01:30 PM GMT, United States - Inflation Data for January:

- Personal Income: actual 1.0% MoM; forecast 0.4% MoM; previous 0.3% MoM;

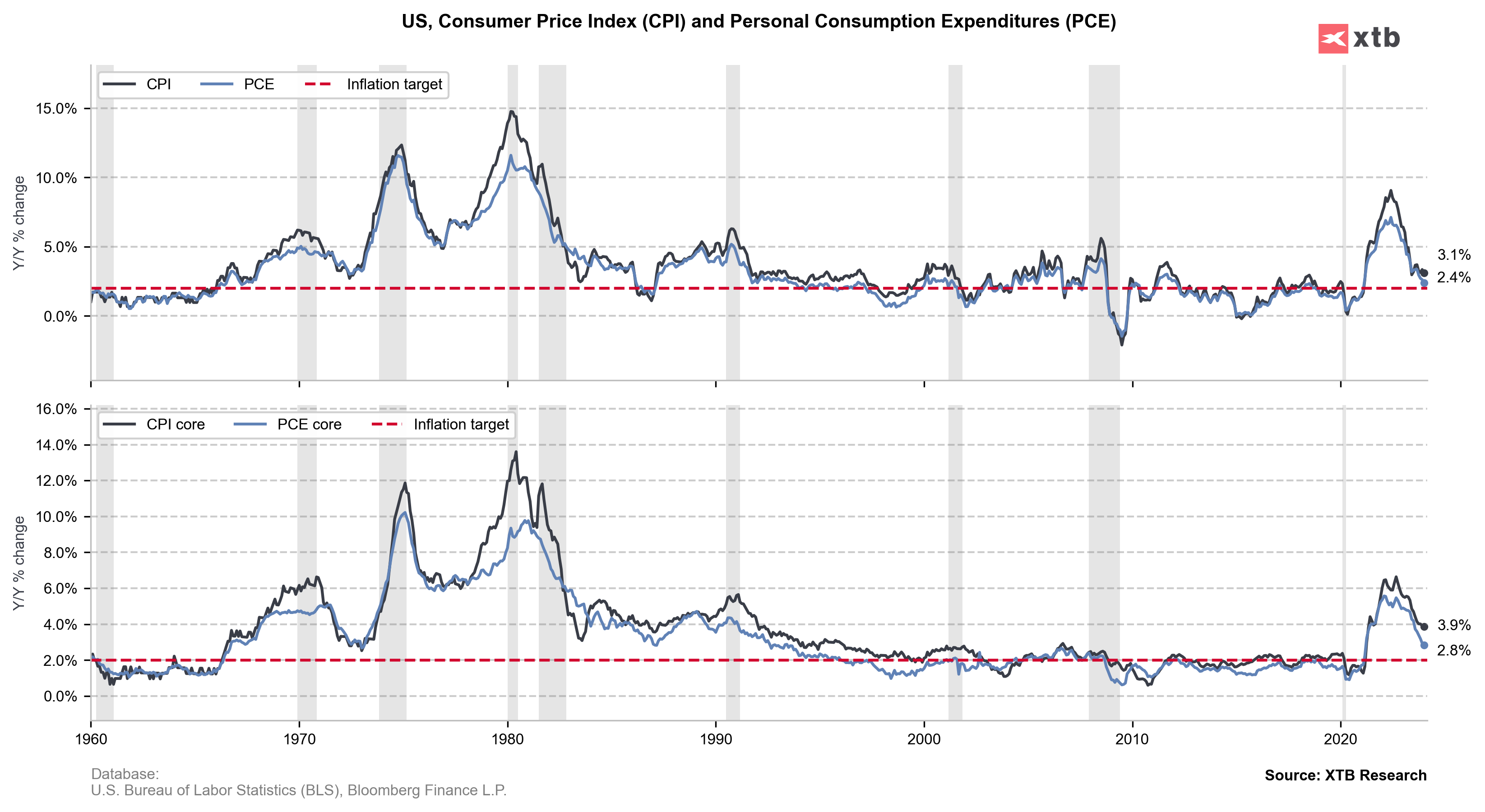

- PCE price index: actual 0.3% MoM; forecast 0.3% MoM; previous 0.1% MoM;

- Personal Spending: actual 0.2% MoM; forecast 0.2% MoM; previous 0.7% MoM;

- Core PCE Price Index: actual 2.8% YoY; forecast 2.8% YoY; previous 2.9% YoY;

- Core PCE Price Index: actual 0.4% MoM; forecast 0.4% MoM; previous 0.1% MoM;

01:30 PM GMT, United States - Employment Data:

- Initial Jobless Claims: actual 215K; forecast 209K; previous 202K;

- Jobless Claims 4-Week Avg.: actual 212.50K; previous 215.50K;

- Continuing Jobless Claims: actual 1,905K; forecast 1,874K; previous 1,860K;

For the week ending February 24, the U.S. saw an increase in initial jobless claims to 215,000, up 13,000 from the prior week, and a slight upward revision in the previous week's data. The four-week moving average decreased slightly. Meanwhile, the insured unemployment rate rose to 1.3%, with the number of people receiving unemployment benefits increasing to 1,905,000, marking the highest four-week average since December 2021.

In January 2024, U.S. personal income rose by $233.7 billion (1.0%), with disposable personal income (DPI) increasing by $67.6 billion (0.3%) and personal consumption expenditures (PCE) going up by $43.9 billion (0.2%). The PCE price index saw a 0.3% increase, excluding food and energy. Real DPI slightly decreased, while real PCE dropped by 0.1%, reflecting a decline in goods spending and an increase in services. The rise in personal income was mainly driven by higher government social benefits, asset income, and compensation, with significant increases in social security benefits and Affordable Care Act enrollments. The increase in PCE was due to higher service spending, offset by a reduction in goods spending, particularly in motor vehicles and energy goods. Personal outlays rose by $54.3 billion, with a personal saving rate of 3.8%. Year-over-year, the PCE price index increased by 2.4%, with a notable rise in service prices and a decrease in goods prices.

Source: xStation 5

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.