belief in Bitcoin's upward potential. On the other hand, STH addresses want to purchase the cryptocurrency at the most attractive price possible. As we can see now, the volatility of investments on the part of STH is low, volumes are relatively similar to each other. In the face of a growing lack of supply from LTH addresses, it is the movements of STH that are most relevant for Bitcoin. A supply gap between $17,000 and $11,000 could trigger a massive sell-off if Bitcoin's price falls about 10% from current levels near $19,000. However, looking at the systematic supply reactions of the major cryptocurrency, such a large drop looks as possible once short-term investors lose faith in the price rebound and feel the breath of active supply on them. With the passage of time and the 'notorious' extinguishing of demand, sentiment may weaken leading to capitulation of STH. Source: Glassnode

The chart analysis above shows the market for Short Term Holders (STH for short). Dividing Bitcoin supply between long and short term addresses, we can observe several phenomena. Bitcoins bought above $30,000 are already mostly owned by LTHs, and there is little supply from them, due to the significant unrealized loss and investors' belief in Bitcoin's upward potential. On the other hand, STH addresses want to purchase the cryptocurrency at the most attractive price possible. As we can see now, the volatility of investments on the part of STH is low, volumes are relatively similar to each other. In the face of a growing lack of supply from LTH addresses, it is the movements of STH that are most relevant for Bitcoin. A supply gap between $17,000 and $11,000 could trigger a massive sell-off if Bitcoin's price falls about 10% from current levels near $19,000. However, looking at the systematic supply reactions of the major cryptocurrency, such a large drop looks as possible once short-term investors lose faith in the price rebound and feel the breath of active supply on them. With the passage of time and the 'notorious' extinguishing of demand, sentiment may weaken leading to capitulation of STH. Source: Glassnode

Bitcoin chart, H1 interval. Bitcoin is reacting negatively to the resistance of the 200-session moving average on 1 hour interval, near $19,080. Depending on Wall Street's opening, however, bulls may break through the resistance and attempt a $20,000 attack. If the sentiment towards risk continues to be weak a path south is not impossible. Currently, contracts point to a weak opening for indexes overseas. RSI is now on neutral level. Source: xStation5

Bitcoin chart, H1 interval. Bitcoin is reacting negatively to the resistance of the 200-session moving average on 1 hour interval, near $19,080. Depending on Wall Street's opening, however, bulls may break through the resistance and attempt a $20,000 attack. If the sentiment towards risk continues to be weak a path south is not impossible. Currently, contracts point to a weak opening for indexes overseas. RSI is now on neutral level. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.