Shares of one of the largest U.S. industrial companies, Caterpillar (CAT.US), are gaining more than 4% today before the open, as the company managed to significantly beat earnings per share expectations in an environment of slowing revenue growth. The company remains one of the main beneficiaries, high infrastructure spending in the United States.

Caterpillar (CAT.US) financial results, for Q4 2023

Revenues: $17.07 billion vs. $17.2 billion forecast (2.8% y/y)

Adjusted earnings per share (EPS): $5.23 vs. $4.73 forecast and $3.86 previously

- Revenue from machinery/energy/transportation division: $16.24 billion vs. $16.53 billion forecast (2.3% increase y/y)

- Revenue from the finance division: $833 million (15% y/y)

- Operating profit margin improved to 18.4% from 10.1%.

- Research and development (R&D) expenses: $554 million vs. $532.7 million forecast (38% y/y)

Comments on results

Sales rose thanks to higher prices and very strong positions in the energy and transportation businesses. Business at the leading U.S. manufacturer of construction and mining equipment continues to do well. Net income rose to $2.68 billion, compared to $1.45 billion in Q4 2022. The favorable f/x effect was also offset by lower sales volume.

Sales in the construction industry fell 5% to $6.85 billion, slightly below forecasts of $6.88 billion, sales in the raw materials industry fell 6% to $3.44 billion (above expectations of $3.29 billion). Sales in the energy and transportation sector, on the other hand, rose by double digits, up 12% to $6.82 billion against $6.7 billion estimates.

Overall, the report indicated that the construction and industrial sectors are doing quite well, despite weaker readings from regional indices in the US. U.S. budget funding for infrastructure is expected to last for many more years, but revenue growth has slowed noticeably as dealers have reduced inventories. Backlog of future orders fell by another $600 million, after falling by $2.6 billion in Q3 2023. Normally, CAT's valuation falls when the backlog of future orders falls, but this time the stock remains resilient to that.

Caterpillar shares (D1)

Caterpillar shares are trading near $325, ahead of the start of US trading. Looking at geometric layouts, the current cycle is starting to turn increasingly vertical, signaling growing optimism and the risk of an equally dynamic correction, where potential support will be around $315 (closing of the price gap) and levels between $280 and $290 per share (price reactions from the fall of 2022 and spring of 2023).

Source: xStation5

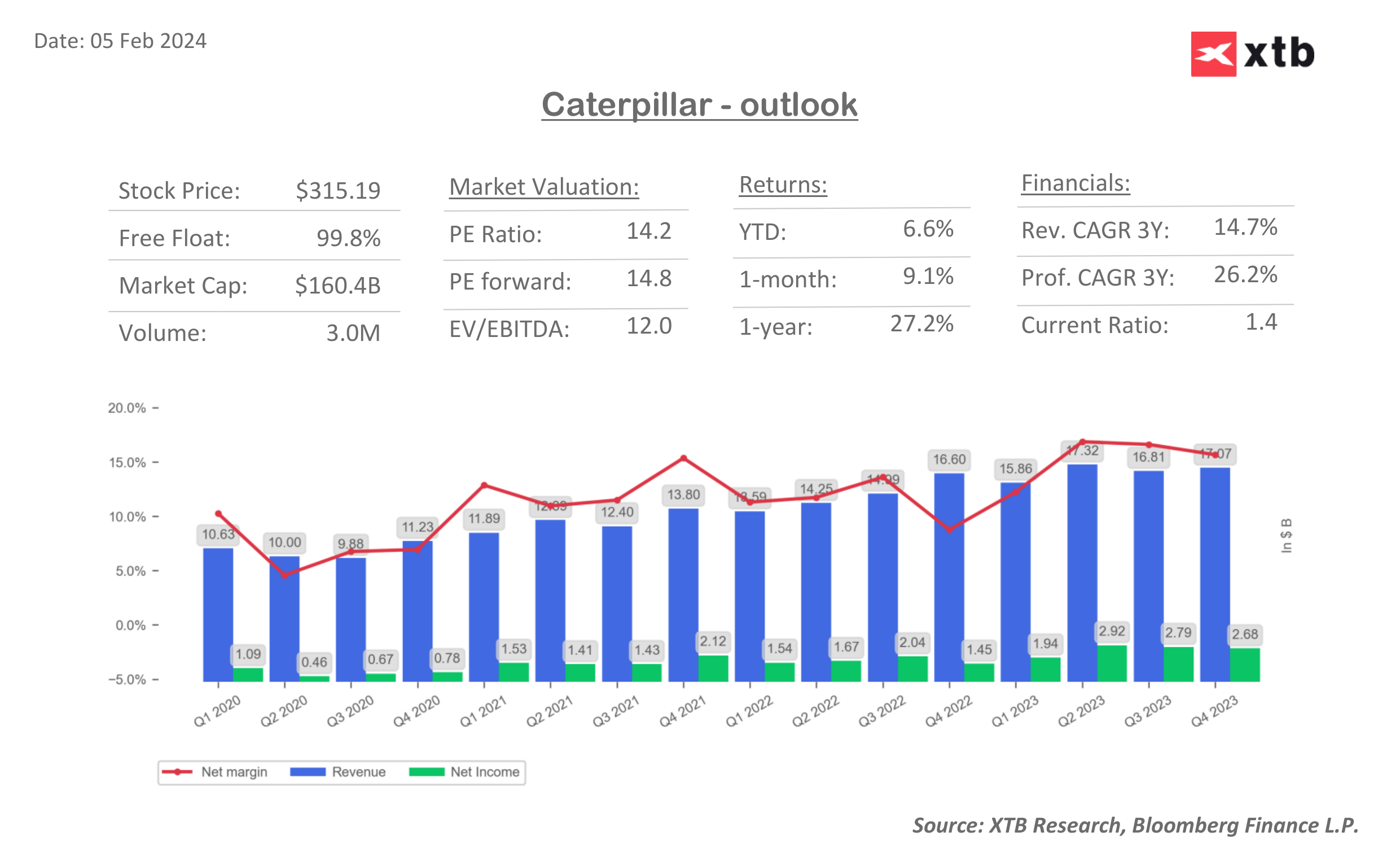

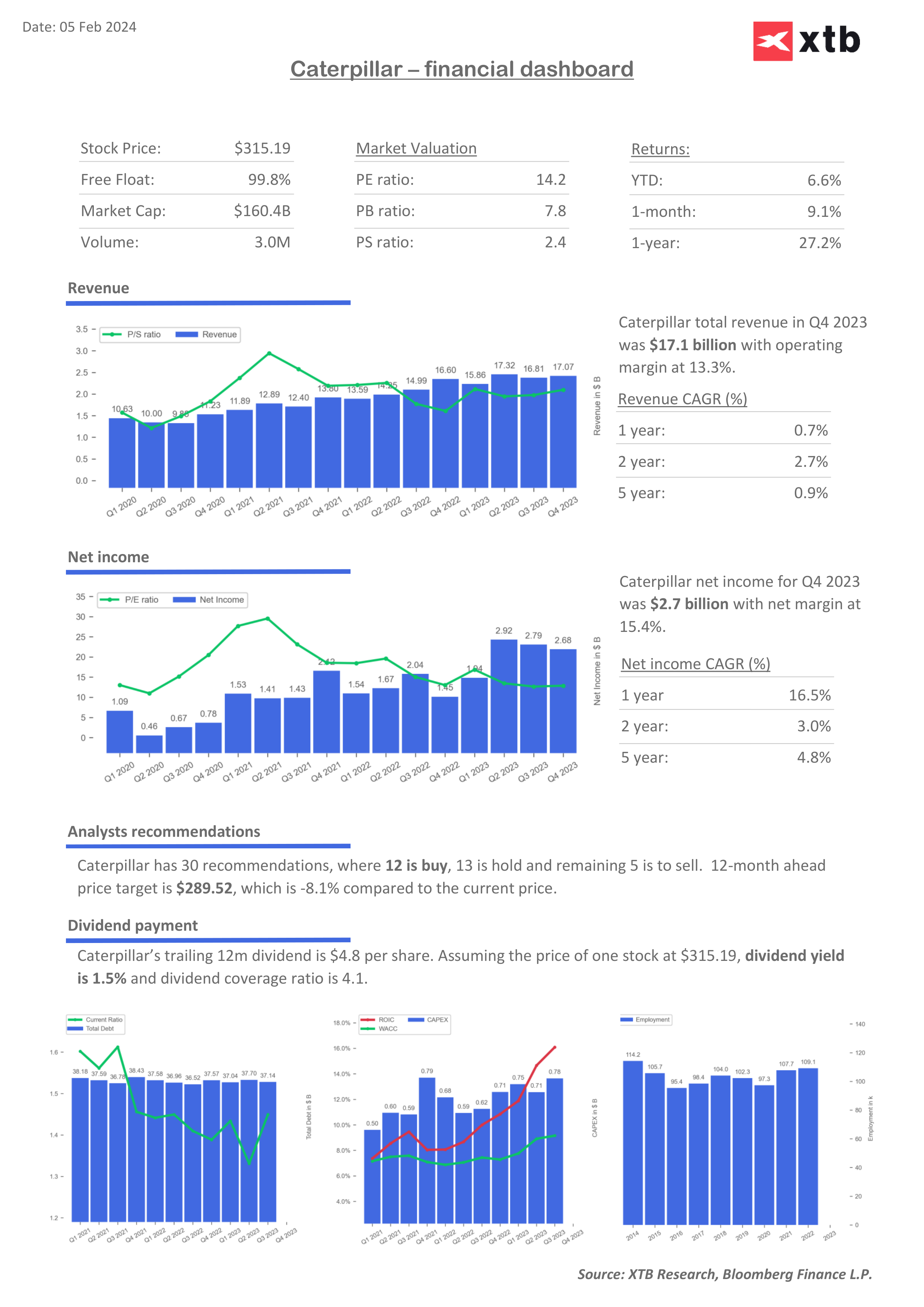

Caterpillar valuation indicators

Source: XTB Research, Bloomberg

Source: XTB Research, Bloomberg

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.