Bitcoin extends its losses today, dropping another 1.00% following yesterday's sharp sell-off. The catalyst for yesterday’s decline was stronger-than-expected ISM data from the U.S., particularly the record-high price subindex. This sparked serious concerns about a resurgence of inflationary pressures in the U.S. Additionally, Donald Trump, in his recent interviews, emphasized campaign promises that reinforce fears of a strong pivot in U.S. policy toward protectionism, which in turn has driven further strengthening of the U.S. dollar.

As a result, the cryptocurrency market experienced cascading liquidations of long positions, exceeding $500 million. This high volatility was fueled by the market's significant leverage, which had been positioned for continued gains after Bitcoin broke above the $100,000 barrier on Monday. Consequently, significant liquidations of long positions followed the release of U.S. macroeconomic data. Pressure on the cryptocurrency market is being exacerbated by weaker sentiment in traditional stock markets and the strong U.S. dollar. Historically, a strengthening dollar has always been correlated with increased selling pressure on risky assets such as Bitcoin. Therefore, considering the dollar’s current strength, which has reached two-year highs and broken out of a two-year consolidation, Bitcoin’s current decline does not seem overly dramatic. Since its low in early October, the dollar index has risen by over 9%.

So far, the dollar's appreciation has acted as a headwind for demand for risky assets. However, it’s possible the market is currently overreacting, and we may see declines reverse after Donald Trump’s inauguration. In yesterday's interview, Trump stated that the dollar is currently overvalued, making it difficult for local companies to compete in the global market. He made similar remarks about interest rates.

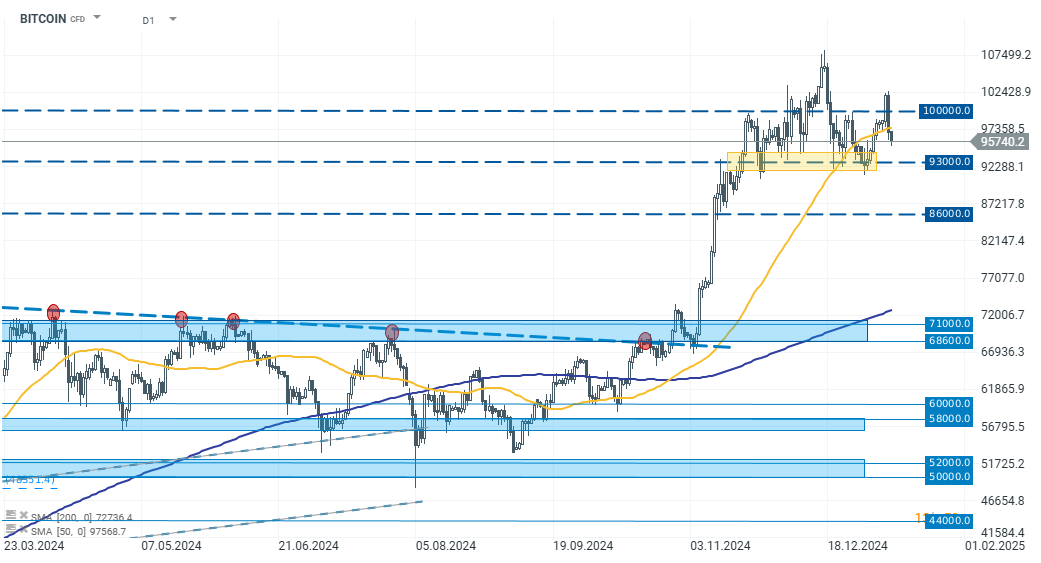

Looking at Bitcoin’s chart, the most important support level now is the zone above $93,000. For bulls, a sustained breakout above the $100,000 barrier remains a key challenge.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.