US data pack for October, including US PCE inflation, was released today at 1:30 pm GMT. Report was expected to show a slowdown in headline and core PCE inflation as well as slightly lower increase in personal spending and income, than it was the case in September.

Actual report turned out to be in-line with estimates, across almost all measures. In fact, only headline PCE inflation on a monthly basis came in slightly below estimates. Initial jobless claims that were released simultaneously turned out to be slightly lower than expected, while continuing claims came in above expectations.

US, data pack for October

- Headline (annual): 3.0% YoY vs 3.0% YoY expected (3.4% YoY previously)

- Headline (monthly): 0.0% MoM vs 0.1% MoM expected (0.4% MoM previously)

- Core (annual): 3.5% YoY vs 3.5% YoY expected (3.7% YoY previously)

- Core (monthly): 0.2% MoM vs 0.2% MoM expected (0.3% MoM previously)

- Personal spending: 0.2% MoM vs 0.2% MoM expected (0.7% MoM previously)

- Personal income: 0.2% MoM vs 0.2% MoM expected (0.3% moM previously)

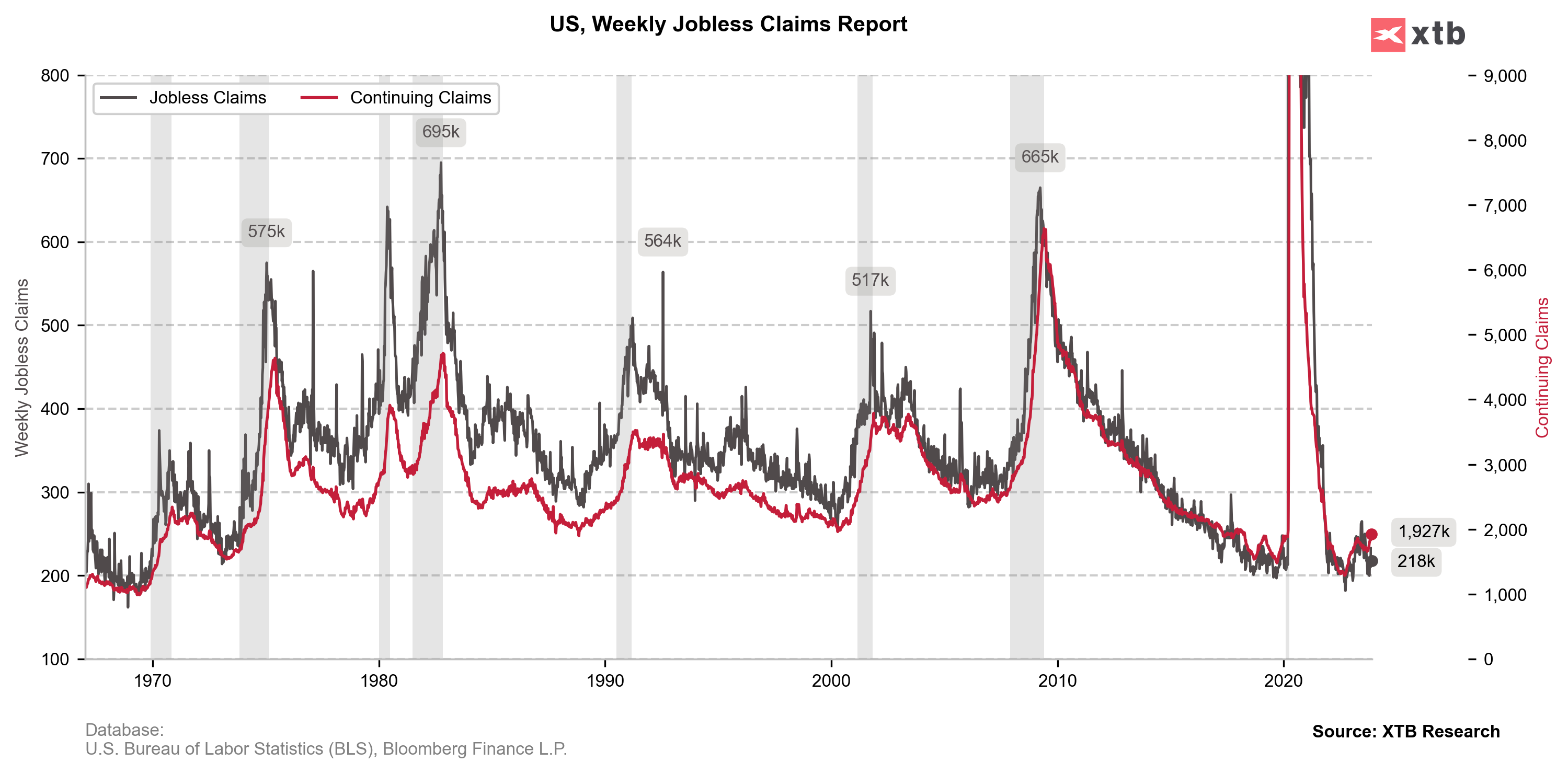

US, jobless claims data

- Initial jobless claims: 218k vs 220k expected (209k previously)

- Continuing jobless claims: 1927k vs 1865k expected (1840k previously)

USD ticked higher following the release but, overall, scale of market reaction was rather small given that the data came in-line with expectations.

Source: xStation5

Source: xStation5

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.