US Manufacturing PMI (flash) decreased to 57.8 in December from 58.3 in November, below analysts’ expectations of 58.5.

The reading pointed to the slowest growth in factory activity in a year. Although the pace of output growth quickened to the fastest for three months, the rate of expansion was muted compared to those seen earlier in the year as material shortages – although easing to the lowest since May, as measured by suppliers’ delivery times – hampered production again. The rate of job creation quickened to the fastest since June, but numerous panellists stated that problems finding and retaining staff persisted. Input prices continued to rise at a marked pace, offering firms little respite from inflationary pressure amid greater transportation, distribution and material costs. Output charges also rose sharply, albeit at the softest rate since April. Finally, output expectations for the year ahead were the greatest for four months.

US Services PMI (flash) dropped to 57.5 in December from 58.0 in the previous month, missing market consensus of 58.4.

Chief Business Economist at IHS Markit, said: “The survey data paint a picture of an economy showing encouraging resilience to rising virus infection rates and worries over the Omicron variant. Business growth slipped only slightly during the month and held up especially well in the vulnerable service sector. Manufacturing output growth even picked up slightly amid a marked easing in the number of supply chain delays, which also helped to take pressure off raw material prices. Barring the initial price slide seen at the start of the pandemic, December saw the steepest fall in factory input price inflation for nearly a decade. “The worry is that rising wage growth, greater transport costs and higher energy prices have pushed service sector cost inflation to a new high, and that any renewed disruption to global supply lines resulting from the Omicron wave could lead to renewed upward pressure on goods prices.”

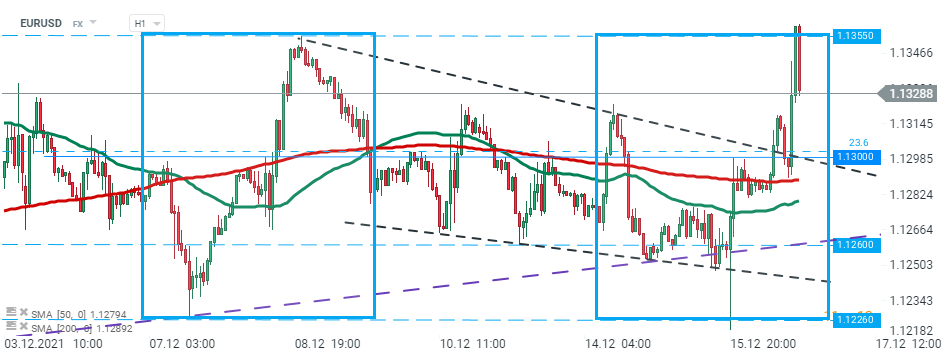

EURUSD pair bounced off 1.1355 resistance and is heading towards support level at 1.1300. Source:xStation5

EURUSD pair bounced off 1.1355 resistance and is heading towards support level at 1.1300. Source:xStation5

BREAKING: Bank of England holds rates as expected 📌 GBPUSD ticks down on dovish vote split 📉

Economic calendar: Central banks overshadowed by stock market volatility (05.02.2026)

EURUSD reclaims 1.18 on excellent German manufacturing data 🇩🇪 📈

Market wrap🚨 European stocks outpace Wall Street📈Nasdaq sell-off to continue?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.