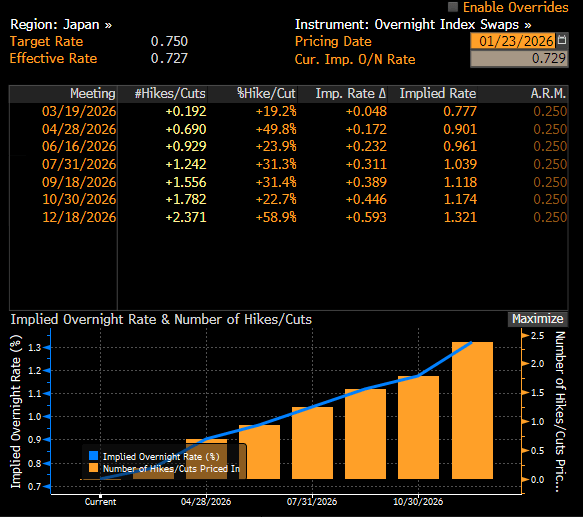

The Bank of Japan (BoJ) has left its short-term interest rate unchanged at 0.75%. While the central bank’s growth and inflation projections leaned toward a decidedly hawkish stance, the yen failed to find immediate traction. The currency remains beleaguered by a deteriorating fiscal outlook, even as expectations mount for a return to tightening by mid-year. Markets are currently pricing in just over two rate hikes for 2026, though some institutions, such as Citi, anticipate as many as three.

Governor Kazuo Ueda’s cautious rhetoric has left the yen under sustained pressure. While a higher rate environment should theoretically support the currency over a multi-quarter horizon, the foreign exchange market remains fixated on the immediate term, where the BoJ’s hesitation dominates the narrative.

The BoJ’s policy decision

-

Rate Hold: The policy rate was maintained at 0.75% following December’s hike from 0.5%. The decision was carried by an 8–1 vote, notably with one dissenting member advocating for an immediate move to 1%.

-

Upward Revisions: The bank raised its GDP growth forecasts for fiscal years 2025–2026 to the 0.9–1.0% range. Crucially, it significantly lifted the path for "core-core" inflation, which is now expected to remain above the 2% target through fiscal 2027.

-

Inflationary Momentum: The official communiqué highlighted that wage pressure and domestic demand are reinforcing inflationary momentum, offsetting lower oil prices and a general easing of global risks.

The Governor’s Message

In his post-meeting remarks, Mr. Ueda reiterated that the bank will "continue to raise rates if economic and inflation forecasts materialize." However, he emphasized that the timing and pace remain data-dependent, with a particular focus on the labor market.

-

Assessment Phase: He noted that insufficient time had passed since the December hike to fully assess its impact, justifying the current pause.

-

Yen Sensitivity: While avoiding direct commentary on exchange rate levels—formally the purview of the Ministry of Finance—he acknowledged that a weak yen inflates import costs and may provide a temporary boost to CPI.

The 2026 Tightening Cycle

The BoJ’s own projections—core-core CPI stable above 2% alongside upgraded GDP growth—provide the fundamental justification for further tightening. Bloomberg Economics anticipates the next move in July, suggesting the bank wishes to avoid an overly aggressive pivot, particularly in an election year. Short-term interest rate markets are pricing a modest path: one hike in mid-year with a potential follow-up toward year-end.

Outlook for the Yen

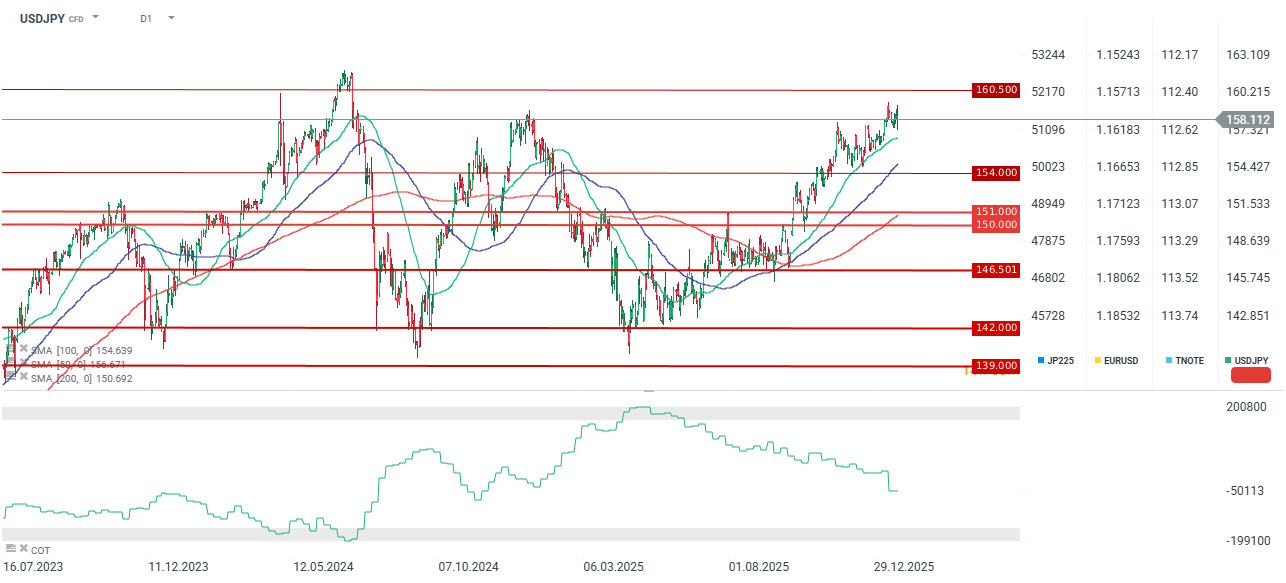

Despite the hawkish forecasts, USD/JPY remains anchored near the 160 level. Investors interpreted the meeting as a "dovish hold," focusing on the lack of a signal for an imminent move.

-

Fiscal Drag: Market participants are increasingly wary of Japan’s fiscal trajectory, specifically proposals to slash VAT on food to zero. Fears of a ballooning deficit under an expansive fiscal policy are weighing heavily on investor sentiment.

-

Yield Spreads: While the US-Japan rate differential still favors the dollar, the historic surge in Japanese yields—with the 40-year JGB hitting 4% for the first time—theoretically offers a yen tailwind. However, this spike is currently driven by fiscal anxiety rather than monetary policy shifts.

-

Fundamental Pivot: On a 6-to-12-month view, the fundamentals favor the yen. A gradual narrowing of rate spreads and the prospect of a softer dollar amid eventual Fed cuts suggest a recovery for JPY from its current lows.

Market Sentiment and Technicals

-

Short-term: The lack of a clear tightening signal ensures continued volatility. While the yen initially softened, it has since stabilized as short-term yields rose and extreme long-term yields moderated.

-

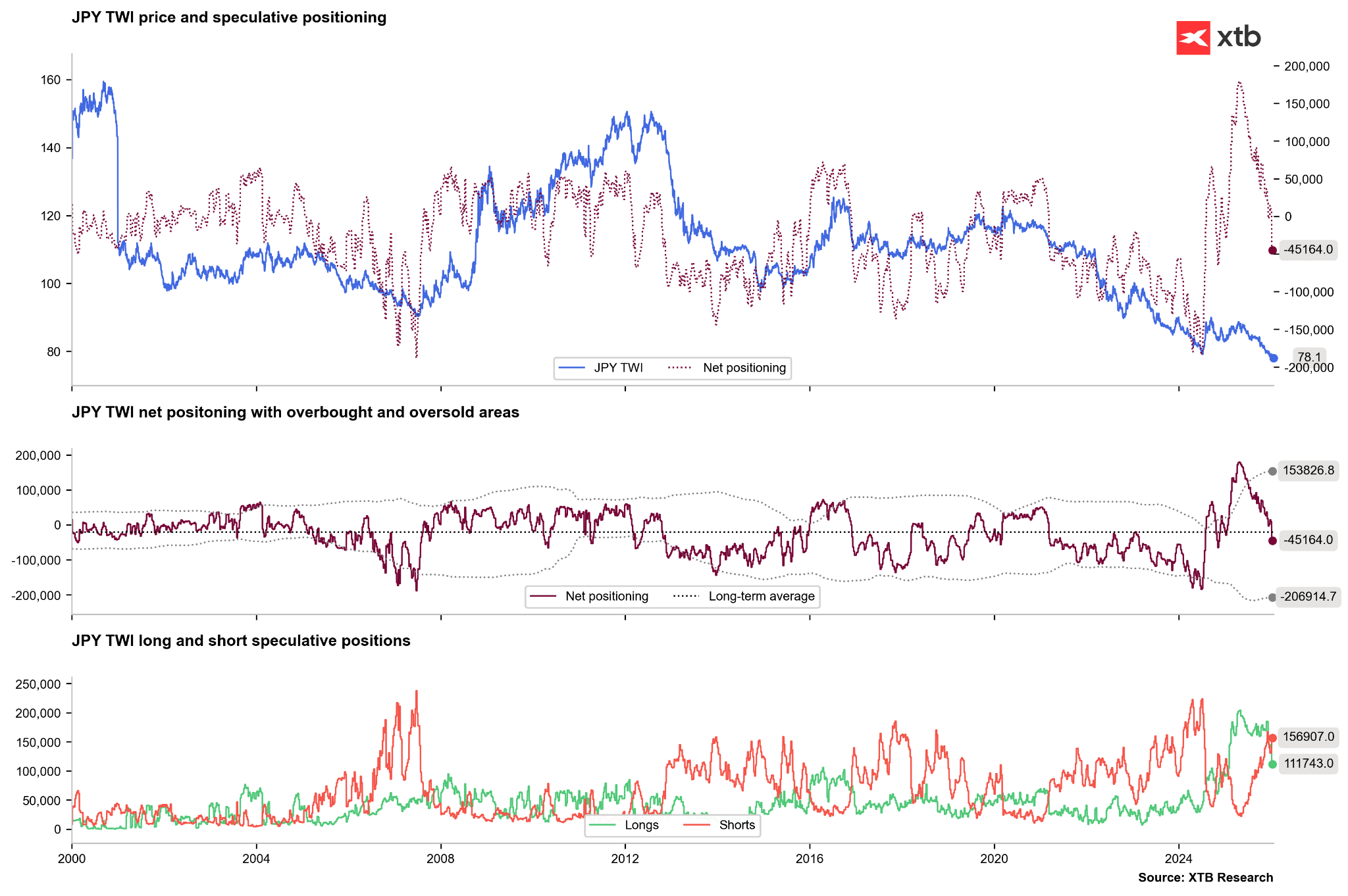

Medium-term: Sentiment toward the yen is currently extremely bearish. However, if growth forecasts are met and the BoJ signals a consistent tightening path, a long-term recovery remains probable.

-

Positioning: Recent data shows an extreme reduction in long positions alongside a surge in shorts. Net positioning is nearing levels (-100,000 contracts) that historically serve as a contrarian signal. This extreme short positioning increases the risk of a "short squeeze," reminiscent of the price action seen in 2024.

Technical View: USD/JPY’s upward momentum is beginning to stall. While a retest of 160 remains possible, a break below the 50-day moving average would be a significant signal. Such a move could trigger a deep correction toward the 150–151 range, especially if the broader market continues to embrace the "Sell America" narrative.

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.