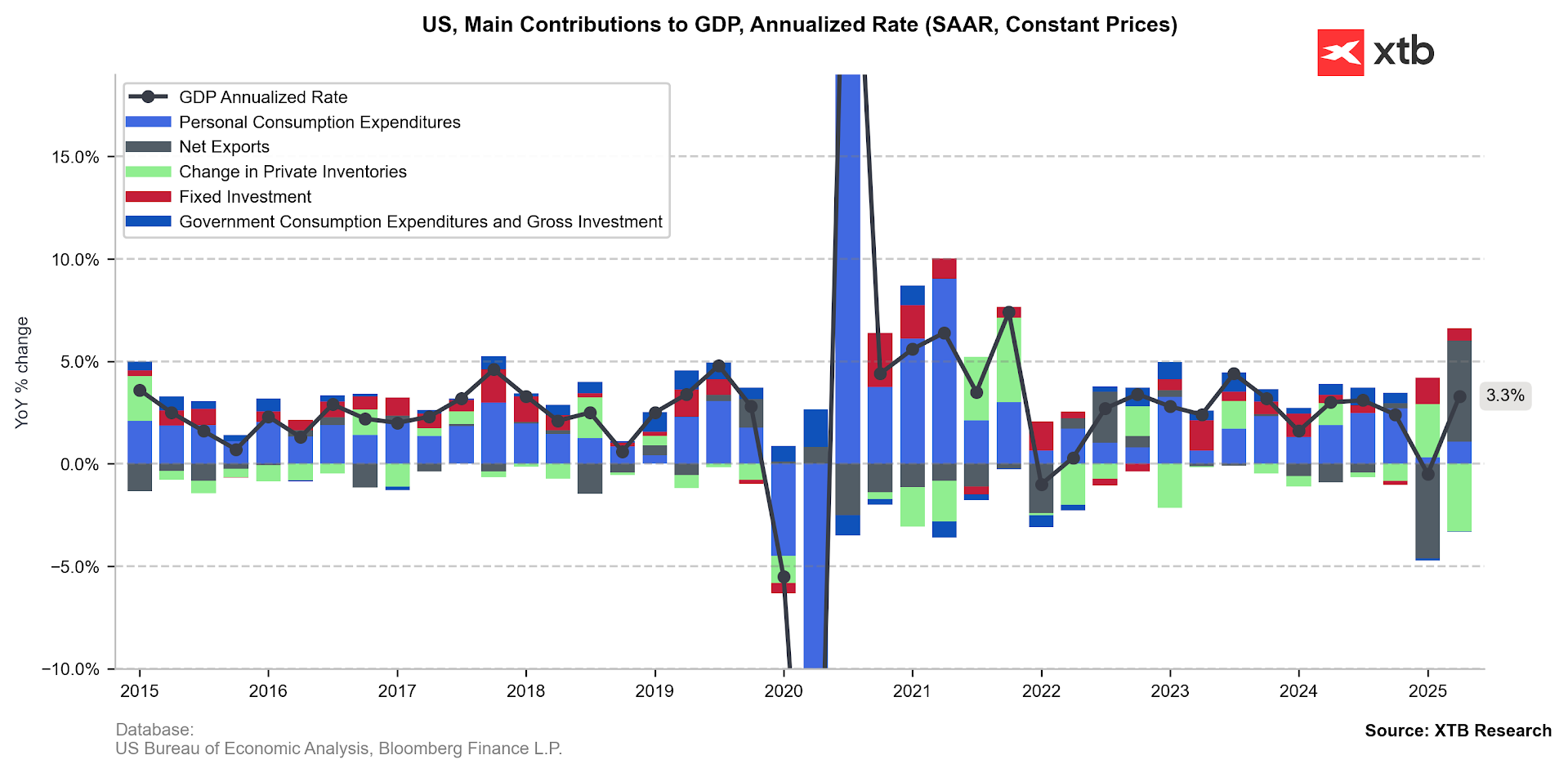

- Final Q2 GDP is revised up to 3.8% (expected: 3.3%; previous reading: 3.3%, Q1: -0.5%). Data was revised up mainly due to net exports that came out even better than in previous readings.

- GDP Price Index in Q2: 2.1% (expected 2.0%; previous: 2,0%, Q1: 3,8%).

- Core PCE Prices in Q2: 2.6% (expected: 2.5%; previous 2.5%, Q1: 3.5%)

- Initial Jobless Claims: 218k (expected: 233k; previous: 232k)

- Trade balance for August: -$85,5B (expected: -$95.7B; previous: -$103,6B)

- Durables Goods Orders for August: 2.9% MoM (expected: -0.3% MoM; previous: -2.7% Mom)

- Core Durables Goods Orders: 0.4% MoM (expected: -0.1% MoM; previous: 1.1% MoM)

Strong US Data Fuels Dollar Rally, Challenges Fed Rate Cut Outlook

A powerful set of US economic data was released, led by a significant upward revision to second-quarter GDP growth. The trade balance came in much better than expected, and initial jobless claims are returning to previous low levels, suggesting the spike from two weeks ago was a one-off event.

Furthermore, durable goods orders showed a strong rebound. While this was largely influenced by transportation orders, core orders also recovered, pointing to broader economic resilience.

Overall, the data paints a very positive picture of the US economy. The dollar strengthened considerably in response, now testing the 1.1700 level. This has also triggered a sharp pullback in US index futures, indicating the market is interpreting the data as hawkish. Given the economy's underlying strength, some members of the Federal Reserve may now question the justification for two interest rate cuts this year, especially since inflation continues to be a problem.

Growth is driven mainly by net exports but there is also a positive contribution from consumption and fixed investment, which indicates that even without tariffs turbulence, the change should be positive. Source: Bloomberg Finance LP, XTB

EURUSD has decreased significantly today due to strong data package from the USD which undermines probability of further Fed cuts this year. Source: xStation5

Market is not sure about future cuts from the Fed after very positive data from the US economy. US500 is below opening price after recent roll-over. Source: xStation5

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎

Bitcoin loses 3% 📉Technical bearish flag pattern?

3 markets to watch next week (05.12.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.