C3.ai (AI.US) experienced a significant surge in its stock value, rising over 24%, following its announcement of better-than-expected financial results for the third quarter and an optimistic revenue forecast.

The enterprise software company, led by Thomas Siebel, is making strides in the generative artificial intelligence market and is actively investing in expanding its global presence. The company has revised its full-year fiscal 2024 revenue projection to between $306M and $310M, up from the earlier estimate of $295M to $320M and exceeding the consensus of $305.53M. Additionally, C3.ai anticipates its fiscal fourth-quarter sales to be in the range of $82M to $86M, compared to a consensus estimate of $83.91M.

Analysts Commentary:

- This positive trend led Wedbush Securities analyst Dan Ives to increase his price target for C3.ai to $40 from $35.

- Despite this positive performance, Morgan Stanley analysts maintain an Underweight rating on C3.ai with an increased price target of $21, up from $20.

For the fiscal third quarter, C3.ai reported an adjusted loss per share of 13 cents on revenue of $78.4M, which was better than analysts' expectations. The company successfully closed 50 agreements during the quarter, including new deals with major firms like Boston Scientific, AbbVie, and T-Mobile US. Furthermore, C3.ai's federal contracts showed substantial growth, with a 100% increase in revenue and bookings from federal services. The company's subscription revenue also rose by 23% year-over-year, accounting for 90% of its total revenue.

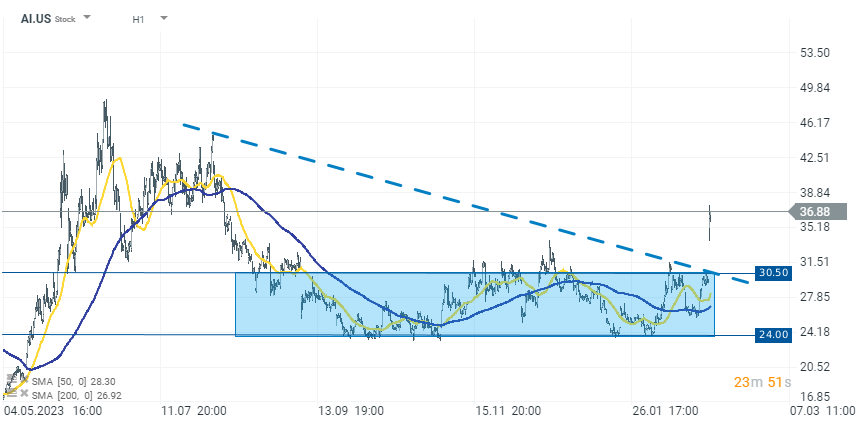

C3.ai shares are rising today by over 24% to $36.90 per share, breaking above the recent consolidation zone below the $30.50 level. Source: xStation 5

Broader AI Trend

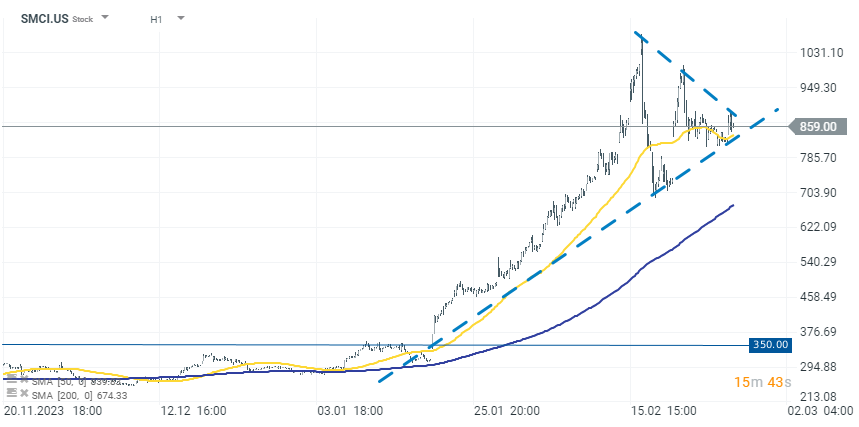

Investor euphoria in the AI sector continues, fueled by Nvidia's recent results. Today, the Nasdaq is testing the 18,000-point level, gaining over 0.70%. Super Micro Computer (SMCI.US) is also gaining on this upward trend and is currently consolidating around its peaks after a recent dynamic rise.

Source: xStation 5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.