- Sudden, dynamic increases in the crypto market are due to a squeeze of short positions and a general change in traders' positioning after another period of lower Bitcoin volatility. Bulls at current levels saw a larger risk premium in an oversold market

- Bitcoin is gaining despite a strong dollar index (USDIDX) and declines on the EURUSD, which underscore that the 'greenback' is still very strong. Potentially, however, the DXY index has reached important resistance at 105 points, and a possible weakening of the US dollar could 'unleash' Bitcoin's upside potential - here too, the 'risk-reward ratio' seems to be driving the bulls

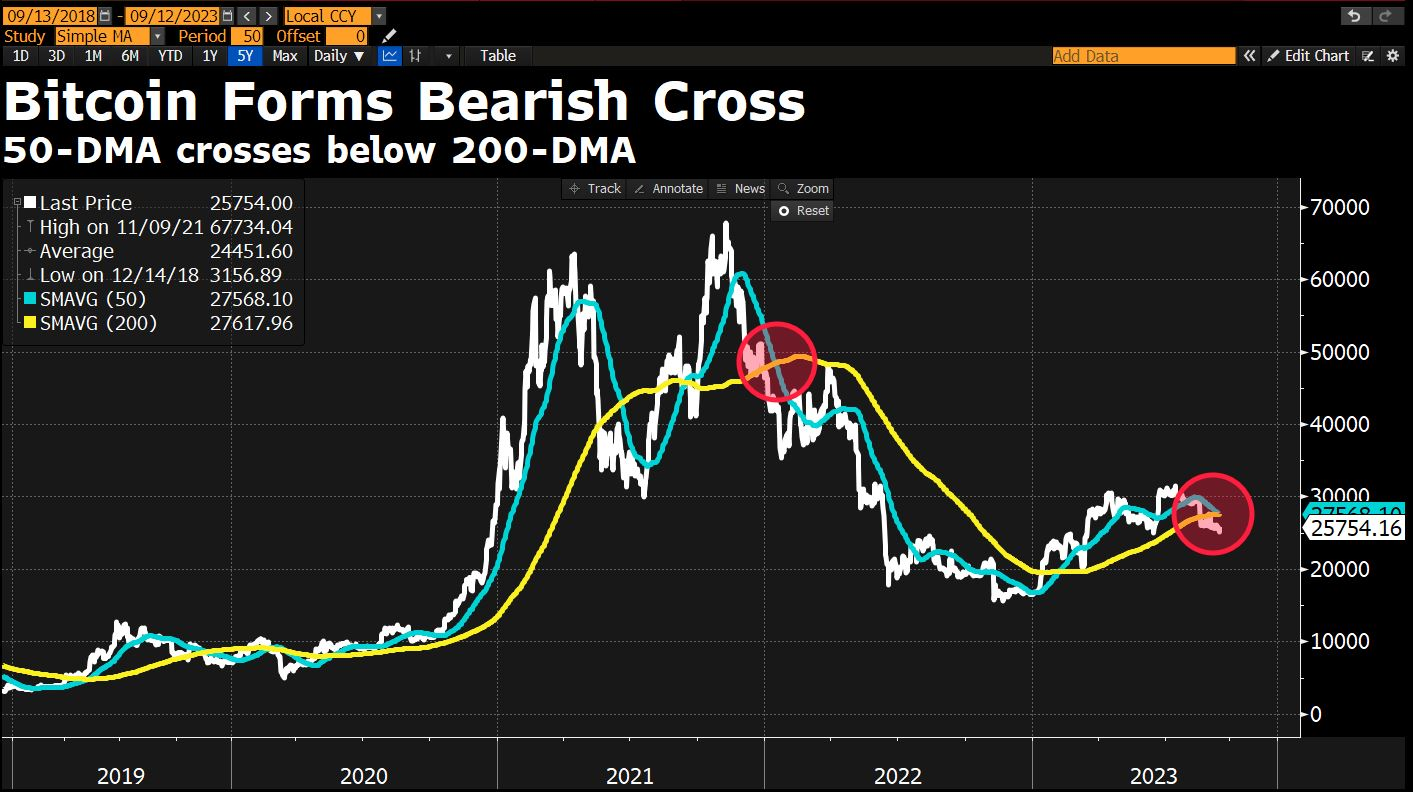

- The potential 'death cross' formation on Bitcoin limits risk appetite and may foreshadow a prolonged period of weakness - nevertheless, in reality, this indicator often proves to be 'lagging' and occurs when the market is oversold and prices are low;

- Increases are accelerating in the altcoin market, which lost heavily yesterday on a wave of concerns about the liquidation of assets (about $3.4 billion in cryptocurrencies) by the FTX exchange, which is in liquidation (estimated sales of $100 to $200 million per week). Solana is gaining more than 5%, Bitcoincash and Filecoin are rising strongly.

BITCOIN stopped the downward impulse almost exactly in the psychological support zone at the level of $25,000, and today the price of the most popular cryptocurrency returned above $26,000. From the perspective of technical analysis, it is worth noting the formation of an incomplete bullish embrace formation, which is somewhat at odds with the previously mentioned intersection of the 50-day and 200-day SMAs, which indicates the so-called "death cross" formation, a pattern seen as a moment of embracing a bear market. Source: xStation5

Source: Bloomberg Finance LP

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.