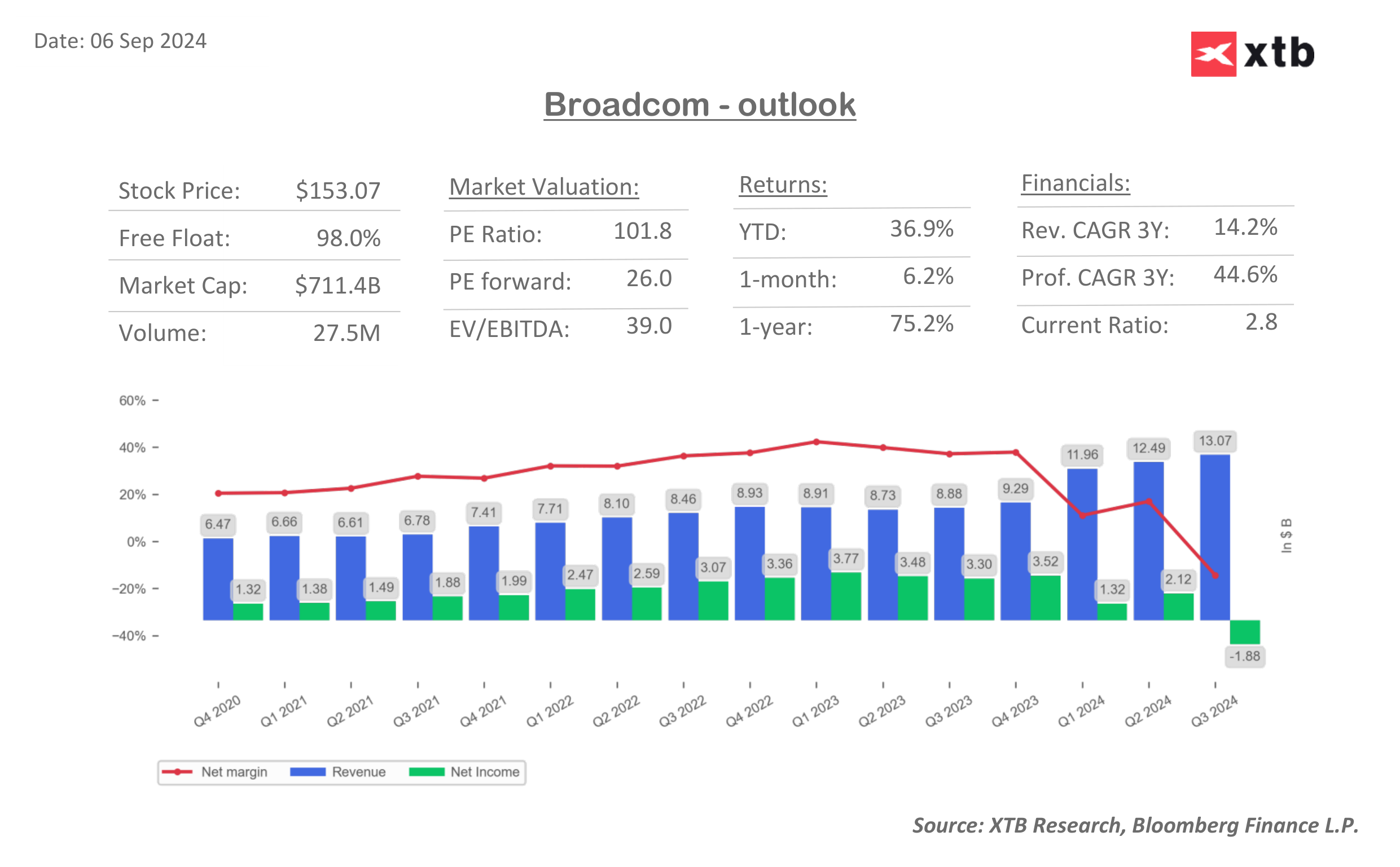

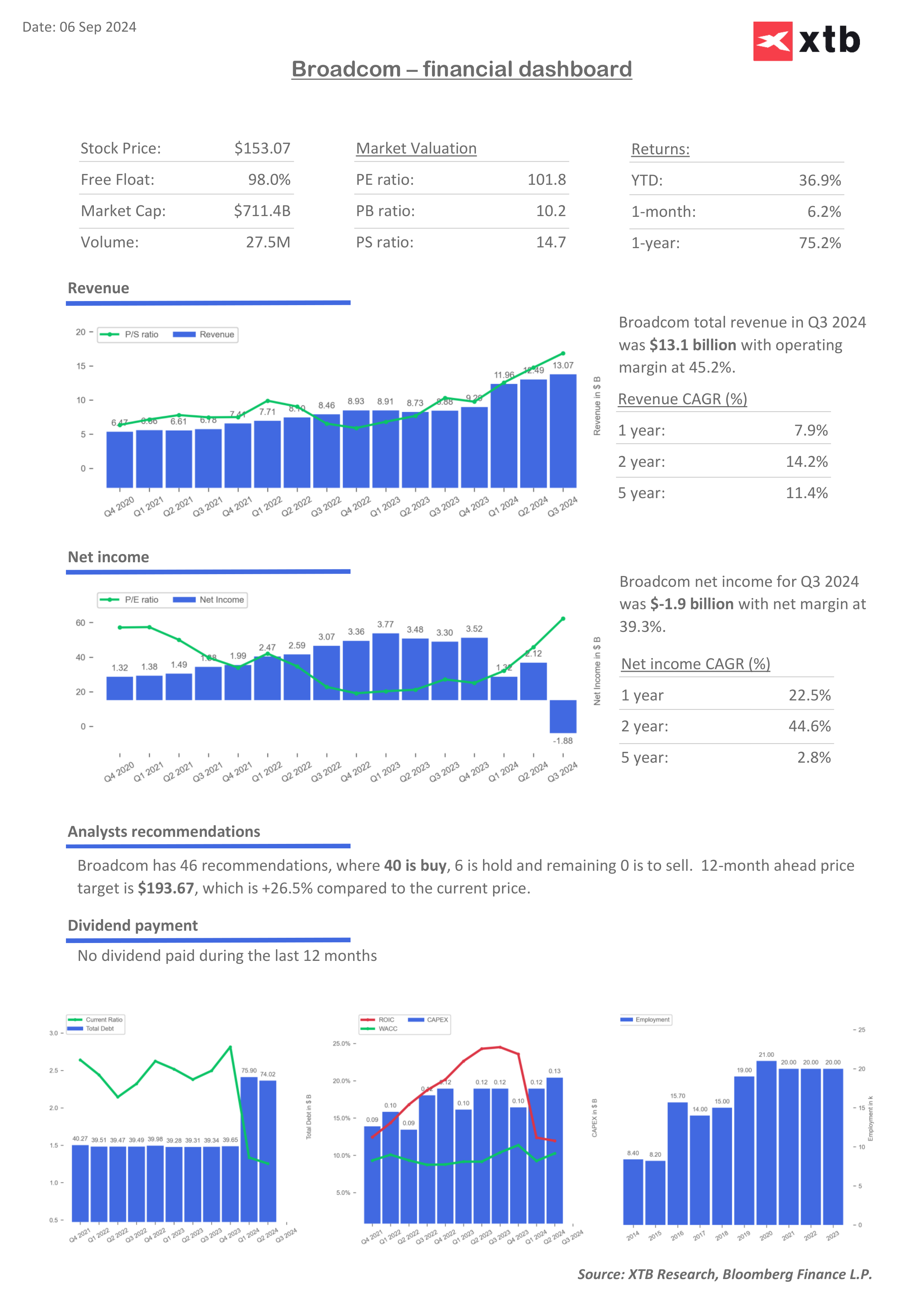

One of the biggest US-based chip producers, Broadcom (AVGO.US) loses almost 10% today, after quarterly results (fiscal quarter ended 4 August 2024). Analysts expectations out beat wasn't spectacular, and the company expects sales in current quarter almost in line with investor expectations, while FY 2024 outlook was only slightly raised, while valuation is still

- Broadcom beaten expectations on earnings per share (18% YoY) and revenue (47% YoY). However, without the positive contribution from the VMWare acquisition, the company's revenue would have grown only 4% y/y and chip demand on its Broadband business was soft.

- The company raised its full-year revenue forecast to $51.5 billion vs $51 billion before, however, this more cautious outlook is the effect of weak cyclical semiconductors demand. Some investors expected faster rebound of it, this year

- Earnings per share came in $1.24 vs. $1.22 forecasts, and sales came in at almost $13.1 billion vs. $12.98 billion expectations. However, the magnitude of the beat in market revenues and EPS forecasts was relatively small

- A forecast for the current quarter, although raised, 'disappointed' expectations; the company expects $14 billion in sales; Wall Street's model forecasts suggested $14.1 billion.

- For the full year, the company expects $12 billion in revenue from AI products; at the start of 2024 it expected $11 billion. However, rising demand for AI chips failed to improve sentiments

- Broadcom reported that broadband revenue declined 49% YoY in the last fiscal quarter, with non-AI networking dropping almost 41% YoY. More 'cyclical' demand for other semiconductors than custom chips and networking was still soft

- Rising AI demand was offset by weak, dropping demand in other, strategic divisions. In consequence, the company reported a loss of $1.88 billion GAAP vs 3.30 billion GAAP in profit in the last year

- GAAP net loss was affected by an on-time event, a discrete non-cash tax provision of $4.5 billion (transfer of intellectual property rights to the United States)

After company earnings, US-based semiconductor stocks are also dropping, leading to weaker sentiments in Nasdaq 100 index; Nvidia (NVDA.US) drops almost 4% in pre-market after the Broadcom quarterly report.

Broadcom chart (AVGO. US, D1 interval)

Current pre-market AVGO price is near to the 38.2 Fibo retracement of the upward wave since 2022 (GPT debut) and SMA200 level, at $138 per share, potentially triggering higher volatility after US market open.

![]() Source: xStation5

Source: xStation5

Source :XTB Research, Bloomberg Finance L.P.

Source :XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.

Source: xStation5

Source: xStation5