Bitcoin’s price fell today below $70,000 and is now testing the $69,500 area, down nearly 4%. At the same time, Ethereum is approaching a test of $2,000, while the popular altcoin Ripple is down 10%, extending the sell-off. Bitcoin is trading at its lowest level since early November 2024, before Donald Trump won the election. The new U.S. administration’s crypto-friendly stance has not managed to stop the panic cycle, and the market now appears to have entered a phase of “bottom discovery.”

Bitcoin (W1 timeframe)

Bitcoin is trading about 5% below the 200-week EMA (EMA200), shown as the red line, which broadly signals a mid-phase bear market. If the 2022 scenario were to repeat, Bitcoin could still face one more downward impulse, likely toward $50,000. The decline from the peak has already exceeded 40%.

Source: xStation5

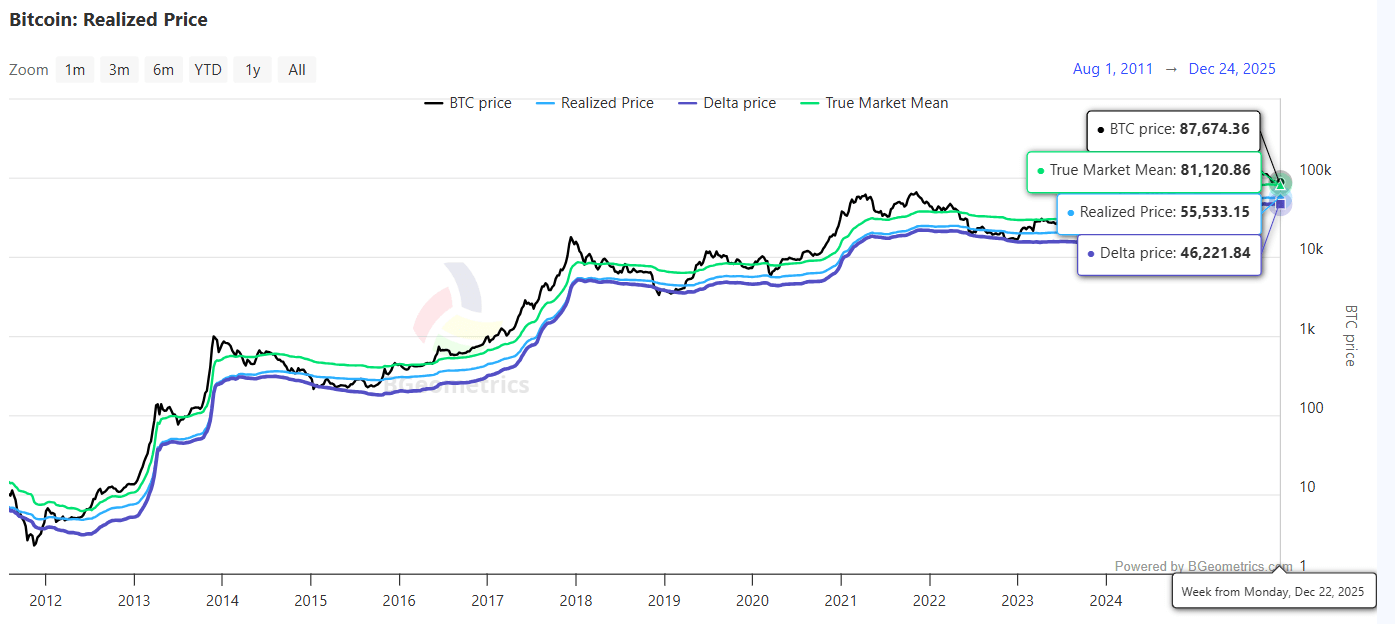

It seems that in this bear-market phase, it may be reasonable to use the previous cycle as a partial reference point. It cannot be ruled out that the price will retest the so-called on-chain price delta this year, a combined “macro” Bitcoin indicator based on long-term support zones and the averaged realized purchase price, currently around $45,000. In the two previous bear markets, the delta level acted as a macro support.

Source: BGeometrics

The weekly RSI for Ethereum stands at 33, compared with 29 for Bitcoin. Despite a 65% drop from its highs, ETH may struggle to regain strength until there is strong, fundamental demand for BTC. In previous bear markets, Ethereum typically fell much more sharply than BTC itself. The latest on-chain reports also point to sales of ETH worth millions of USD by wallets linked to the project’s founder, Vitalik Buterin.

Source: xStation5

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

BREAKING: Massive Crude Build Shatters Expectations. WTI is down by 1%

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Chart of the day: US100 gains ahead of the Nvidia earnings 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.