Recently, many events have overlapped and influenced the prevailing sentiment on the cryptocurrency market.

On the one hand, we observe weakening bulls on the broader financial market after high index results in the first quarter of this year. Investors are trying to price in new quarterly reports published by the largest technology companies in the US and deteriorating macroeconomic data, which are starting to forecast the upcoming recession on the financial markets.

On the other hand, a lot has happened in the crypto market space. The recent hearing of SEC chairman Gary Gancler did not bring any new news. The SEC chairman continued his narrative without any explanation that all cryptocurrencies except BTC should be considered security - despite many questions from the House Financial Services Committee.

Another wave of declines came today after the news about Coinbase suing the SEC. According to the information provided, Coinbase has taken legal action in a US federal court to force the country's securities regulator to give a definitive response to a petition it submitted in July. The petition sought clearer regulatory guidelines for the cryptocurrency industry in the US.

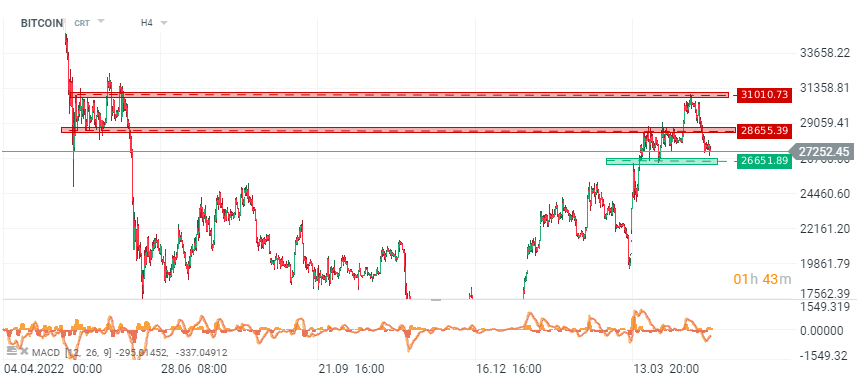

On the 4-hour timeframe, the BTC price continued to consolidate below $28,000, with the largest cryptocurrency by market capitalization trading at around $27,240, down 0.55% in the past 24 hours. BTC has already dropped by 13% from its recent highs of $31000. The price broke through the key support level around $28,600, indicating a bearish trend in the short term. Currently, the price is at the equilibrium level of the last consolidation range, indicating that the market is in a state of indecision. However, further price action downwards is expected, with the next resistance level likely to be at $26,650. This level acted as a support in the past. Overall, the short-term trend for Bitcoin appears bearish and traders should exercise caution when taking long positions. It is essential to keep an eye on any major news events or developments in the cryptocurrency space that may impact the price of Bitcoin.

On the 4-hour timeframe, the BTC price continued to consolidate below $28,000, with the largest cryptocurrency by market capitalization trading at around $27,240, down 0.55% in the past 24 hours. BTC has already dropped by 13% from its recent highs of $31000. The price broke through the key support level around $28,600, indicating a bearish trend in the short term. Currently, the price is at the equilibrium level of the last consolidation range, indicating that the market is in a state of indecision. However, further price action downwards is expected, with the next resistance level likely to be at $26,650. This level acted as a support in the past. Overall, the short-term trend for Bitcoin appears bearish and traders should exercise caution when taking long positions. It is essential to keep an eye on any major news events or developments in the cryptocurrency space that may impact the price of Bitcoin.

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.