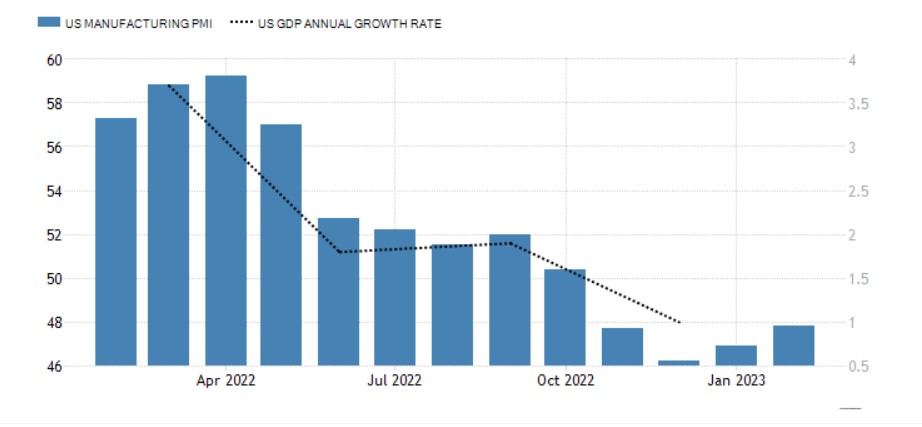

• The S&P Global US Manufacturing PMI rose to 47.8 in February from 46.9 in January, well above market forecasts of 47.3 flash estimates showed.

The reading pointed to a fourth consecutive month of falling factory activity although the smallest in the current sequence of decline. Production continued to fall amid weak client demand and new orders decreased sharply, with some companies noting that sufficient stocks at customers and high inflation dampened demand conditions. Meanwhile, lower buying activity also contributed towards an improvement in vendor performance. Suppliers’ delivery times were reduced to the greatest extent since May 2009 amid weak demand for inputs and fewer logistics issues. Employment rose at the fastest pace since last September and firms reduced their backlogs of work solidly. Input prices softened although selling prices rose the most in three months. Finally, the level of business confidence was broadly in line with that seen in January.

• The S&P Global US Services PMI jumped to 50.5 in January from 46.8 in the previous month, also above analysts' estimates of 47.2, a preliminary estimate showed.

Quite a positive surprise. Services are back above expansion territory, which shows that the economy may not be slowing down at all. This is also good news for GDP from the perspective of Q1.

US GDP may rebound in the first quarter. Source: Trading Economics

EURUSD deepened decline after PMI release. The pair broke below major support at 1.0660. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.