- The U.S. Department of Justice has conveyed that regulators will soon announce a global enforcement directive for the cryptocurrency market;

- The regulators' efforts make investors see the collapse of the entire industry as less and less likely, and reassure them that digital assets will continue to grow and mature as a new asset class;

- The cryptocurrency market is catching its breath and reasserting itself in the belief that the worst is over, and that the FTX bankruptcy ultimately did not trigger the collapses of other cryptocurrency exchanges;

- Despite relatively hawkish comments from Fed members suggesting that markets are getting prematurely and excessively excited about falling inflation, Wall Street is ignoring the warnings, rising indexes are helping the crypto market;

- Bulls continue their rally, and weakening macro data from the U.S. economy may cause the Fed to indeed start considering halting rate hikes in the first half of 2023 which could give fuel to risky assets.

- Bitcoin is approaching $21,500 and Ethereum is trading above $1,600 for the first time in more than 2 months.

Comments from Davos

The ongoing World Economic Forum in Davos has traditionally featured representatives of the cryptocurrency industry this year. Giving an interview, Vice President of Policy and Regulatory Strategy of fintech Circle, Teana Baker-Taylor indicated that the period of total speculation in the cryptocurrency market is over, companies in the industry are now focusing on real use cases of the technology. Blockchain companies are posting gains today, with shares of Coinbase (COIN.US), HIVE Blockchain (HIVE.US) and Argo Blockchain (ARG.UK) rising. On the other hand, Cliff Sarkin, head of strategic relations at Casper Labs, a cryptocurrency company that is also present in Davos answering questions indicated that he remains 'cautiously optimistic' while more and more industry insiders are beginning to believe that the cryptocurrency market has already reached the bottom.

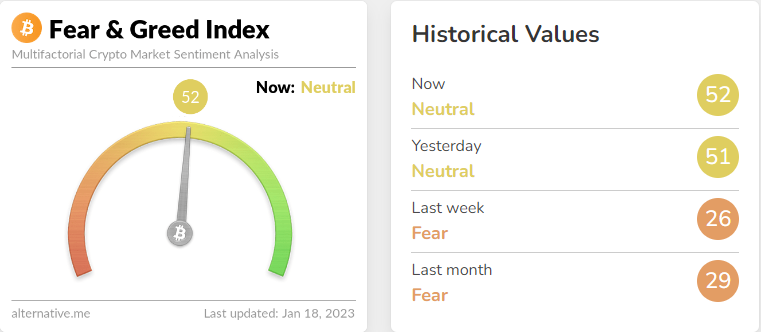

The Fear and Greed Index indicates that crypto market sentiment is once again neutral near 52 points. The index in recent days for the first time and in months crossed the 50 point level. Source: alternative.me

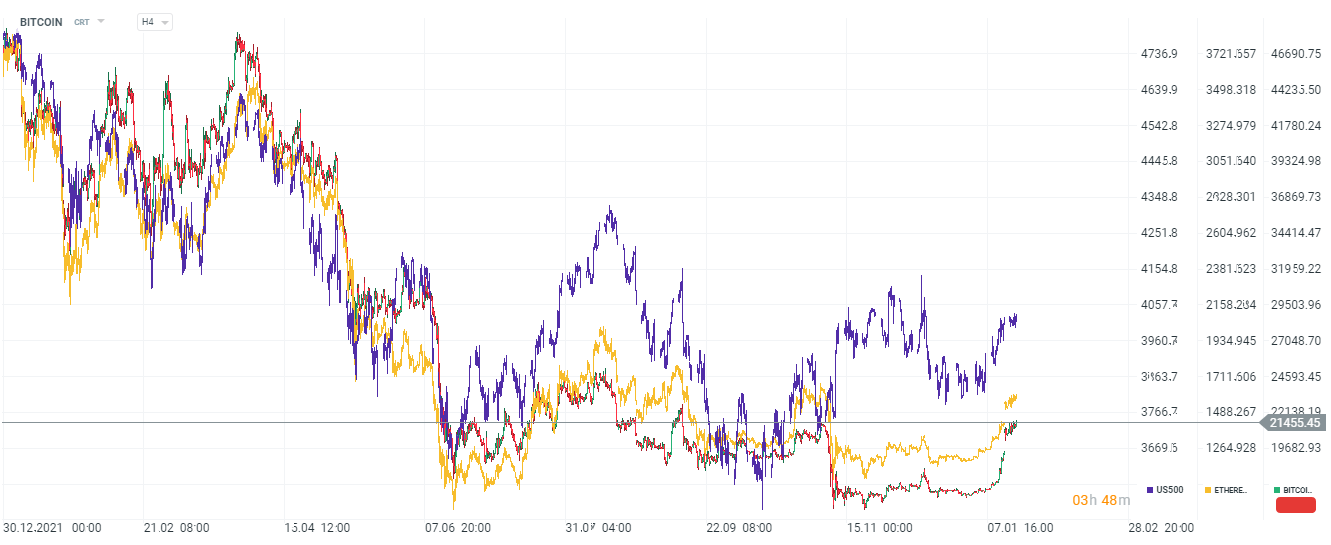

Bitcoin, Ethereum (gold line) and US500 (purple line), H4 interval. Euphoria among cryptocurrencies continues as the stock market records a definite improvement in sentiment in the face of falling inflation, a slowly weakening economy and a declining argument by the Fed for maintaining a very restrictive cycle of rate hikes. Bitcoin and Ethereum's correlation with the S&P500 index continues. Source: xStation5

Bitcoin, Ethereum (gold line) and US500 (purple line), H4 interval. Euphoria among cryptocurrencies continues as the stock market records a definite improvement in sentiment in the face of falling inflation, a slowly weakening economy and a declining argument by the Fed for maintaining a very restrictive cycle of rate hikes. Bitcoin and Ethereum's correlation with the S&P500 index continues. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.