Catalent (CTLT.US), a contract pharmaceutical manufacturer whose clients include giants like Moderna, Johnson & Johnson, and Novo Nordisk, has announced a delay in the publication of its highly anticipated Q1 report. The company also indicated that it expects to significantly reduce its forecasts for the remainder of the year. Investors reacted with panic, resulting in a significant decline in the company's stock price. Catalent attributed the delay and reduced forecasts to performance issues and higher costs at three of its facilities. These issues are expected to impact both company profits and prospects. The company has acknowledged previous forecast discrepancies and is currently working to address these issues.

-

Catalent is going to lower its annual revenue projections by over $400 million. The final report has been rescheduled for May 15th to allow for adjustments in the financial statements.

-

The company has signaled performance issues and warned that slower-than-expected growth in production capabilities will weigh on results.

-

Catalent has estimated a goodwill impairment of over $200 million primarily related to the acquisition of Bettera Wellness.

-

In February, Catalent had forecasted full-year net revenues between $4.63 billion and $4.88 billion, along with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) between $1.22 billion and $1.30 billion.

-

According to analysts, quality and transparency issues may harm the company's reputation and its relationships with current and future clients.

-

Catalent was the sole manufacturer of Novo Nordisk's weight-loss drug Wegovy. However, the Danish company has not been affected by this and has already revealed a second producer last month to meet the growing demand.

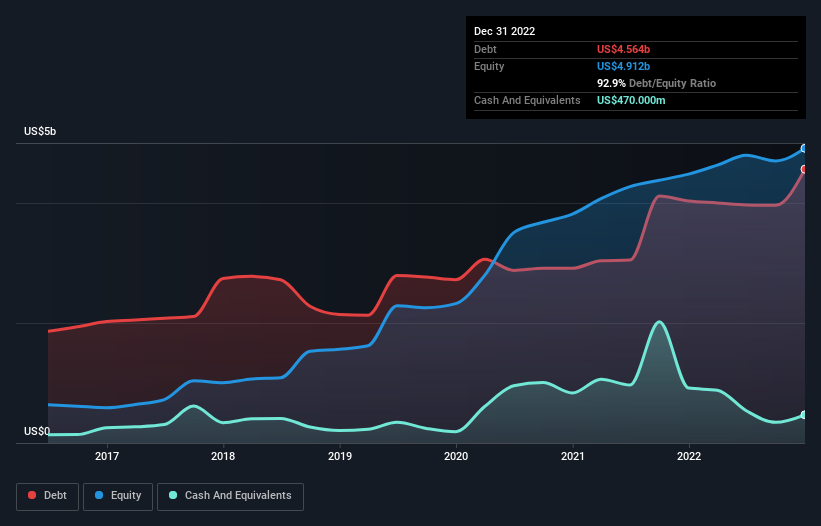

Recently, the company's debt has been increasing at a faster rate than the valuation of its assets, as of May 5th. The debt-to-equity ratio stands at approximately 0.93, indicating that the company's asset valuation is at a similar level to its overall level of debt. Source: SimplyWallStreet.

Recently, the company's debt has been increasing at a faster rate than the valuation of its assets, as of May 5th. The debt-to-equity ratio stands at approximately 0.93, indicating that the company's asset valuation is at a similar level to its overall level of debt. Source: SimplyWallStreet.

After a massive downward gap, Catalent shares are retracing close to the low of the March 2020 sell-off. Source: xStation5.

After a massive downward gap, Catalent shares are retracing close to the low of the March 2020 sell-off. Source: xStation5.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.