The largest cryptocurrency, Bitcoin, is losing about 3% today and has fallen below $71,000. The broader crypto market's declines coincide with today's weaker sentiments in the indices. The yields of 10-year U.S. treasuries have risen in the last three days from around 4.1% to nearly 4.29%. Today's data from the U.S. economy showed that February's PPI inflation rose more strongly than expected, complementing Tuesday's 'hawkish' CPI report, which indicated persistent pressure in services excluding rents.

Today's labor market data turned out to be very solid, with initial jobless claims falling to 209,000 compared to 210,000 previously, and the number of continued claims dropping to a long-unseen 1.8 million. As a result, yields are gaining again, and the bond market is under pressure. The strengthening of the dollar and the rise in risk-free rates are not favorable to risky assets, and it seems that in the next few hours we might observe profit-taking by some ETF funds, which have been intensely accumulating Bitcoin lately; this could happen if Wall Street's weaker moods ahead of tomorrow's 'triple witching day' persist; however, this is still not a confirmed scenario.

Bitcoin (H1 interval)

Bitcoin is testing the simple, exponential moving average SMA100 (black line), which has proved to be a fairly strong support level since the end of February. A plunge below $70,000 could potentially trigger a wave of profit-taking. On the other hand, a rebound towards $73,000 could open the way to new, historic highs.

Source: xStation5

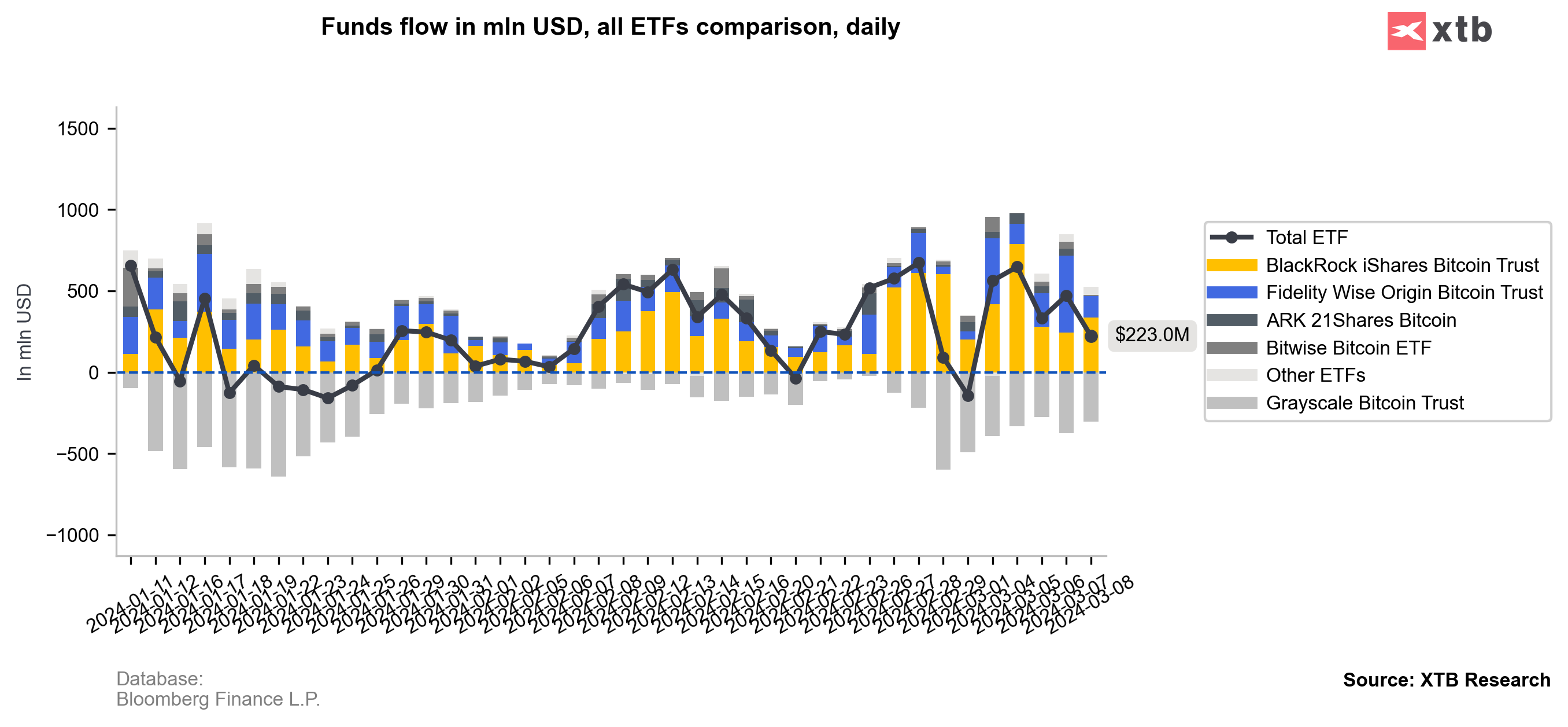

Inflows into ETF funds (data until Friday, March 8) grew, although outflows from Grayscale ETF are clearly continuing.

Source: XTB Research, Bloomberg Finance LP

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.