This week's last session on the markets brings huge volatility. Stock market indexes are posting massive declines, and even more interesting is the currency market, which is dominated by the complete capitulation of the British pound. There are several reasons for such a big sell-off, but the most important are:

-

Decline in the pace of rate hikes by the BoE (in the face of huge uncertainty about the further trajectory of inflation)

-

Huge fiscal uncertainty (which could further rock inflation)

Prime Minister Liz Truss' government today unveiled details of the so-called "mini-budget." It aims to boost the long-term growth potential of the British economy and includes massive tax cuts:

-

A reduction in the basic rate of income tax from 20% to 19%

-

Reducing the higher rate of income tax from 45% to 40%

-

The increase in corporate tax to 25%, which was to take effect next year, has been suspended for the time being. The corporate tax will remain unchanged at 19%

If the government enacts these proposals, they will be the largest tax cuts since 1972. While the tax cuts are stimulating the economy and should have a positive impact on the currency, the pound is experiencing a continuation of the discount. This can be attributed to one major uncertainty - how these tax cuts will be financed, and this is what the market is most concerned about. Market analysts indicate that the government will have great difficulty financing the deficit in the face of such economic uncertainty.

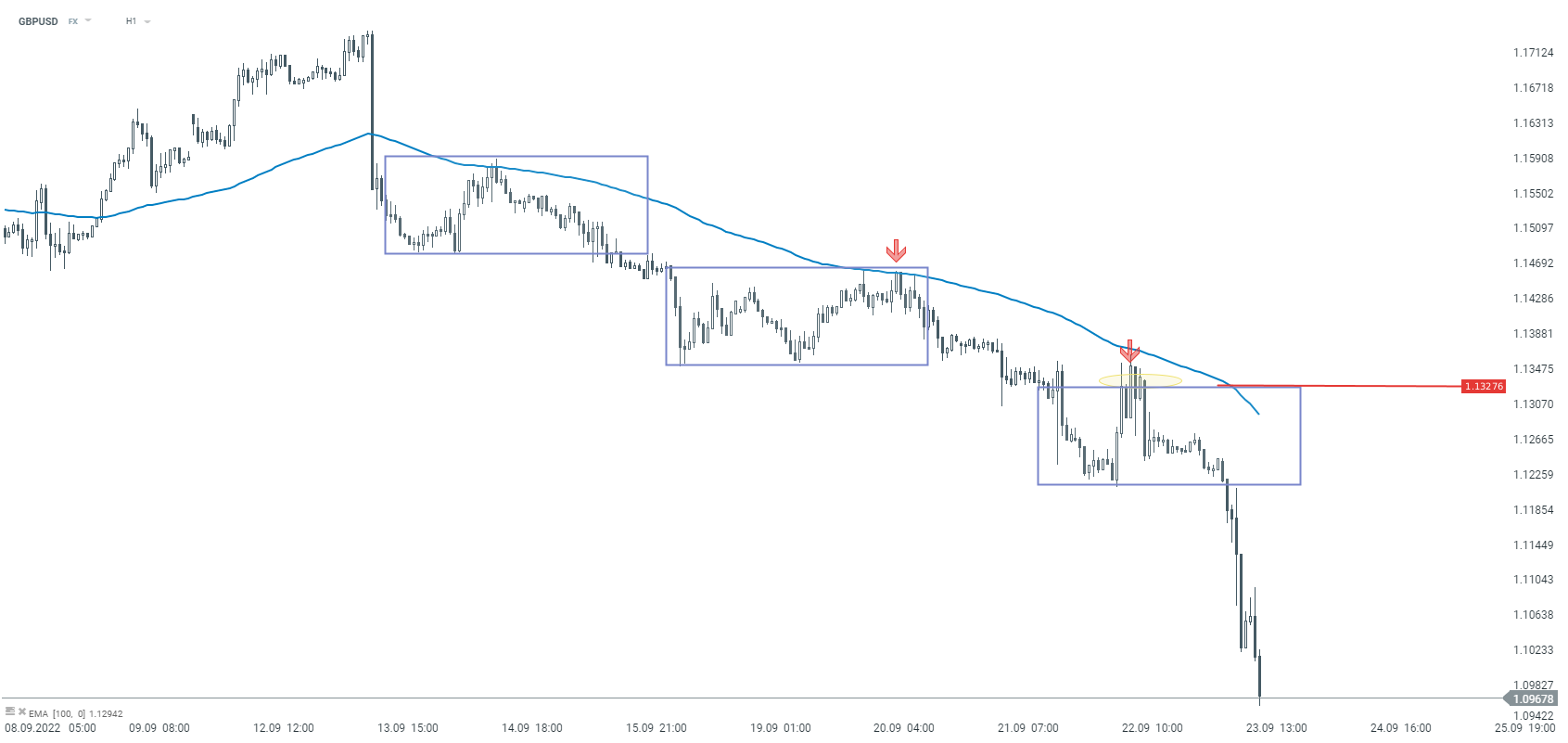

Looking technically at the chart of GBPUSD, we observe a solid sell-off. Despite the huge volatility, the quotation is behaving according to the rules of technical analysis. The last three corrections were almost identical (marked with rectangles), and the downward movement is supported by the average of the last 100 periods. So it seems that as long as the 1:1 arrangement is not negated, or the price does not return above the moving average, the downward movement should be expected to continue.

GBPUSD H1 interval. Source: xStation5

Chart of the Day: EUR/USD after data from Europe and weaker US labor market

Daily summary: Red dominates on both sides of Atlantic

BREAKING: ECB maintains rates in line with expectations!💶

BREAKING: Bank of England holds rates as expected 📌 GBPUSD ticks down on dovish vote split 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.