The USDCAD pair jumped to the highest level since the beginning of November on Tuesday as lower oil prices and the rebounding US dollar continue to put pressure on Canadian currency, which is highly correlated with crude prices.Tomorrow investors will focus on the Bank of Canada interest rates decision. Money markets broadly expect the BoC to raise its key rate by a slower 25 bps hike, but a second straight 50bps raise is not out of the question as policymakers weigh soaring inflation against a slowing economy.

USDCAD pair jumped to a 4-week high of 1.3665, which is marked with an upper limit of the 1:1 structure and 61.8% Fibonacci retracement of the downward wave launched in October 2022. If current sentiment prevails, an upward move may accelerate towards the 1.3800 level. USDCAD, H4 interval. Source: xStation5

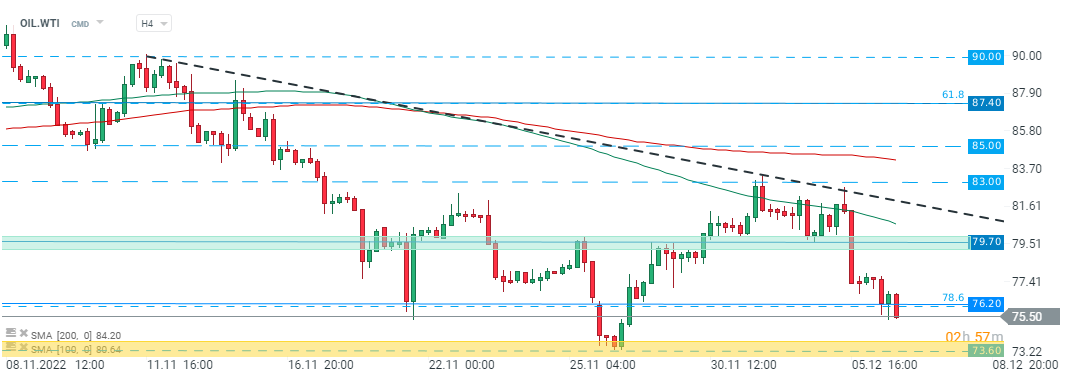

OIL.WTI continues to move lower and during today's session sellers managed to push the price below major support at $76.20 which is marked with previous price reactions and 78.6% Fibonacci retracement of the upward wave launched in December 2021. If bears manage to uphold current momentum, downward move may deepen towards November 2022 lows around $73.60. Source: xStation5

OIL.WTI continues to move lower and during today's session sellers managed to push the price below major support at $76.20 which is marked with previous price reactions and 78.6% Fibonacci retracement of the upward wave launched in December 2021. If bears manage to uphold current momentum, downward move may deepen towards November 2022 lows around $73.60. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.