- Bitcoin falls and stops at key support line, $70 billion has been wiped out from the capitalization of the entire cryptocurrency market

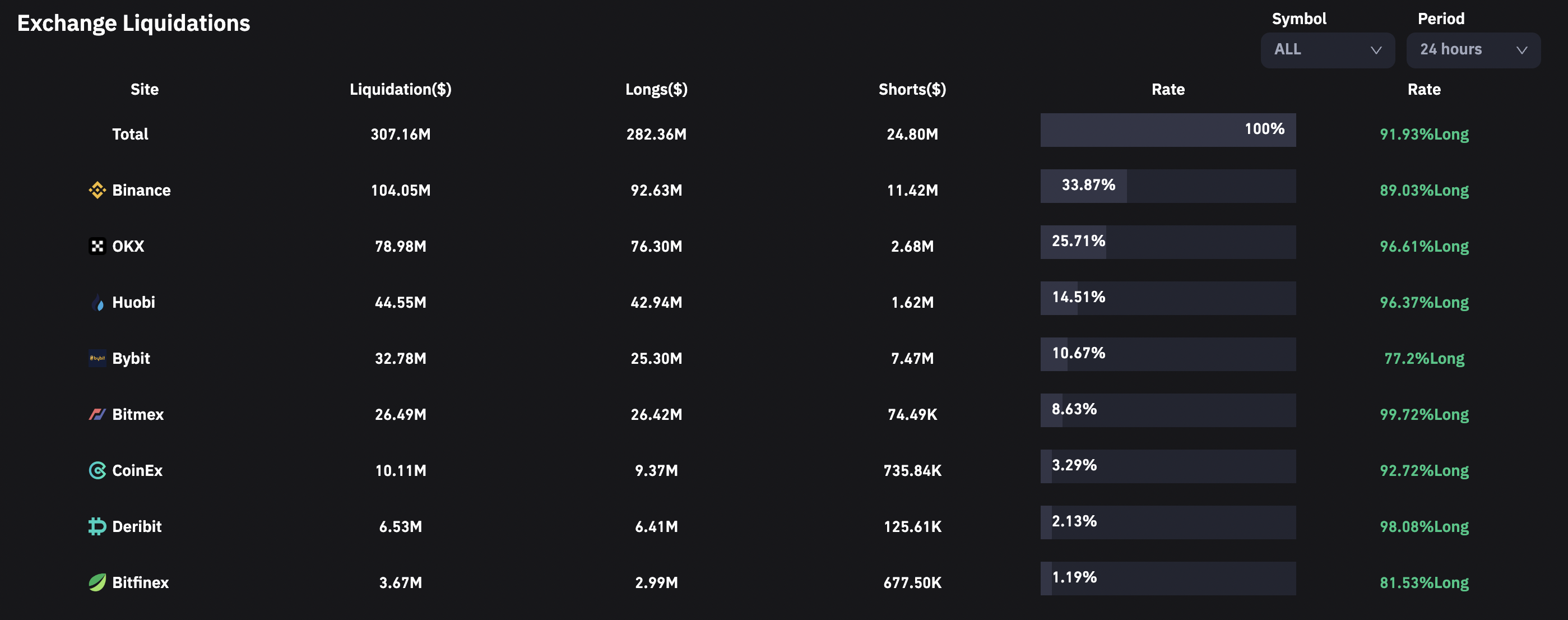

- The value of liquidations caused by Bitcoin's drop below $20,000 is already more than $307 million

- Weakening indexes on Wall Street put pressure on cryptocurrencies as the risk of a systemic crisis grows

- According to Arkham Intelligence, cryptocurrency lender Voyager Digital has deposited a total of $138.88 million in 25 different cryptocurrencies on exchanges since the beginning of March. The company, which is in liquidation, has been selling off assets, a pace that has increased in recent days. In March, Voyager liquidated more than $100 million in ETH and $26 million in ShibaInu, among other assets;

- Joe Biden's proposed budget for the new year includes the elimination of tax breaks for cryptocurrency investors and a higher tax imposed on so-called 'miners' digging Bitcoin

- Wells Fargo analysts point out that Signature Bank (SBNY.US) will not be the new Silvergate Capital and could potentially benefit after its closure

The most liquidations of futures traders took place on the Binance ($307 million) and Huobi ($45 million) exchanges. Traders on BTC lost the most, with a total of nearly $112 million. Source: coindesk

- Cryptocurrencies were weighed down by the definitive closure of crypto-bank Silvergate Capital. Sentiment was then hit by a massive sell-off in Wall Street financial institutions, driven by the plight of SVB Silicon Valley Bank (SIVB.US);

- Concerns grew over banks' unrealized losses on bonds whose valuations have been affected by the Fed's monetary tightening cycle. The Federal Deposit Insurance Corporation reported in February that U.S. banks' unrealized losses on available-for-sale and held-to-maturity securities totaled $620 billion (December 31, 2022), up from $8 billion a year earlier - before the Fed began raising interest rates;

- In addition, there was also a 'flash crash' of the Huobi token overnight, which saw a 90% drop in just a few minutes although it began to rebound hours later. The exchange intends to create a $100 million fund to support liquidity. All of this, coupled with comments from regulators caused a drop in sentiment.

Looking at the chart of BITCOIN, on D1 interval, we see that the price has reached a very interesting place from the technical side. The declines have stopped at the 200-session moving average (SMA200, red line), and the RSI relative strength indicator is showing the levels of extreme oversold seen recently after the FTX collapse. All this means that if systemic problems do not spike in the coming days, the bulls may try their chances to break out above the psychological resistance at $20,000.

Source: xStation

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.