US, NFP report for July.

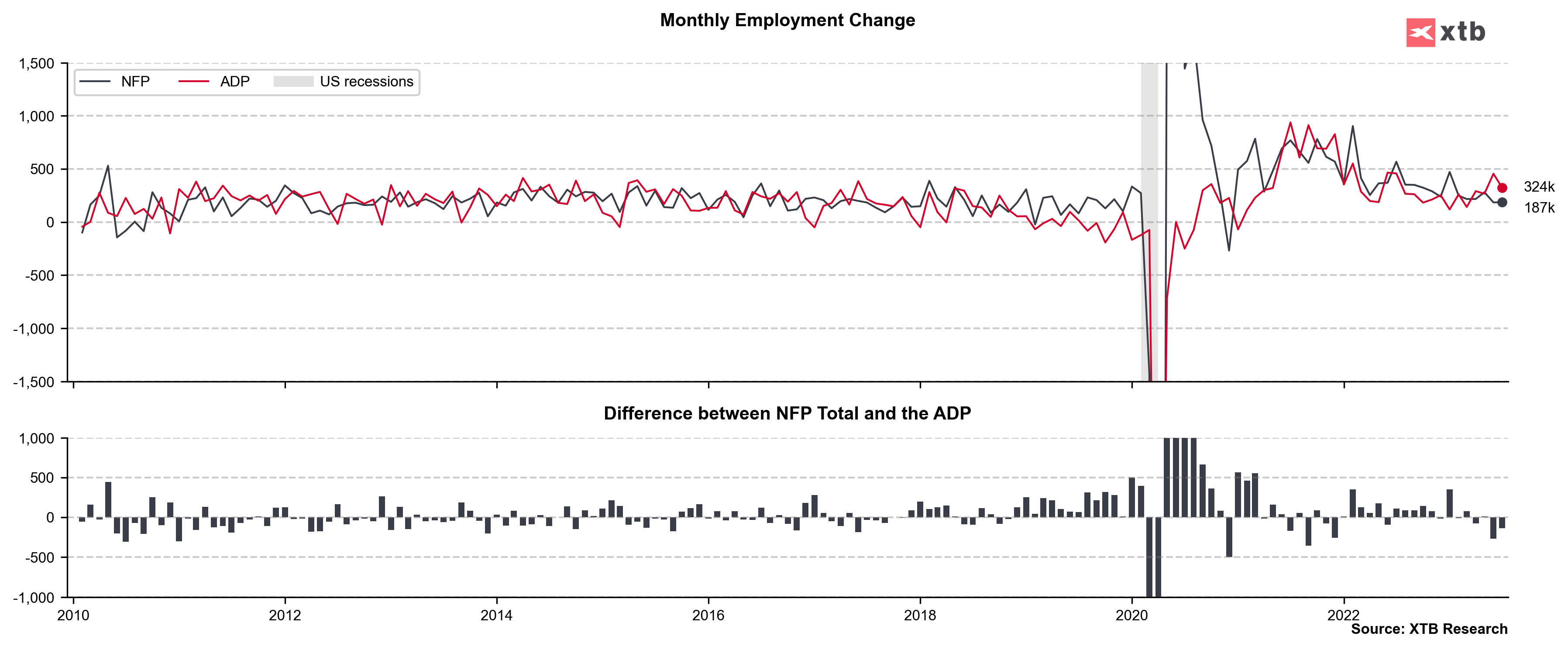

- Non-farm payrolls: 187k vs 200k expected (209k previously)

- Unemployment rate: 3.5% vs 3.6% expected (3.6% previously)

- Wage growth (monthly): 0.4% MoM vs 0.3% MoM expected (0.4% MoM previously)

- Wage growth (annually): 4.4% YoY vs 4.2% YoY expected (4.4% YoY previously)

In July, the U.S. total nonfarm payroll employment rose by 187,000, and the unemployment rate remained stable at 3.5%. Job gains were recorded in health care, social assistance, financial activities, and wholesale trade, while other industries saw little change. The unemployment rate for various demographic groups showed minimal fluctuations, with a notable decline for Asians to 2.3%. The number of persons on temporary layoff decreased by 175,000, while the number of permanent job losers remained stable at 1.4 million. The labor force participation rate stood at 62.6%, and the employment-population ratio was 60.4%. The number of part-time workers and those not actively looking for work remained relatively constant. Average hourly earnings increased by 14 cents, and the average workweek decreased slightly. The report also included downward revisions to May and June's total nonfarm payroll employment numbers by 49,000 combined.

EURUSD thicks significantly higher after the publication, strong US labor market increases the likelihood of rate hikes in the next Federal Reserve (Fed) meeting, M15 interval, source: xStation5

EURUSD thicks significantly higher after the publication, strong US labor market increases the likelihood of rate hikes in the next Federal Reserve (Fed) meeting, M15 interval, source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.