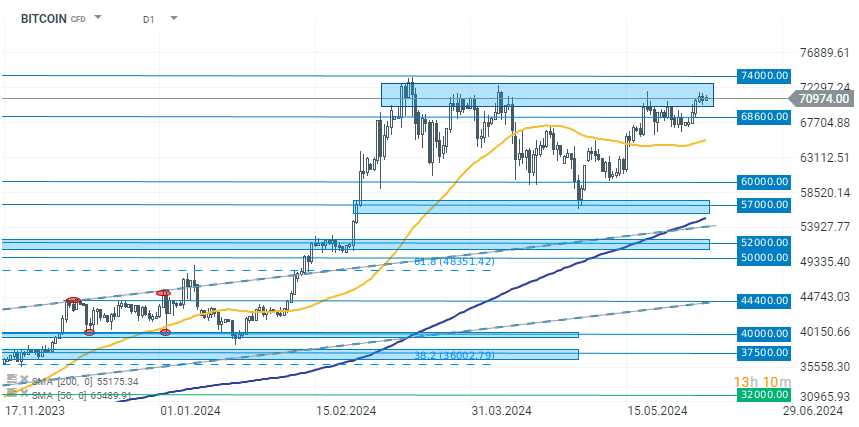

Bitcoin is gaining 0.45% today and is once again above the $71,000 level. However, the resistance above this level is strong enough that even record ETF inflows are unable to break through it. Looking at previous cycles, Bitcoin returned to growth 2-3 months after a halving following a period of correction or consolidation. In this scenario, the current consolidation should not be a significant surprise.

However, it is important to remember the current macroeconomic environment. High interest rates continue to exert pressure on the economy, and the effects are becoming increasingly noticeable. The risk of recession still exists, and in such a scenario, it is hard to imagine a sustained bull market in risky assets such as cryptocurrencies. Today's labor market report could also significantly impact the cryptocurrency market. In recent months, Bitcoin has become particularly sensitive to the broader financial market situation due to the increasing share of external capital. Therefore, the data release could determine whether Bitcoin breaks above $71,000 or undergoes another correction to around $70,000 or below.

Source: xStation 5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.