Bitcoin plunged below major support of $45,000 and other projects also recorded heavy losses during today's session as investors digest recent hawkish comments from FED members and brace themselves for release of FOMC minutes at 7:00 pm BST. Despite negative moods it is worth mentioning that on-chain data indicates that bulls did not lay down their weapons yet. According to data from Glassnode, crypto exchanges recorded sharp cryptocurrency outflows in recent months which points out that “historically strong accumulation” was taking place.

Crypto exchanges recorded outflows of nearly 96,000 bitcoin each month. Source: Glassnode

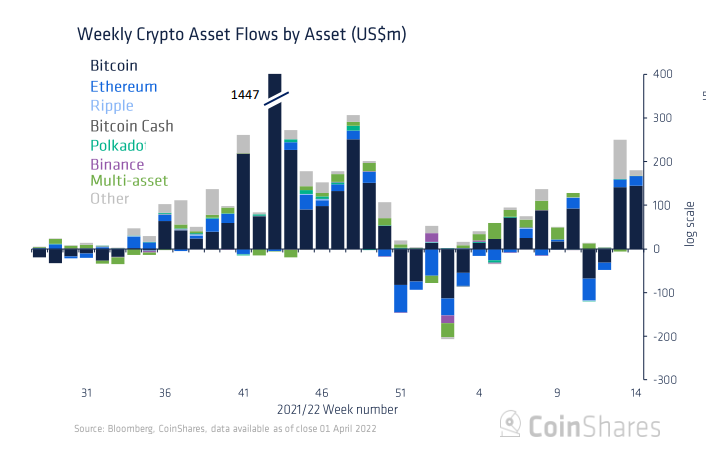

Also cryptocurrency investment funds recorded inflows totaling $180 million. This is a second week of inflows, the majority of which came from Europe.

Bitcoin recorded the highest inflows of 144 million. Source: CoinShares

Bitcoin recorded the highest inflows of 144 million. Source: CoinShares

Bitcoin price dropped below the key horizontal support at $ 45,000 on Wednesday, which poses a risk of further declines. If the correction move continues, the next major support to watch lies at $ 43,000, which is marked with the lower limit of the 1:1 structure and the 38.2% Fibonacci retracement of the last upward wave. Source: xStation5

Bitcoin price dropped below the key horizontal support at $ 45,000 on Wednesday, which poses a risk of further declines. If the correction move continues, the next major support to watch lies at $ 43,000, which is marked with the lower limit of the 1:1 structure and the 38.2% Fibonacci retracement of the last upward wave. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.